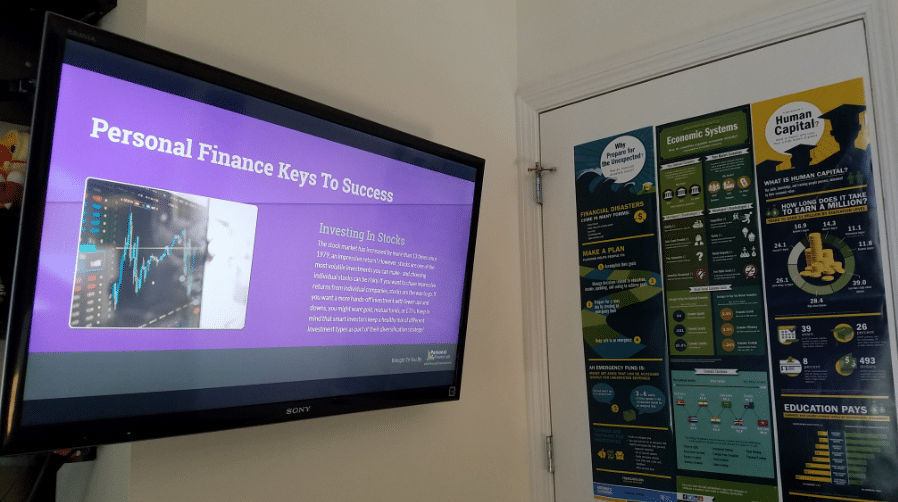

Marquette Catholic High School in Michigan City, Indiana was one of the first schools we worked with to transform one of their classrooms into a full Financial Literacy Lab.

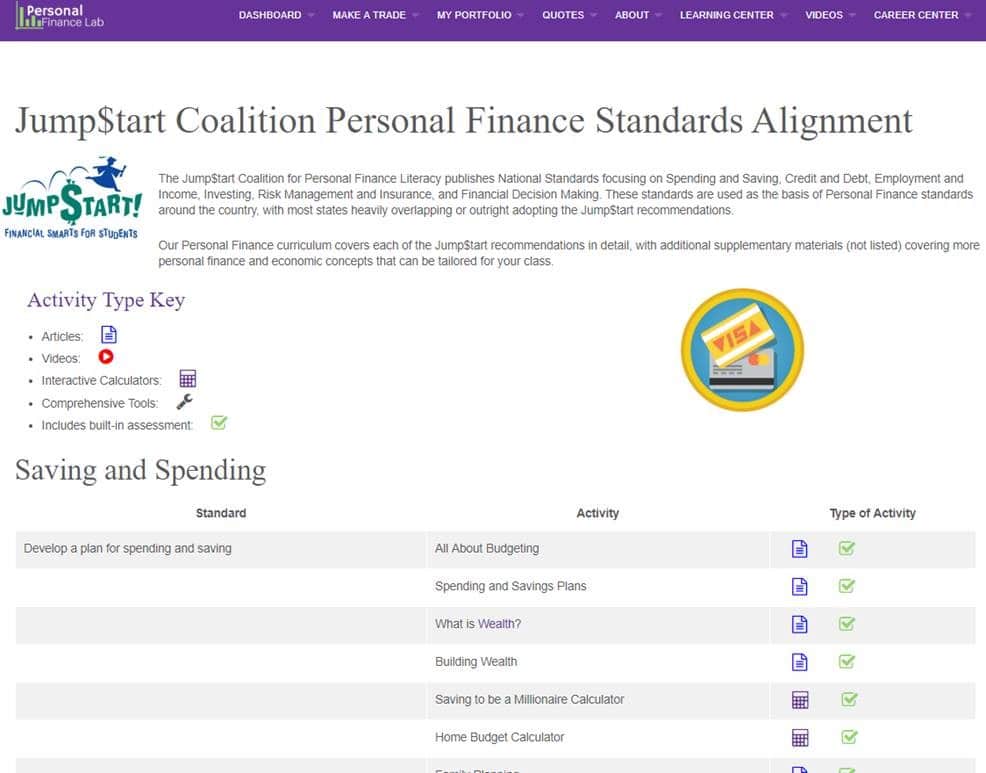

The Marquette program utilizes the Personal Finance Lab simulation and curriculum both in their Economics classes and their Global Trading classes, focused on investing and finance.

The Lab Space

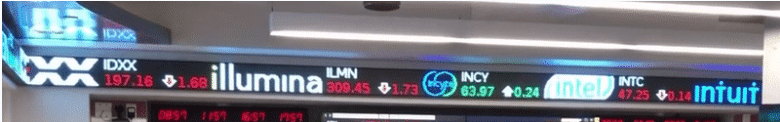

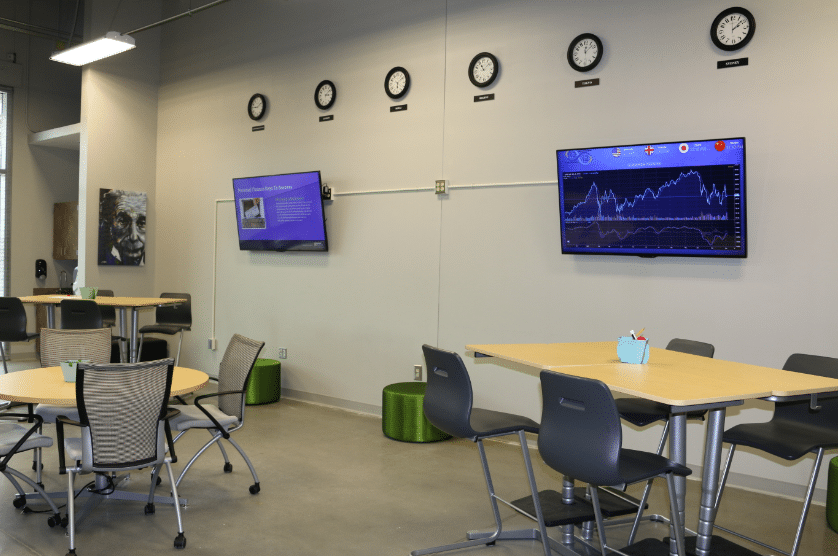

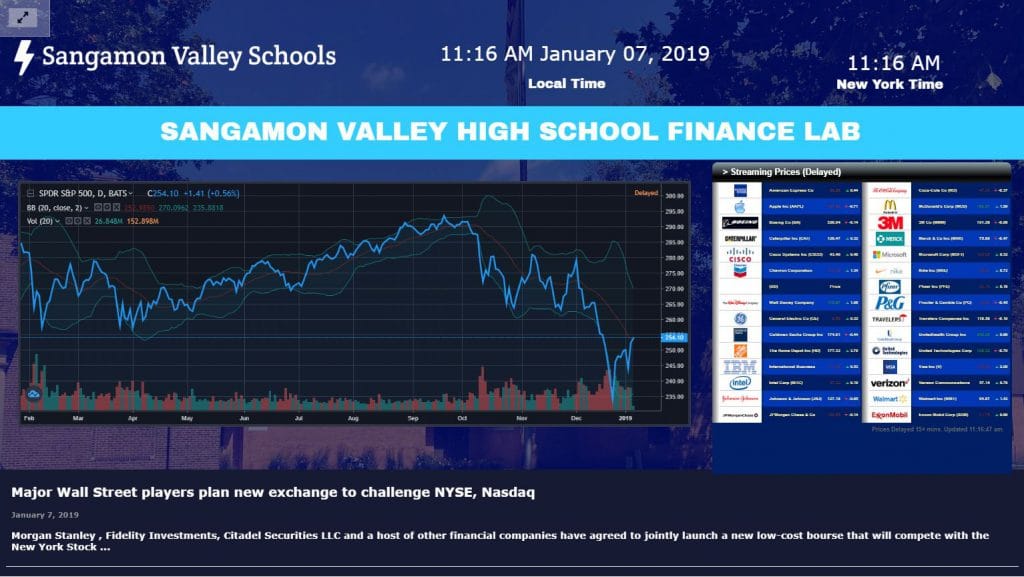

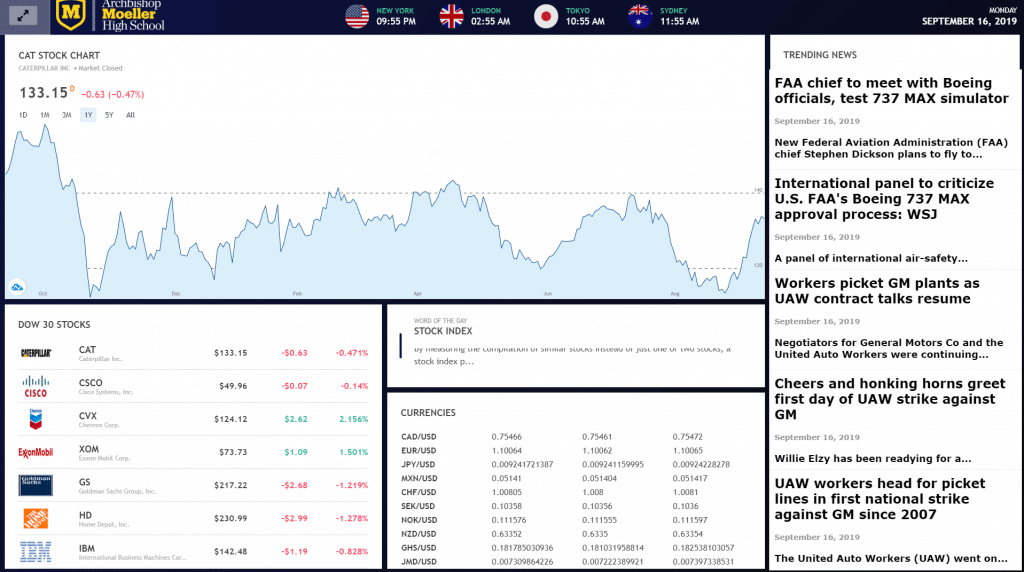

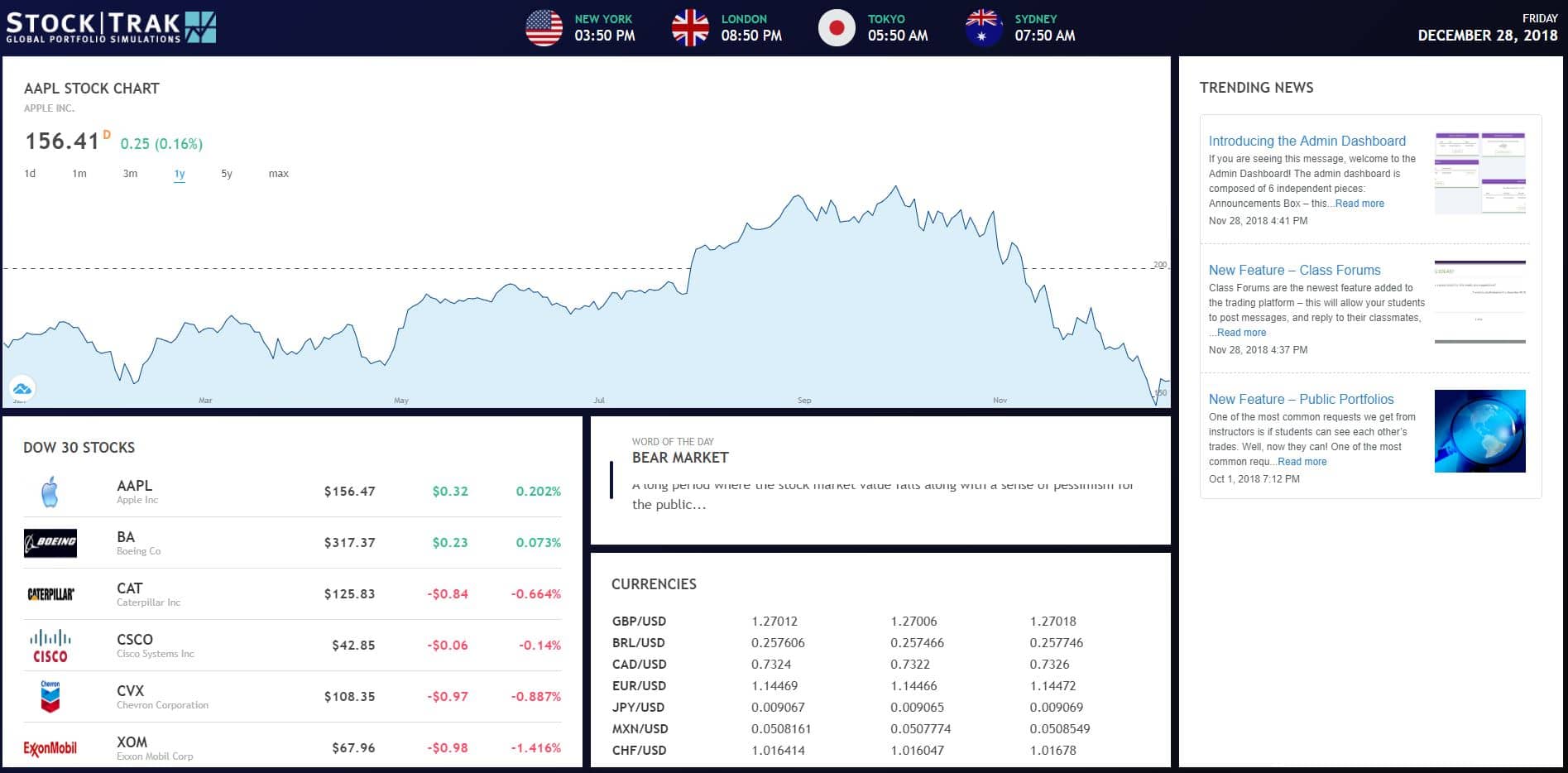

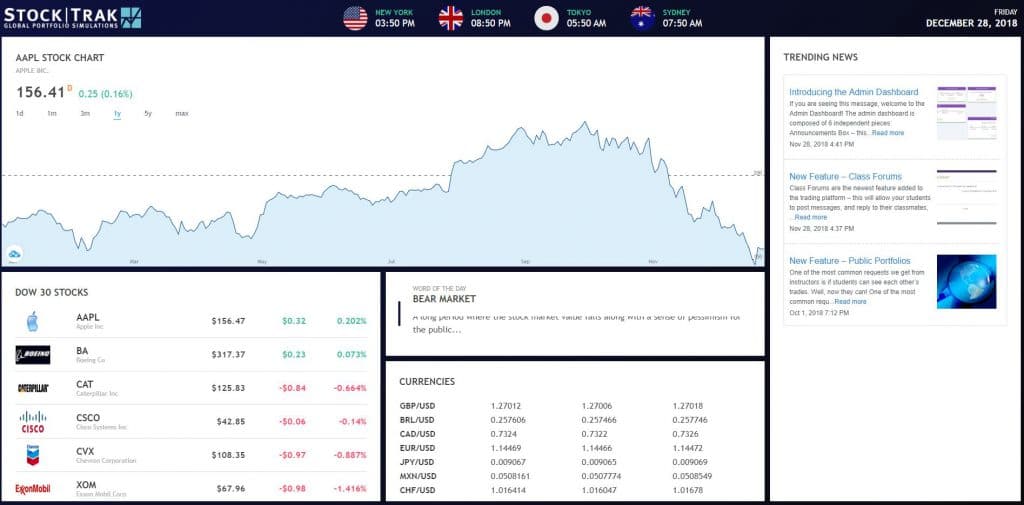

The Marquette lab is fitted with a wall-to-wall LED ticker along the ceiling, displaying 100 NASDAQ stocks. They also have a second smaller ticker displaying the time in some of the major markets from around the world that their Global Finance class focuses on – Chicago for futures and options, New York for American equities, London for European equities and futures, along with the Beijing and Sydney exchanges, all of which are available in the Personal Finance Lab trading platform.

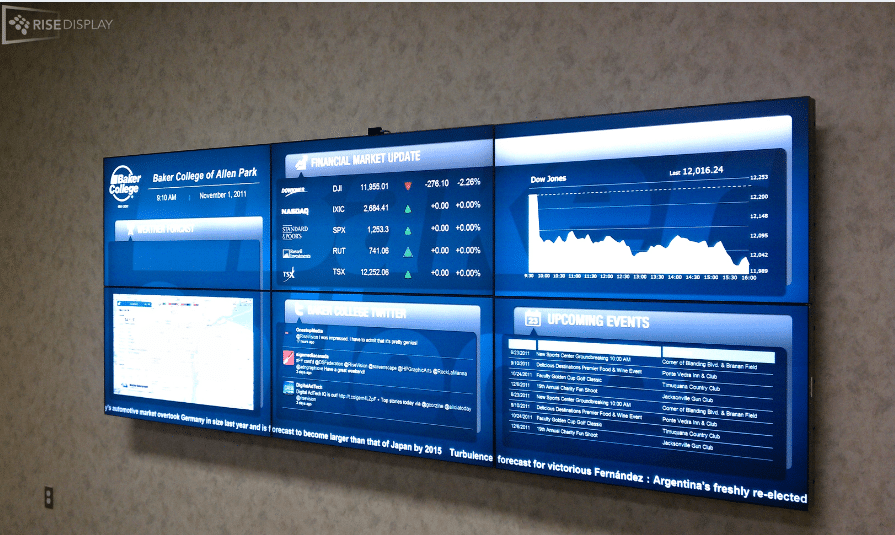

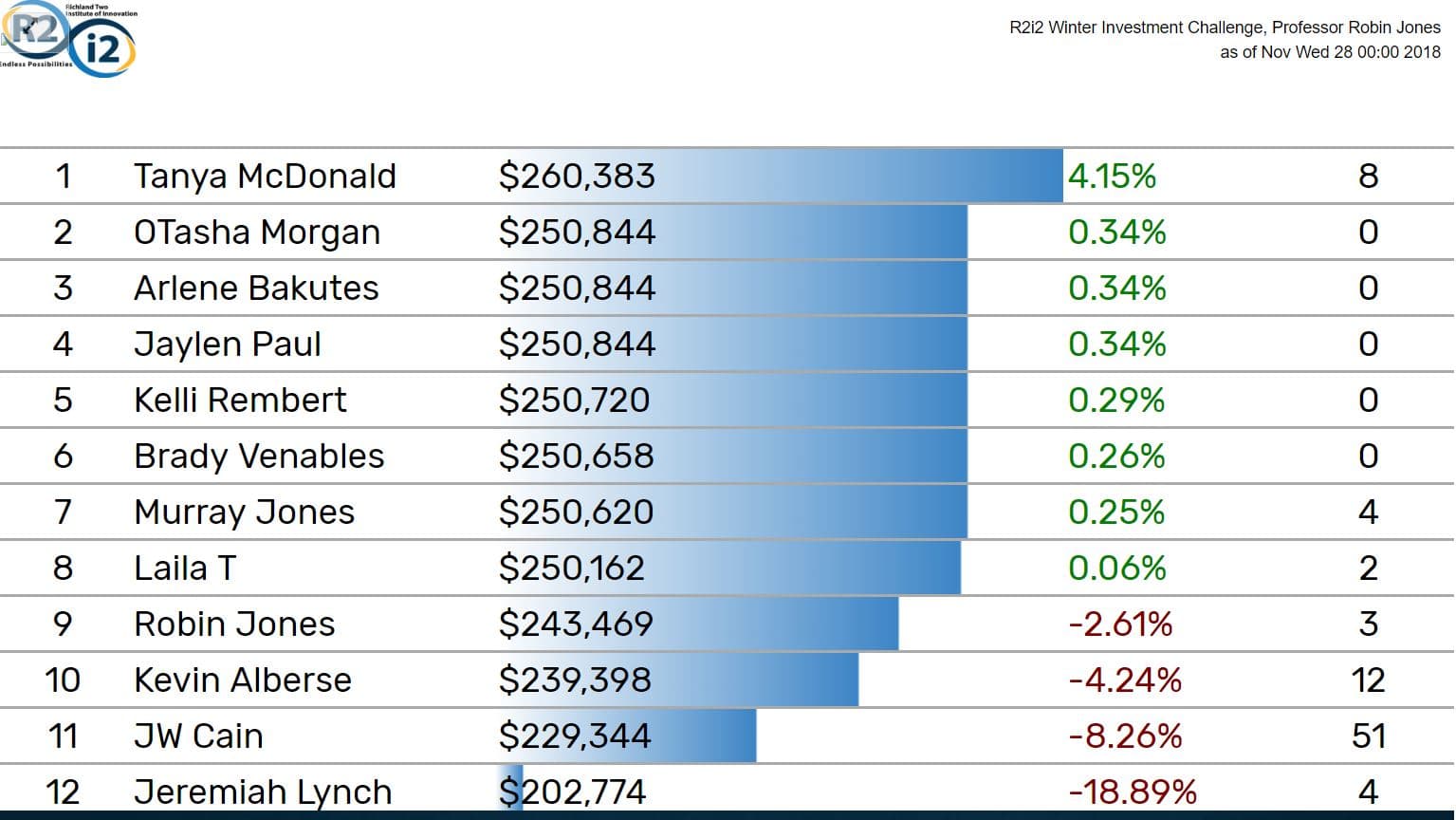

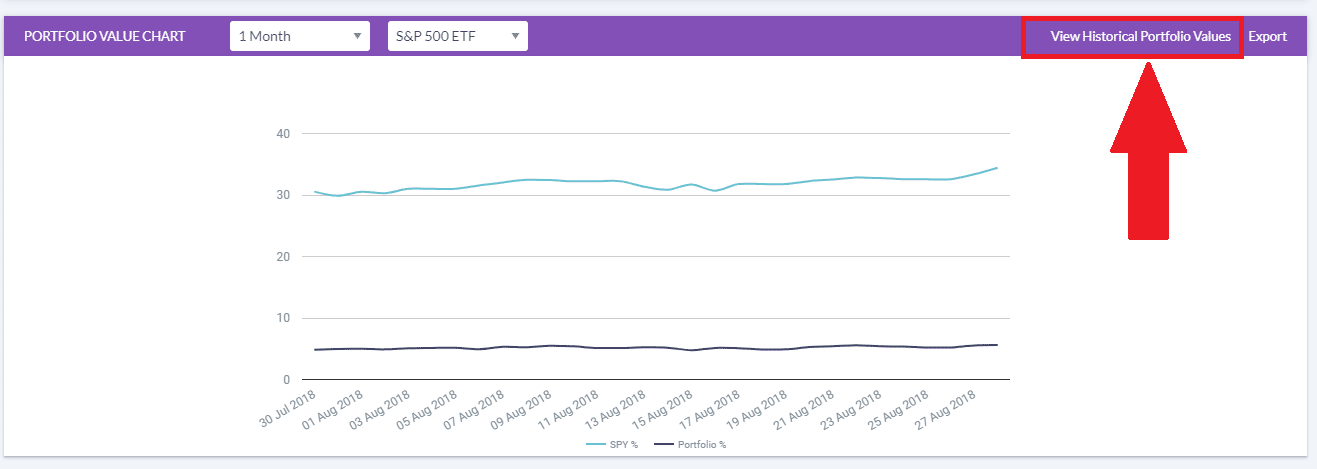

They also use two LCD displays, which alternate between live quotes for Forex and Commodities, a stock watchlist, live market news, live updating stock charts, and a streaming leaderboard of their class rankings (you can see more of what you can add to your displays on our blog post here).

The Classes

In the Lab itself, Marquette holds their Global Finance classes, Intro to Business classes, and Microsoft Office classes. The Intro to Business and Microsoft Office classes do not currently take advantage of the Personal Finance Lab website, but the streaming rankings are always a great discussion point, as they see their friends and classmates moving up the leaderboard.

Marquette is a 1-to-1 iPad school – outside the lab space itself, they also use the PersonalFinanceLab website, curriculum, and simulation in their Economics classes. While these classes do not meet in the Lab itself, they are still able to utilize all the PersonalFinanceLab resources from anywhere with internet access – making it perfect even for homework assignments.

Over the last 12 months, the total usage of the PersonalFinanceLab website has increased from about 15 students a semester to over 60, as more teachers at the school find ways to incorporate the platform in their lesson plans.

Using Personal Finance Lab With The Global Trading Class

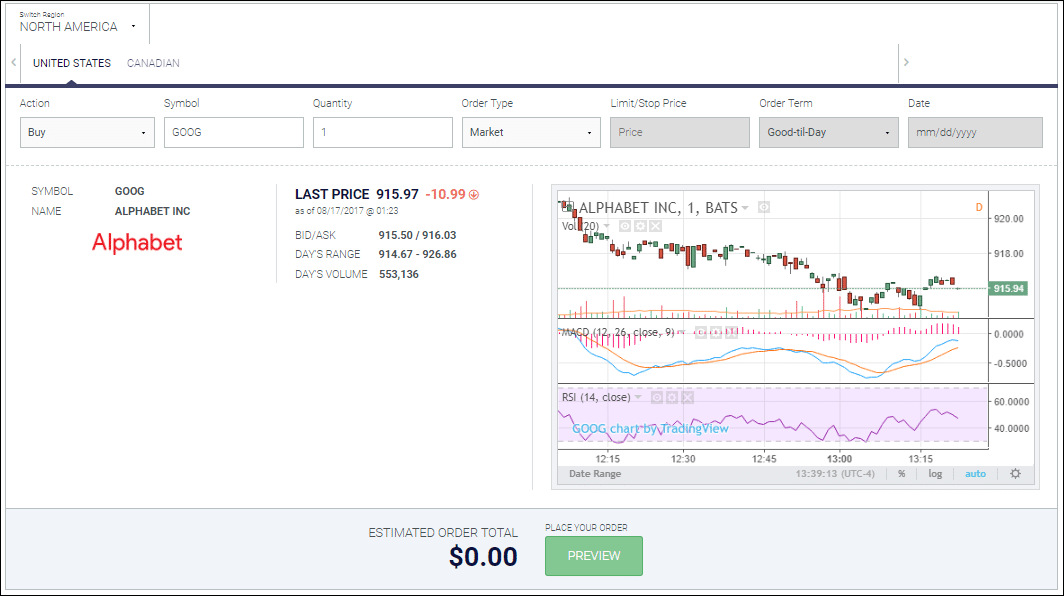

The Global Trading class was the first to utilize the stock game in their classes. This CTE-focused course has between 10 and 20 students a semester, with an emphasis on researching investments.

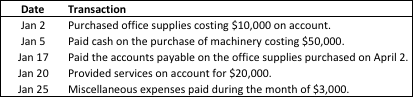

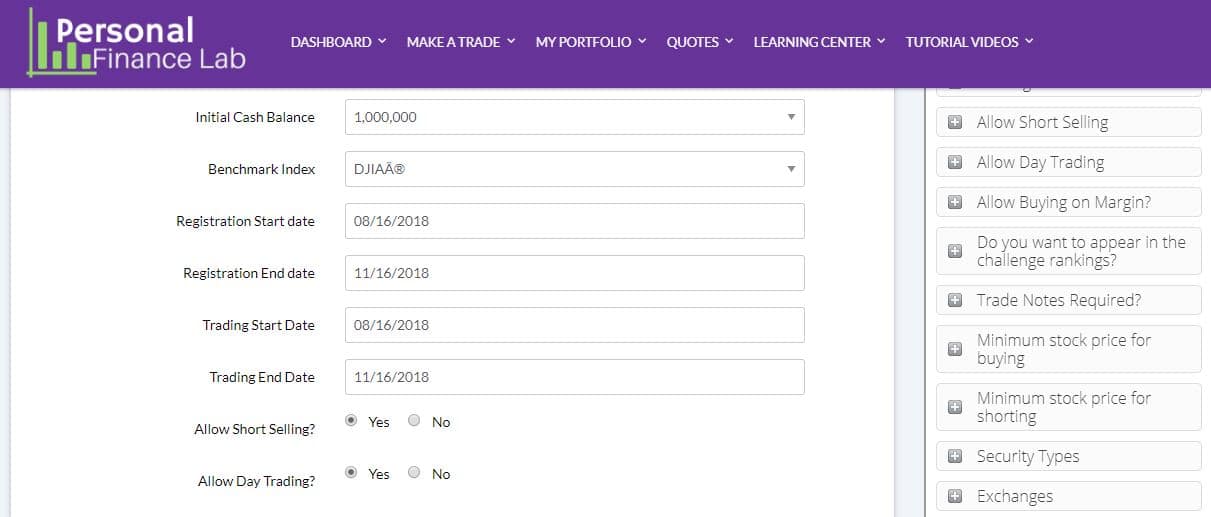

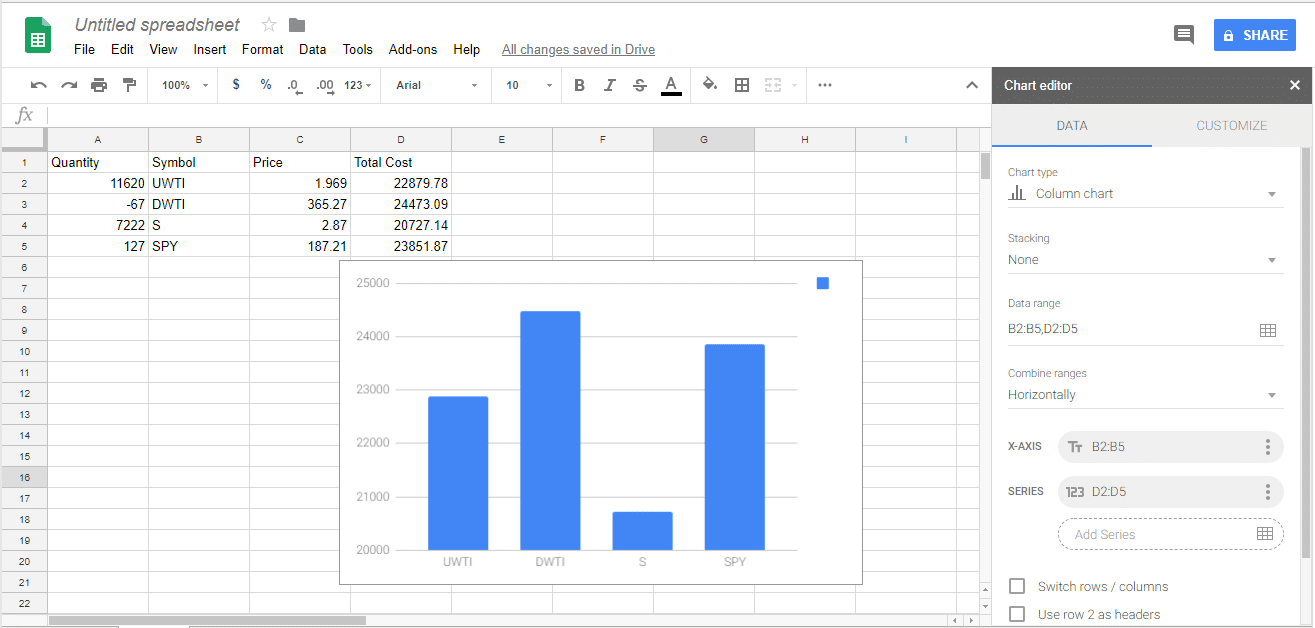

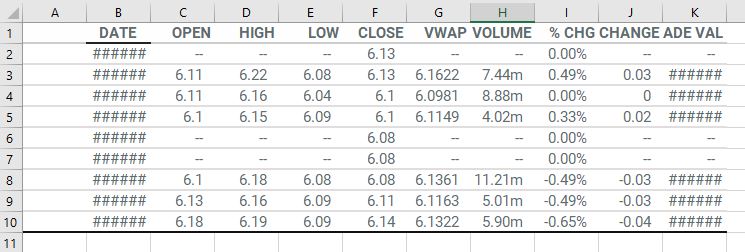

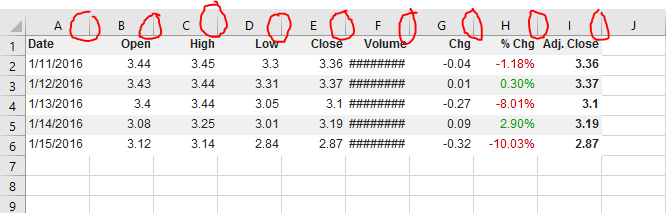

Snapshot of the Financial Statements Research tool

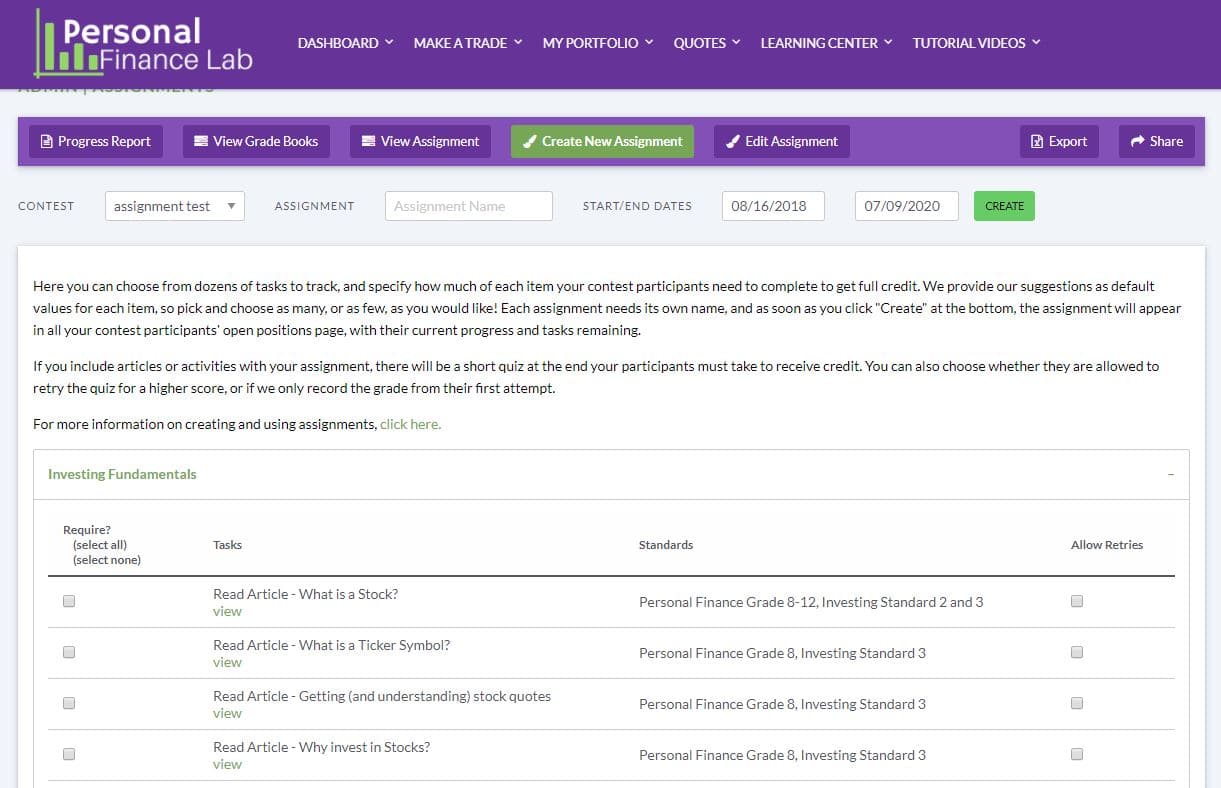

The class also utilizes the built-in Assignments feature to get students familiarized with investing and building a portfolio. Each week, students are given a new “Assignment”, borrowing both from the included stand-alone lessons, and integrated Investing 101 Beginner’s Investing Course.

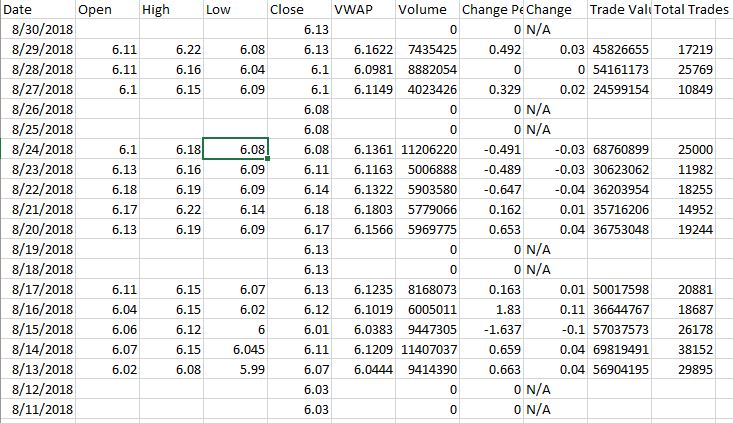

Snapshot of a student progress report – names obscured for privacy

So far, a group of 9 students this semester have placed over 550 trades between them (that’s over 60 trades each!), and we are barely through the midterms!

Since the Global Trading class meets in the Lab itself, the class rankings are broadcast to the LCD screens, and the students from other classes can monitor the standings of their friends – with a lot of interest getting generated to start a school Investing Club!

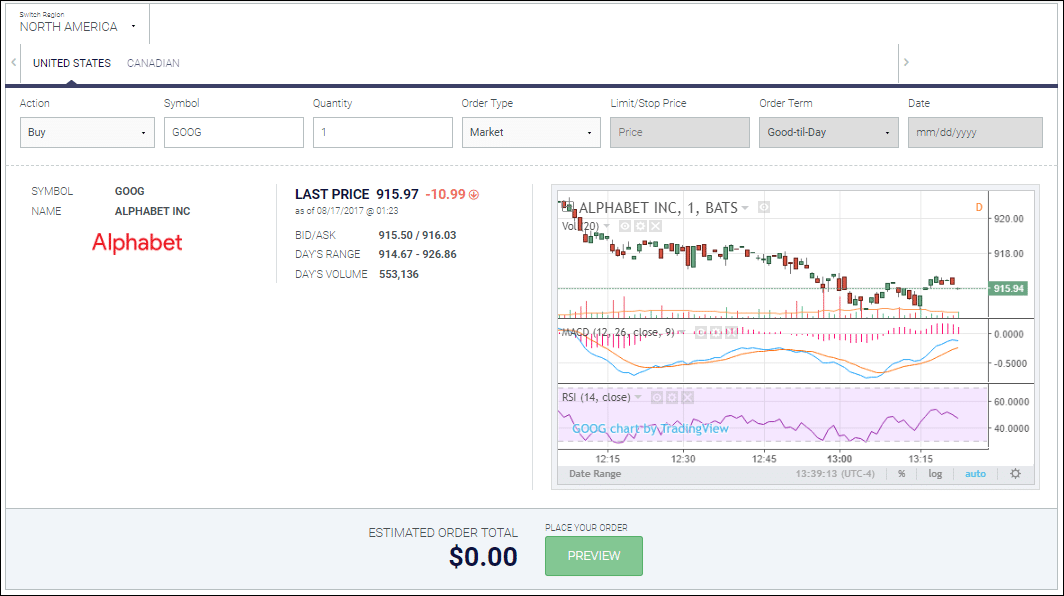

Using Personal Finance Lab With The Economics Class

Starting this semester, Marquette is also using the PersonalFinanceLab website in their Economics class. This class does not meet in the lab itself – students typically log in using their iPads elsewhere at school (or at home for homework).

The economics class swaps intensive investing for more of a focus on the lessons and curriculum (the class of nearly 40 students have about 700 total trades).

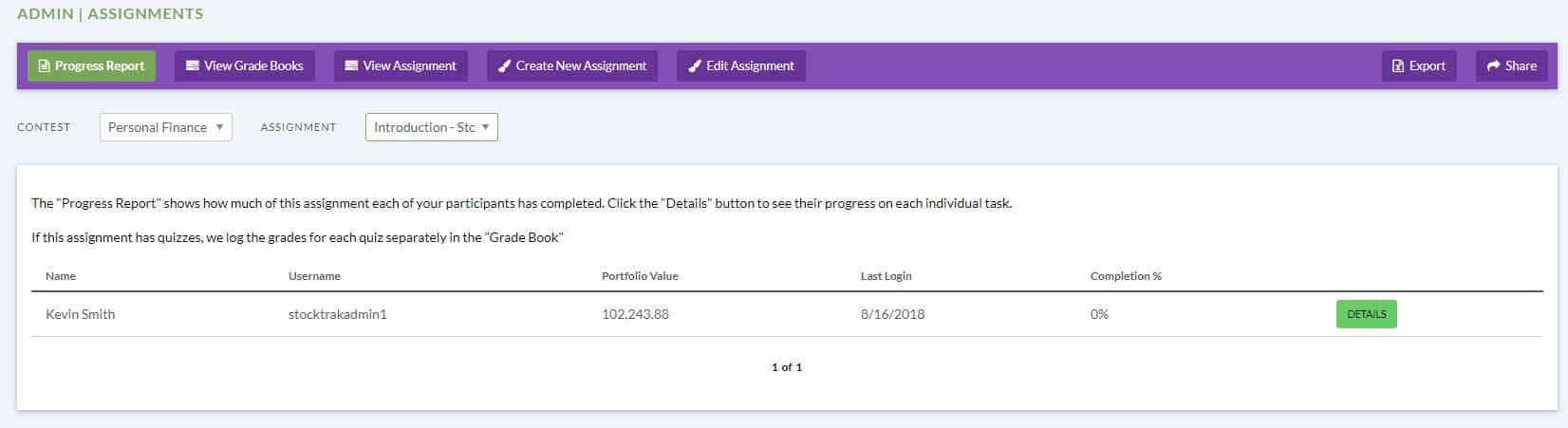

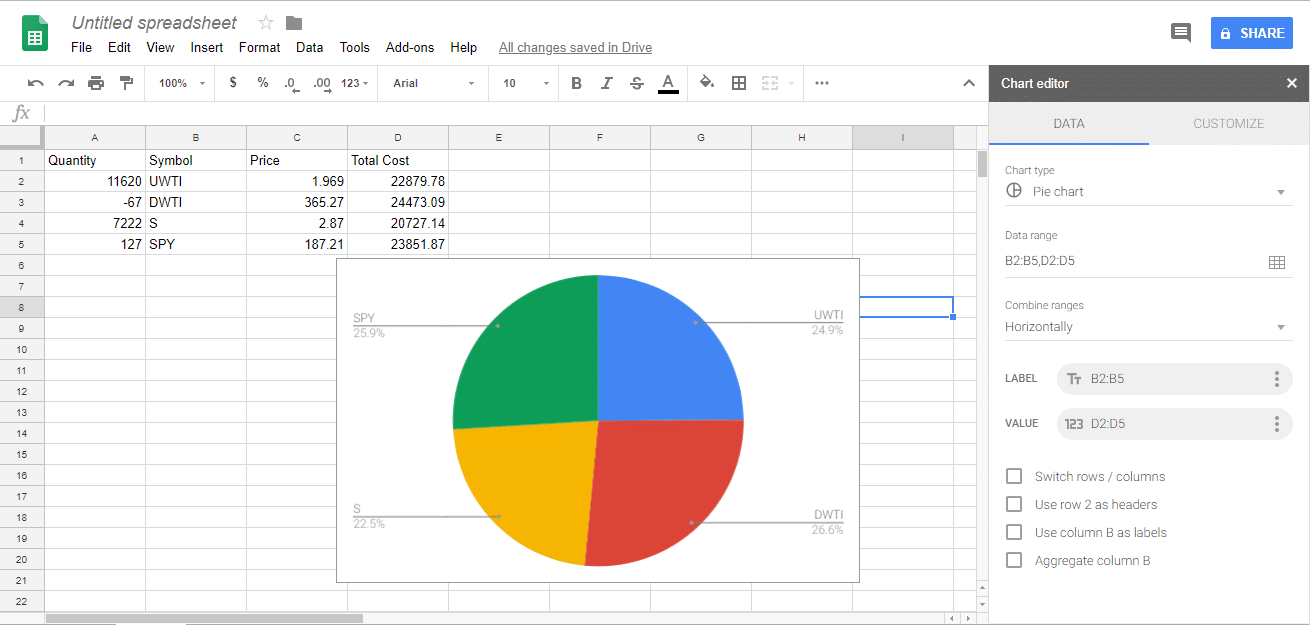

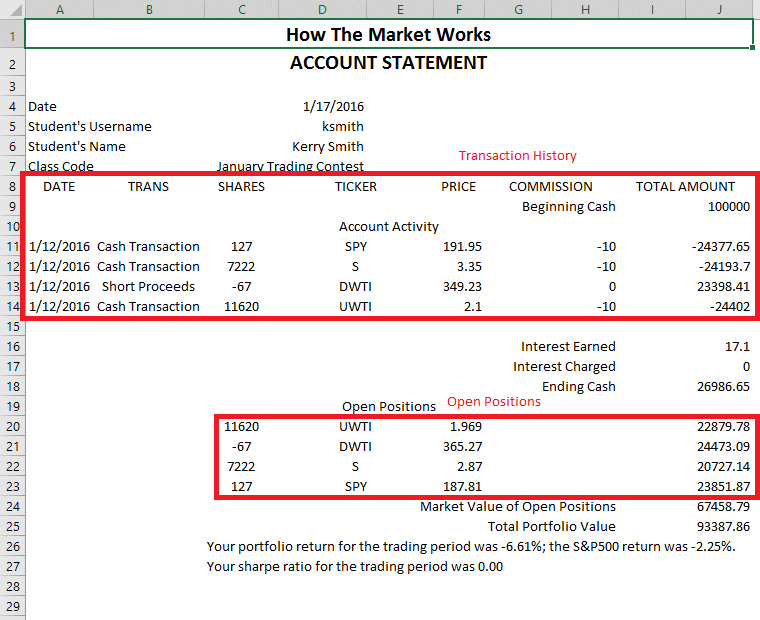

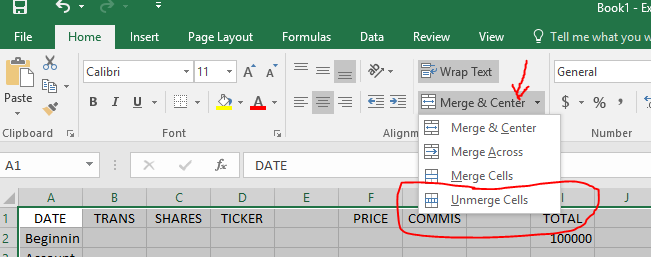

Snapshot of the Teacher Dashboard

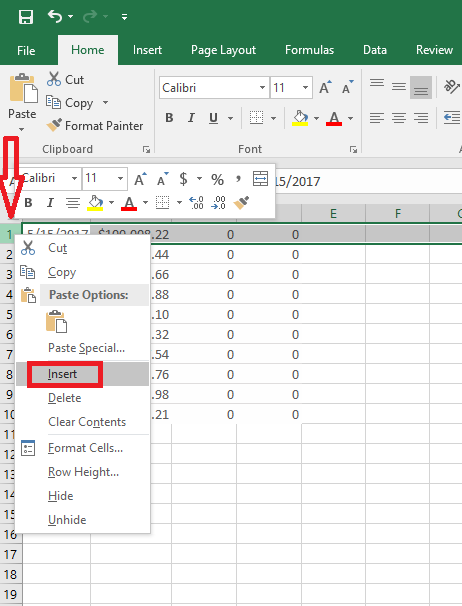

The economics teacher structured the class Assignments to start small and work big – the first 2 weeks focus on stocks and investing (to get introduced to the concept of managing a portfolio) before adding in Economics and Personal Finance lessons, tailoring the week’s assignments to align with the topics covered in class. In all, there are 9 separate assignments, arranged week by week, with an average of 3 topics covered in each Assignment.

The addition of the Economics class greatly increased the reach of their Lab resources throughout the school, from a CTE-specific resource used by the business classes to an invaluable resource used by the social studies department as well (and a much wider audience of students).

Looking To The Future

Since launching the Lab, there has been a huge boost in interest for finance and investing across the school, and they hope to launch a new Investing Club later this year. Their new business teacher is also looking to use PersonalFinanceLab.com as a more active part of her lesson plans next semester.

If you are interested in getting more information, or ordering PersonalFinanceLab for your school, be sure to fill out the information request below!

[contact-form-7 id=”17211″ title=”Request More Information”]

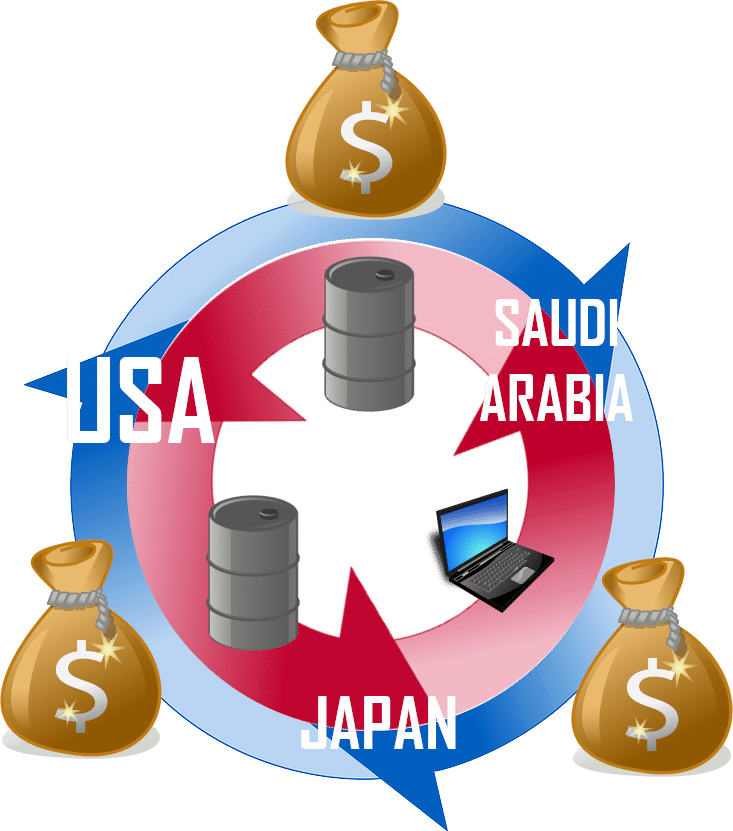

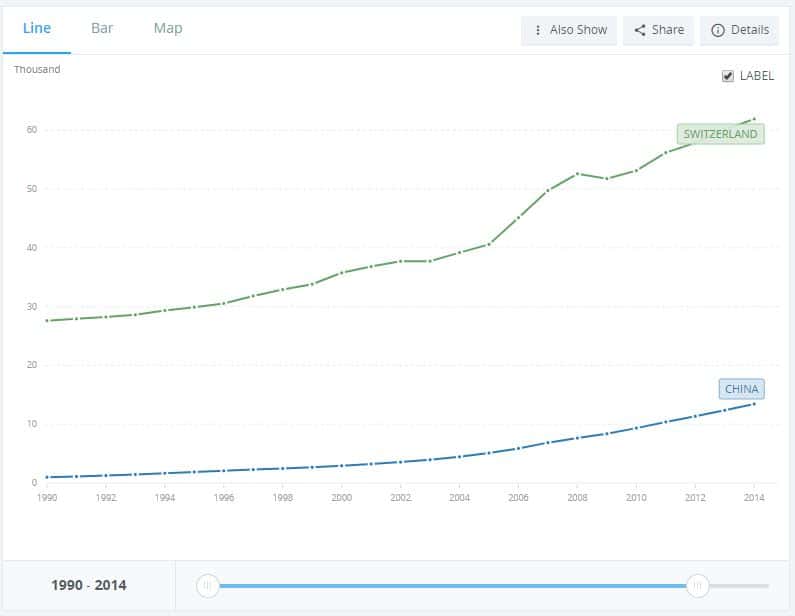

Imagine two farmers – Alice and Bob. Alice and Bob both have farms located 15 miles away from a major city, and both have about the same quality of soil. If they both grow corn in the same year, they will produce about the same amount, and earn the same income. In this example, neither Alice nor Bob has any comparative advantage.

Imagine two farmers – Alice and Bob. Alice and Bob both have farms located 15 miles away from a major city, and both have about the same quality of soil. If they both grow corn in the same year, they will produce about the same amount, and earn the same income. In this example, neither Alice nor Bob has any comparative advantage. If Alice always re-invests half of her income into her business, but Bob does not, within a few years Alice’s machines and tools will be a lot more up-to-date and productive than Bob’s.

If Alice always re-invests half of her income into her business, but Bob does not, within a few years Alice’s machines and tools will be a lot more up-to-date and productive than Bob’s.

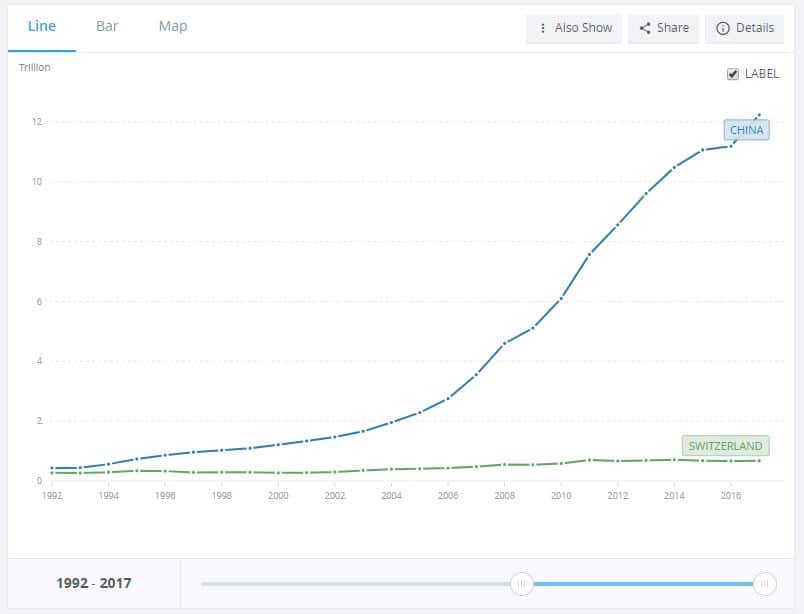

There are a few ways to calculate GDP, but the easiest measurement looks at consumption, investment, government activity, and net exports.

There are a few ways to calculate GDP, but the easiest measurement looks at consumption, investment, government activity, and net exports.

GDP increases when output increases. When we look at how much a country could potentially produce in a given year, if its resources were all being utilized to the maximum, we would consider:

GDP increases when output increases. When we look at how much a country could potentially produce in a given year, if its resources were all being utilized to the maximum, we would consider: Think of it this way: England spent over a hundred years and the equivalent of billions of dollars building railroads all over their country to help speed up trade. Every year, companies would spend millions to make small improvements to the rail engine technology. This slowly improved their technology, quantity, and quality of capital goods.

Think of it this way: England spent over a hundred years and the equivalent of billions of dollars building railroads all over their country to help speed up trade. Every year, companies would spend millions to make small improvements to the rail engine technology. This slowly improved their technology, quantity, and quality of capital goods.