Definition

Futures Contracts are a standardized, transferable legal agreement to make or take delivery of a specified amount of a certain commodity, currency, or an asset at the end of specified time frame. The price is determined when the agreement is made.

Here are some useful terms for futures:

Contract Size: This specifies the number of units of the underlying future to be delivered. It could be in barrels, tons, liters, etc. We use this contract size to determine the multipliers on our website. The multipliers essentially multiply your profit/loss for every contract. For example, if the delivery is 10,000 liters of orange juice one contract of OJ would multiply your profit loss by 10,000. Hence if the price of your future contract moves from 1$ to 1.01$ you will gain 100$ (10,000 * 0.01$) for each contract you own. These vary widely from future to future from contract sizes of 10 to 100,000.

Margin: Futures do not ask you to put the entirety of the deliverable cost upfront. It is determined by margins and vary widely from future to future. On this simulator that is the actual “cost” of the money you have to put aside. In real life you would get margin calls and have a maintenance margin depending on how much money you have lost or gained depending on the current market price of the future which will limit your losses. On our platform, however, there is no maintenance margin or margin calls so it is possible to lose very large sums of money.

Termination Of Trading: This determines when the most current contract will stop trading. It can vary quite a bit from future type to future type. Certain futures stop trading months before the actual delivery so be sure to check on CMEGroup if you are unsure.

Trading Hours: The trading hours for futures vary depending on the type of future. Currency trades close to 24 hours a day whereas other futures have large trading halts during the day monday to friday.

Note:Many sites do not make the discrepancy between electronic trading and trading on the floor. It is important to check that your future is trading electronically as on the floor trading is typically not available to the average investor and is not available on this simulator. Again, you can check on CMEGroup for the exact trading times of each future.

Example

If I buy a December Crude Oil contract I am saying that I will deliver x amount of barrels (as stated in the contract) by the settle date in December and the counter party of the futures contract will give the dollar amount specified when buying the contract. However, in real life as on the simulator, physical delivery of these contracts are actually quite rare (you will never deliver any physical goods on the simulator). What is more common is to simply settle the difference as a profit or loss in the owners investor account. Hence if we buy a Crude oil future for 50$ and the price changes to 55$ at delivery it will be 5$ per contract times the contract size.

Why use Futures?

The original use for futures was to hedge against uncertainty. A farmer or the company that buys his crops could use futures to “lock-in” a price ahead of time and therefore make budgeting and other monetary decisions far easier. The same can be said for airlines who do not want to have to deal with daily price fluctuations and so use futures to know the price ahead of time.

Futures are still used in this matter but have also evolved to broader markets, most notably trades and speculators.

Futures also provide a way to greatly leverage positions due to the low margin costs and large contract sizes (multipliers)

Simulator Future Trading

Before you trade futures, you should know that they trade differently from other security types.

When you buy a futures contract, you aren’t actually paying for its full value – you are just agreeing to pay for the goods that it represents at a later date. This means your “Cash Balance” will not go down. However, you do need to put down a deposit, so the “Margin Requirement” is deducted from your buying power.

The margin requirement can vary by future, but it will appear when you get a quote for the contract you are interested in. Futures also trade in contract sizes – one futures contract can represent 100 or even 1000 of the commodity it represents (this will also appear in the quote as “Contract Size”).

When you want to sell your future, this is when cash changes hands – you will make (or lose) cash based on how much the value of the entire future changes during the period you were holding it. This makes trading futures very risky – if you have a future with a contract size of 10,000, and own just 10 contracts, that contract can go down by just $3, and you will have lost $300,000.

If your contest allows trading futures, you can find them on the Futures trading page.

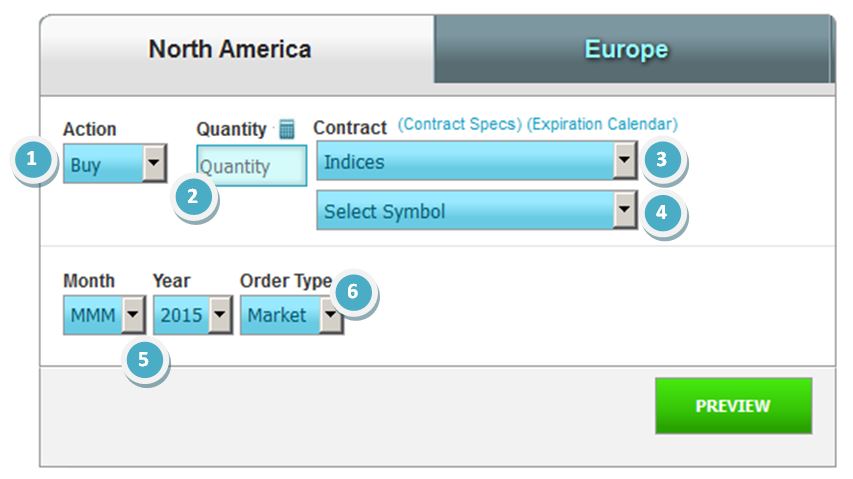

- Action: Here you can select: Buy, sell, short, cover just as you would for stocks.

- Quantity: Enter the quantity desired of options contracts. Remember even with 1 futures contract you can have huge exposure depending on the contract size. Always look at the volatility and contract size of the future you are trading to determine your level of risk.

- Contract:This will list the category of contract you wish, indices,food,energy, etc. You can then select the specific futures contract you want in the “select symbol” drop-down.

- Month-Year: This can only be selected after selecting the future you want. This will select the contract month of your option. Note: if you get an error it is usually because the month and year you selected has expired, simply look at the next month or year to get a current future expiry.

- Order type: Here you can select whether you want a market, limit or stop order.

Select preview and you can confirm your purchase.

Note: futures trading can be risky due to the high leverage used. They also have a lot of small nuances and complexity. It is always a good idea to get as much information as possible straight from the source from CME Group or in certain cases Ice Futures

Pop Quiz

[qsm quiz=62]