While the wild roller coaster swings of the market make the media highlights, stocks remain an excellent choice to achieve a high – and steady – return. In finance textbooks, this is called return on investment (ROI) and is one of the most important measures of all investments choices. After all, when comparing different investment choices, isn’t it all about how much money can be earned upon an investment?

Over time, stocks have proven to achieve a consistently high ROI. For example, over the entire century, from 1900 to 2000, global stocks returned 9.2% on average, per year (U.S. stocks returned an even better 10%!) while bonds generated 4.4%, and cash (short-term Treasuries) returned only 4.1% on average, per year.

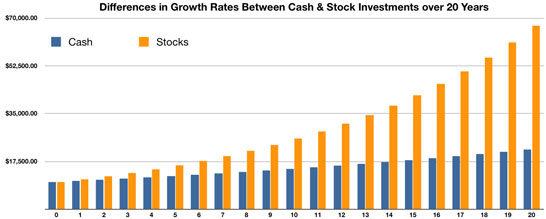

The difference between investing in stocks versus staying in cash and earning short-term Treasury rates over a lifetime of saving can end up being hundreds of thousands of dollars! Take a look at the chart below of two different investors. One invested in cash (Investor A), the other in stocks (Investor B). Both investors had the exact same amount of money to invest ($100,000) and same amount of time to see their investments grow (20 years). Look at the difference:

Investor A ended up with $214,567, a 114% return – not bad. But Investor B who bought stocks ended up with $532,590, a 433% return!!! By investing in stocks by simply buying the broad stock market through the S&P 500 index, Investor B made $317,823 more money than Investor A who remained in cash and earned short-term Treasury rates..

Uninformed people think you can get rich or poor fast with stocks as compared to other more stable investments. You certainly could achieve these dubious results. However, if you follow the simple rules you learn in this course, you will prevent yourself from falling into that trap. It is a fact: over the last 100 years, stocks have proven to be the BEST investment despite their daily – sometimes hourly – ups and downs.

However, timing and your investment horizon (the amount of time you have to leave your money invested) will determine your success. Take a look at this table below. If you had only 1 year to invest in the stock market, over the last 100 years you could have earned anywhere between 61% and -39% in that 1 year. But if you had 10 years to invest in the stock market, you would have AVERAGED somewhere between 19% and 0.50% per year, with a likely return of 11.10%.

| Years | Highest | Lowest | Average |

|---|---|---|---|

| 1 | 61.00% | -39.00% | 13.20% |

| 3 | 33.00% | -11.00% | 11.60% |

| 5 | 30.00% | -4.00% | 11.90% |

| 10 | 19.00% | 0.50% | 11.10% |

| 20 | 15.00% | 6.40% | 9.50% |

Teacher Introduction Webinars

Teacher Introduction Webinars What Is A Short Stock?

What Is A Short Stock? Investing in Italy

Investing in Italy