Now that you know what the stock market is and what role the Stock ExchangeStock exchanges are simply organizations that allow people the ability to buy and sell stocks. play, let’s take a step back and look at how stock prices and the economy move. As you might expect, timing is extremely important in investing because you must learn how to time your buys and your sells.

Your first requirement is to understand ” business cyclesThe typical business cycle consists of periods of economic expansion, contraction (recession) and recovery to a new peak..” Understanding what business cycles are is relatively easy to do, but predicting them is nearly impossible and even the best economists at Harvard University rarely agree.

If you are over the age of 18, you know that business cycles exist. We have all heard the terms of recessionA recession occurs if a business cycle contraction is severe enough and the GDP declines for 2 consecutive quarters., depression, expansions, boom, and bust. The economy seems to go strong for a while where everyone has a job, feels optimistic about the future and we hear the stock market setting new highs. Then it seems as if overnight, we hear about companies that have overbuilt, laying people off and freezing wages. You may not have realized it then, but you were riding the ups and downs of a business cycle.

Don’t confuse one company’s sudden success with business cycles. Fads and single industries or conditions seldom influence a business cycle. Like a perfect storm, business cycles are the product of multiple components. As a newer investor, you should understand and accept that they happen. It’s never a question of “if,” only “when” a business cycle will peak or bottom out. Investing just before a peak can be costly. Conversely, investing at the bottom can be quite profitable.

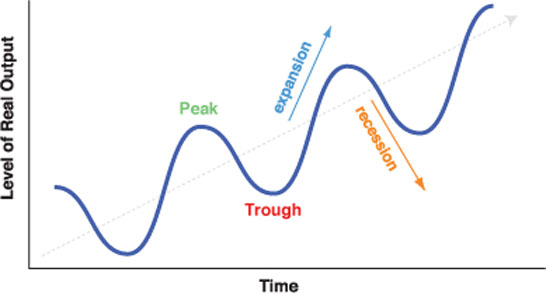

The typical business cycle consists of periods of economic expansion, contraction (recession) and recovery to a new peak as seen in the graph below:

A business cycle is usually identified as a sequence of four phases:

- 1. Contraction (A slowdown in the pace of economic activity)

- 2. Trough (The lower turning point of a business cycle, where a contraction turns into an expansion)

- 3. Expansion (A speedup in the pace of economic activity)

- 4. Peak (The upper turning of a business cycle)

A recession occurs if a contraction is severe enough and the GDP declines for 2 consecutive quarters. During recessions, which generally last 1 or 2 years, interest rates decline to help stimulate new business. A deep trough is called a slump or a depression.

Now, here’s the premise behind economic cycles: They are more than just mere fluctuations in economic activity; they are significant oscillations of human behavior consistent and powerful enough to impact the economy. Sometimes the business cycle moves in shorter cycles, and occasionally it might take a decade to recover back into a growth mode (think Depression here).

Economists and Wall Street argue all of the time about when we have topped out and when we have bottomed out. That is why so much attention is paid to the economic indicators that the U.S. Government releases monthly or quarterly like the Indicators below:

| Indicator | Source | Frequency |

|---|---|---|

| Advance Monthly Sales for Retail and Food Services | Census Bureau | Monthly |

| Advance Report on Durable Goods | Census Bureau | Monthly |

| Construction Put in Place | Census Bureau | Monthly |

| Gross Domestic Product | Bureau of Economic Analysis (BEA) | Quarterly Data, Revised Monthly |

| Manufacturers’ Shipments, Inventories, and Orders | Census Bureau | Monthly |

| Manufacturing and Trade: Inventories and Sales | Census Bureau | Monthly |

| Monthly Wholesale Trade | Census Bureau | Monthly |

| New Residential Construction | Census Bureau | Monthly |

| New Residential Sales | Census Bureau | Monthly |

| Personal Income and Outlays | Bureau of Economic Analysis (BEA) | Monthly |

| U.S. International Trade in Goods and Services | Census Bureau & Bureau of Economic Analysis (BEA) | Monthly |

| U.S. International Transactions | Bureau of Economic Analysis (BEA) | Quarterly |

For the purposes of this introductory course, suffice it to say that you must start paying attention to the cycle the current economy is in. If you want to explore further the deep and fascinating world of cycles, here are some of the more important cycles you should look at:

- The Kitchin Cycle

- The Juglar and Kuznets Cycles

- The Kondratieff (Kondratiev) Wave

- The Schumpeterian Cycle of Innovation

- The Armstrong Cycle of Economic Confidence

Knowing where you are in the overall business cycle is very important as an investor. As you might expect, just as the economy moves in cycles, so too does the stock market. In fact, the stock market generally moves in advance of the business cycle because the stock prices are based on both past earnings and future expectations of earnings.

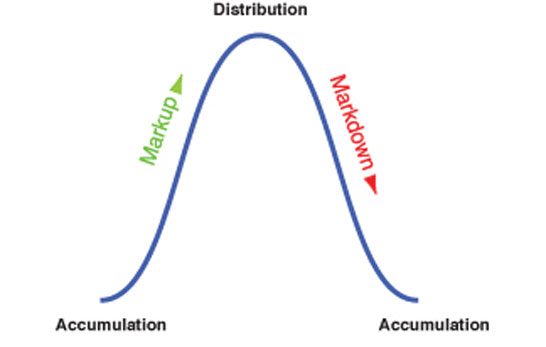

Furthermore, as the economy is moving in its cycles and the stock market is moving in its cycles, stocks also move in cycles. After all, you can find the best stock to buy in the world, but if it is not timed well with the overall business and market cycles, it may turn into a loss. Every stock or asset class goes through a classic cycle that is similar to the business cycle. Here is a diagram of the four stages of a stock’s cycle:

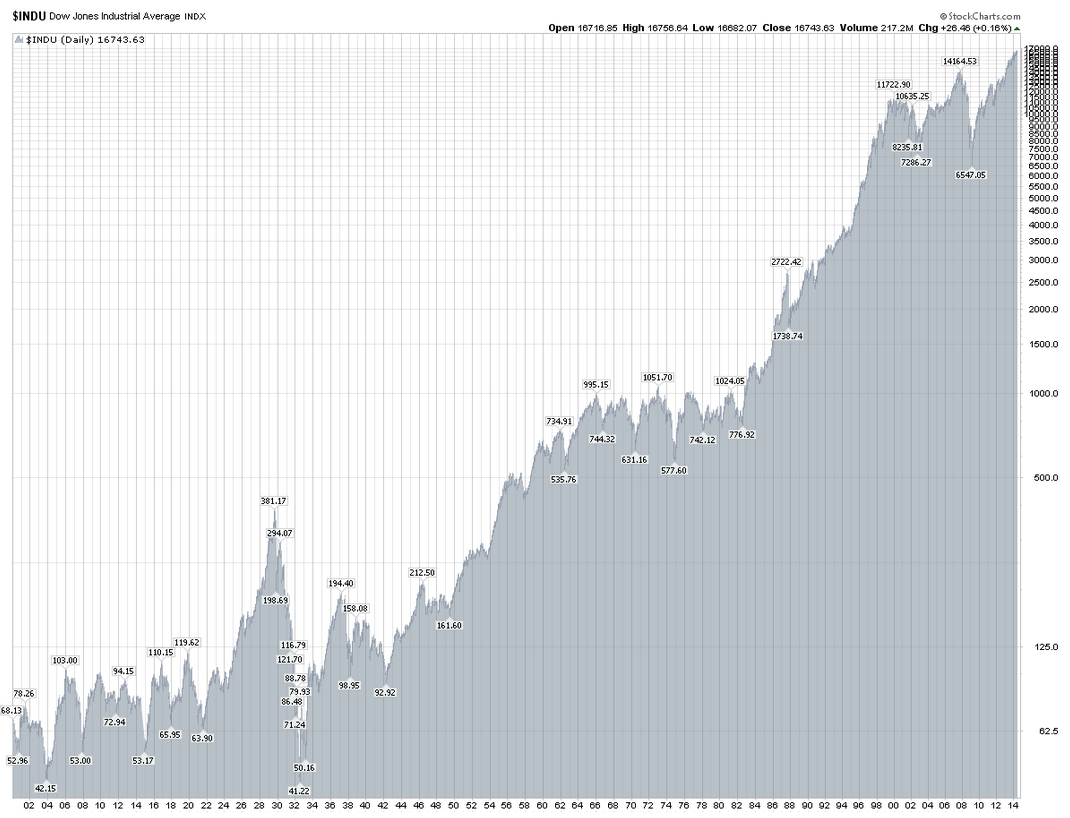

Now compare these charts with a chart of how the market has performed since 1900. This is a chart of the Dow Jones Industrials Average. This is simply a composite price of the 30 largest companies in the U.S. and is used as a benchmark as to how the market is performing overall. You will note many up and downs in the market, but with the overwhelming trend being up.

When you look at the chart of any stock or index, it typically moves in cycles that are closely related to the overall business cycle. For more information on timing stock picks with business cycles, our article here: Understanding Market Cycles: The Art of Market Timing