A mutual fund is a type of investment where a money manager takes your cash and invests it as he sees fit, usually following some rough guidelines. For example, the Fidelity Group has a fund that specializes in finding high dividend paying stocksStocks are “equity investments”, which means that individuals that own stock shares of a company actually own part of that company., one that specializes in bank stocks, and one that specializes in European stocks, etc. You simply find a fund that matches your objective, you review its past performance and its management team, and then you write a check to that mutual fund.

Most mutual funds are called “open-ended” funds because they will continue to take your cash, manage it for you, and issue shares to show your ownership. Each night the mutual funds calculate the value of all of their holdings and divided that value by the number of shares they have issued, and that number is called the Net Asset Value or NAVNet Asset Value of a mutual fund at the end of the business day. It is the equivalent of a share price of a stock.. So if the Fidelity Bank Fund had a value of $10.00 and your write them a check for $5,000 you would now own 500 shares of this fund. Gains, losses, and earnings are mutually shared with investors in proportion to the size of their investment.

Since one of the primary rules of investment is to diversify portfolios, a mutual fund can be a simple and successful way to accomplish this goal. With one investment, you will own shares of stock in many corporations.

How Does a Mutual Fund Work?

To research mutual funds, Morningstar.com is one of the top web sites to check out. The Morningstar website:

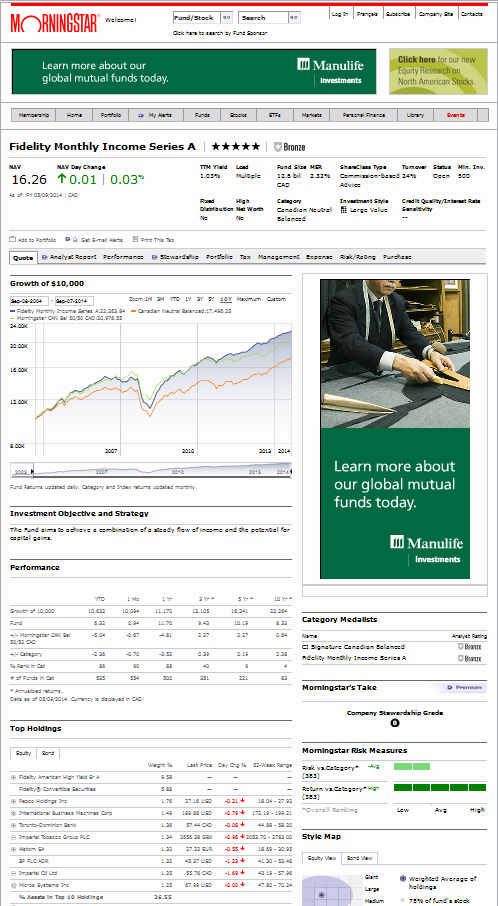

- rates funds on a 1-5 scale so you can quickly review a fund’s performance

- shows mutual fund performance against relevant sectors and other funds

- shows the top holdings (what stocks they own) in all mutual funds

- shows the people who manage these funds

- shows the expense fees for each fund

Below is a screen shot from Morningstar of the Fidelity Monthly Income Series.

out for as an investor because they can quickly and devilishly eat into your profits over time. Do higher management fees correlate to higher returns and better performance? As it turns out, the answer is NO. In fact, many studies have been done that show higher fees generally correlate to lower performance.

Mutual Funds are not traded on an open market like stocks and the prices of mutual funds are calculated just once a day, at the end of every trading day. The price for a mutual fund is called the Net Asset Value (NAV) because it is a calculation of the entire value of stocks and other assets held by the fund divided by the total number of shares outstanding: