This is a free national competition where you can play the Stock Game and Budget Game and get the chance to win prizes, and appear in national rankings.

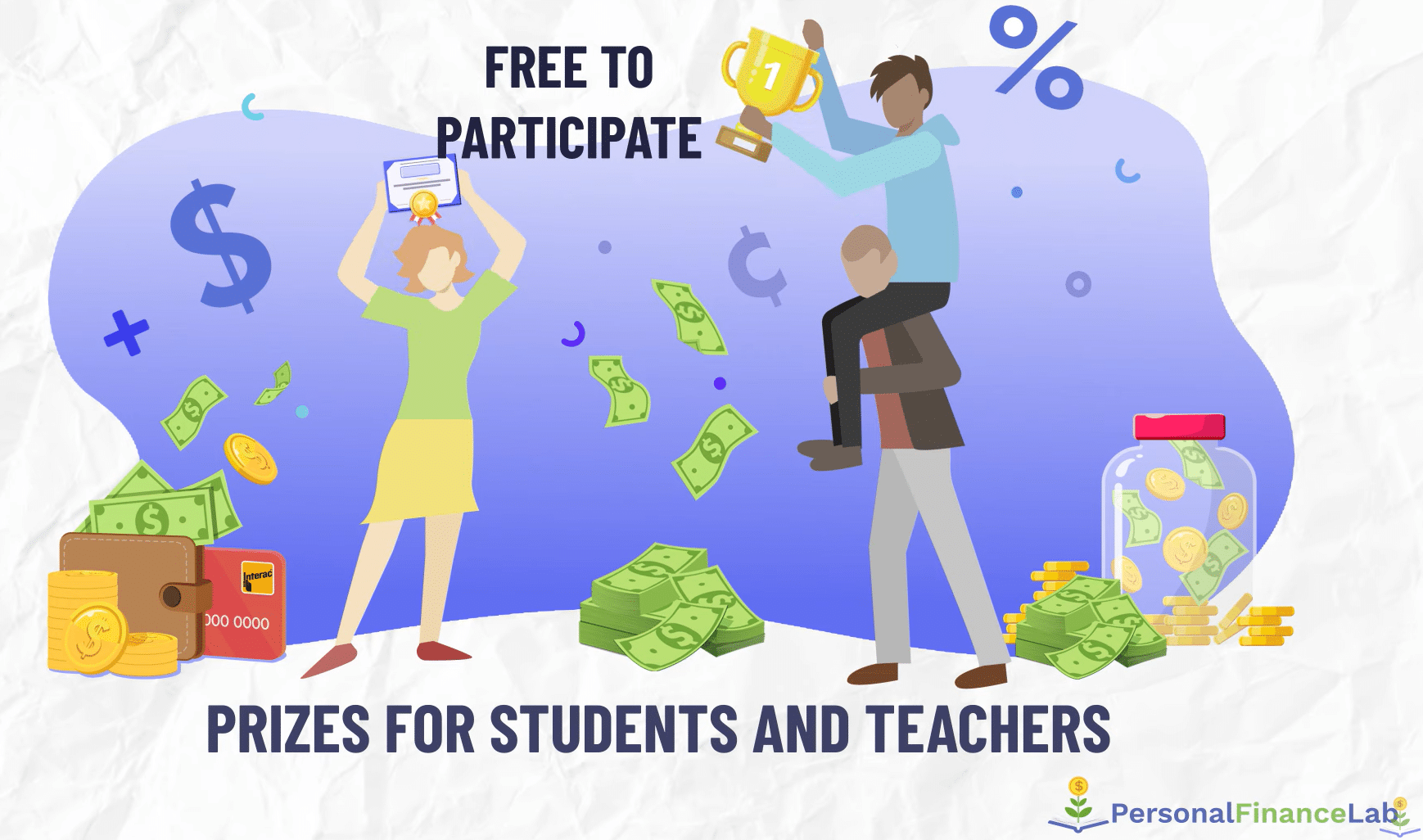

If you are interested in participating, you can use the same login details you’re already using in your class. Click the link below to register to the Financial Literacy Challenge. After logging in, you can switch between sessions from the Student Dashboard.

Register Now

Prizes Total of

The top 3 students from both the Budget Game and Stock Game in each region will each win a $50 Amazon Gift Card. Plus, the top 3 overall winners for each game win an additional $50 Gift Card!

Prizes Total of

3 teachers will receive a $100 Amazon Gift Card. Students can nominate their teacher, and we’ll pick 3 lucky winners who will each get a $100 Amazon Gift Card.

Students practice managing a monthly budget, and building their emergency savings fund while learning how to make responsible money management decisions.

Learn more

Students practice managing a virtual portfolio of US stocks, bonds and mutual funds. With live rankings, research tools, and real-time prices.

80+ self-graded personal finance lessons and financial literacy tutorial videos. Teachers can track student progress and grades.

Students start the game with $500 in their Checking Account and $500 in their Investing Account. Students can play through 12 virtual “months” of the budget game, with each “month” taking about 20 minutes to complete.

For the first 6 “months” of the game, students will be college students with a part-time job. They will earn $18 an hour, and need to pay rent, phone bill, tv/internet bill, energy bill, and grocery bills every month, plus many unexpected expenses!

For the last 6 “months” of the game, students graduate from college and start their first full-time job, earning $28 an hour. Rent and other bills become more expensive, plus new bills for a car loan, car insurance, fuel, health insurance, and a student loan payment.

As students earn money in the Budgeting Game, they can choose to spend it to improve their Quality of Life, save it in their savings account to build their Emergency Fund, and transfer it to their investing account to reach their Long-Term Savings Goals!

Game score for the Budgeting Game is based on adherence to principles of Personal Finance (building their emergency fund, setting and hitting savings goals, building their credit score, and maintaining a healthy Quality of Life), NOT total net worth – but we show rankings on net worth too for fun!

Rankings in the stock game are based on the student’s percentage return on their portfolio. Transferring large amounts of money from the budgeting game to the stock game can give more investment options, but does not confer a direct advantage in the rankings.

Students taking part in the Financial Literacy Challenge also have access to over 80 supplemental lessons on personal finance topics.

These lessons are available from when a student is registered until the end of May. Completing all lessons is NOT a requirement to be eligible for prizes.

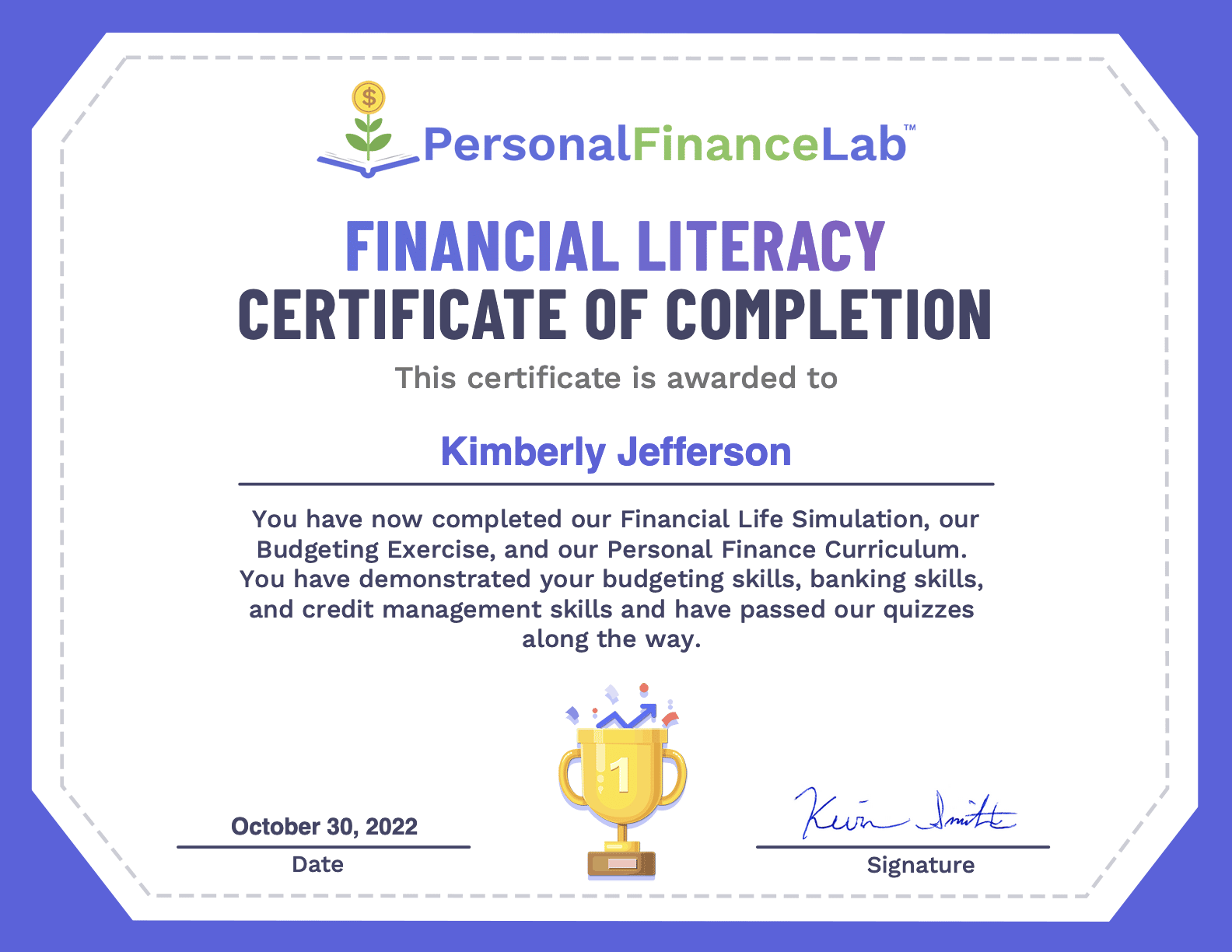

However, each student who completes all supplemental lessons by May 30, 2025 will earn the PersonalFinanceLab Certificate of Completion. Students can downloaded their certificate from their student dashboard as a PDF.

These lessons cover topics across:

No, your challenge profile is independent from your class – trades in the stock game or activities in the stock game will not impact your class. However, completing lessons in the Challenge will also record as complete in your class (if they are required as part of your class assignment), and any badges you earn in the Challenge also carry over to your class profile.

No, students can choose to participate only in the budget game, only in the stock game, or both games. However, students will need to at least begin playing the Budgeting Game and transfer cash over to their Stock Game portfolio to have the required minimum portfolio value to be eligible for prizes.

Completing the budget game, from start to finish, takes about 3.5 hours for most high school students. This can be accomplished in the classroom or at home as a supplement. Completing the stock game varies by student interest level – building an initial portfolio and conducting stock research for a student who has never participated in an investing game before takes approximately 2 hours.

Students’ scores in the budget game come from 4 places: setting (and reaching) monthly Savings Goals of at least 10% of their expected income each month of the game, building an Emergency Fund of at least $1,000 in their savings account, using their credit card responsibly to build up their Credit Score, and building their Quality of Life by spending their money wisely (including making purchases to furnish their Apartment). Small amounts of bonus points are also earned by participating in Comparison Shopping, and other mini-games throughout the game.

Students can trade stocks, ETFs, and mutual funds trading on US exchanges (including but not limited to NYSE, NASDAQ, and AMEX), plus a selection of US corporate and treasury bonds.

While we do not have a “practice period”, classes that register early will have access to our supplemental lessons (required for the Financial Literacy Certificate of Completion) and “Getting Started” tutorial videos, preparing students for how to play the games once they open.

Students can transfer money back and forth from their Investing Account and Budget Game account. We rank students in the Stock Game by portfolio % return (not raw $ value) so students who are less successful at the Budgeting Game are not at a disadvantage in the stock game. However, this could allow students to inflate their % return in the stock game by selling all of their assets and transferring their cash back to the budgeting game.

For example, a student may invest $100 in a stock that increases in price by 10% (a $10 return), while the rest of their original cash is uninvested. This would make their portfolio value $510, or a 2.5% total return for the rankings. This student may then choose to sell their stock, and transfer $490 from the Stock Game to the Budget game. Now their portfolio value is $20, on an initial investment of $10 – showing a 100% return.

The rule requiring students to maintain a minimum balance in the stock game is in place to prevent students from using a similar technique to artificially increase their total portfolio return and gain an unfair advantage in the overall rankings.

“Fractional Trading” means that students can buy less than 1 share of a stock at a time (for example 0.1 shares of TSLA). Fractional sharing allows students to invest any $ in any stock they wish to invest in, and has become common practice in most brokerages for personal investing. Since our competition starts students with only $500 and requires students to invest no more than 25% of their portfolio in any one stock, fractional investing allows students to buy fractions of popular stocks like Tesla, Amazon, and Google, even though they do not have the buying power to purchase one full share.

The PersonalFinanceLab platform does feature Canadian (and many other international) stocks, cryptocurrencies, and options trading in our platform. However, we do not include these security types in the free Financial Literacy Challenge – they are only available in custom classes created by schools with a site license.

When logging in, students will be prompted with several “Assignments” on their dashboard, including lessons on Investing, Spending, Saving, Credit, Risk, and Taxes. Completing all lessons in all units earns the students a Certificate of Completion, which they can download from their dashboard.

The Certificate of Completion can be earned any time, even after the competition has ended.

We sure do! Check out our Video Library for tutorial videos!