Comparative Advantage is the concept where one person, business, or economy is able to outproduce one particular product or service compared to another person, business, or economy.

The concept of comparative advantage is essential to understanding both why people choose different careers, and why countries engage in international trade.

Comparative Advantage At The Personal Level

When it comes to people, comparative advantage will have a large role in determining jobs and income. There are two main types of comparative advantage – Natural, and Acquired.

Natural Comparative Advantage

Imagine two farmers – Alice and Bob. Alice and Bob both have farms located 15 miles away from a major city, and both have about the same quality of soil. If they both grow corn in the same year, they will produce about the same amount, and earn the same income. In this example, neither Alice nor Bob has any comparative advantage.

Imagine two farmers – Alice and Bob. Alice and Bob both have farms located 15 miles away from a major city, and both have about the same quality of soil. If they both grow corn in the same year, they will produce about the same amount, and earn the same income. In this example, neither Alice nor Bob has any comparative advantage.

However, there are a few things that can change this, including Distance, Quality, and Aptitude:

Distance

If Alice’s farm was actually 30 miles away from the city, it would mean she would need to travel 20 more miles than Bob to get her produce to market. That adds an extra cost – even if she works just as hard and produces the same amount of corn, she will have a lower income than Bob just because of the distance.

Quality

If the soil in Alice’s farm is a lot rockier and less fertile, she will end up producing less corn with the same amount of work as Bob.

Aptitude

If Alice is not as fast a planter as Bob, it will also mean she will produce less corn with the same amount of work. For comparative advantage, “Aptitude” is something you are born with, not something you can acquire later with training.

Acquired Comparative Advantage

Natural comparative advantage is outside someone’s control, but acquired comparative advantage is something that will change over time.

Skill

If Alice goes to school or focuses on honing her farming skills, she might become a better planter, or more efficient with her inputs. This will give her a comparative advantage over Bob.

Capital

If Alice always re-invests half of her income into her business, but Bob does not, within a few years Alice’s machines and tools will be a lot more up-to-date and productive than Bob’s.

If Alice always re-invests half of her income into her business, but Bob does not, within a few years Alice’s machines and tools will be a lot more up-to-date and productive than Bob’s.

Personal Comparative Advantage and Careers

All of these factors also come into play when choosing jobs and careers. You might have a lot of aptitude at a job you don’t like – this means that you might have a comparative advantage at the beginning of someone else, but that person could easily surpass you with training and dedication. At the end of the day, your income and job satisfaction will come from both your natural comparative advantages and your acquired ones. Doing something you enjoy, while constantly working to improve your skills, is a good way to secure growing income (so long as what you choose to do has value on the markets – someone will still need to pay you!).

National Comparative Advantage

The same factors that impact a person’s comparative advantage also applies to countries. An easy example is oil, which constantly trades between countries all over the world.

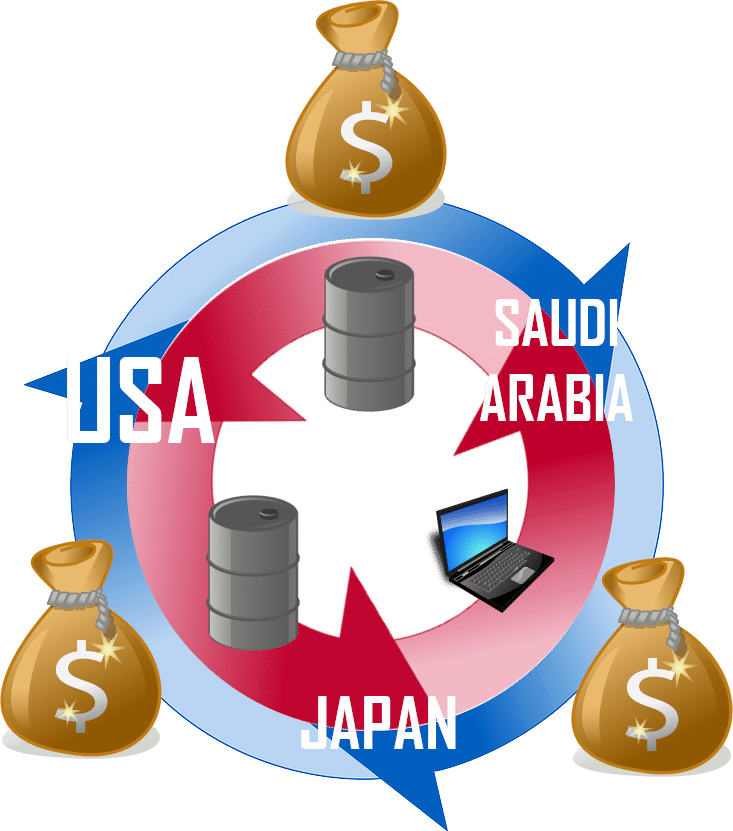

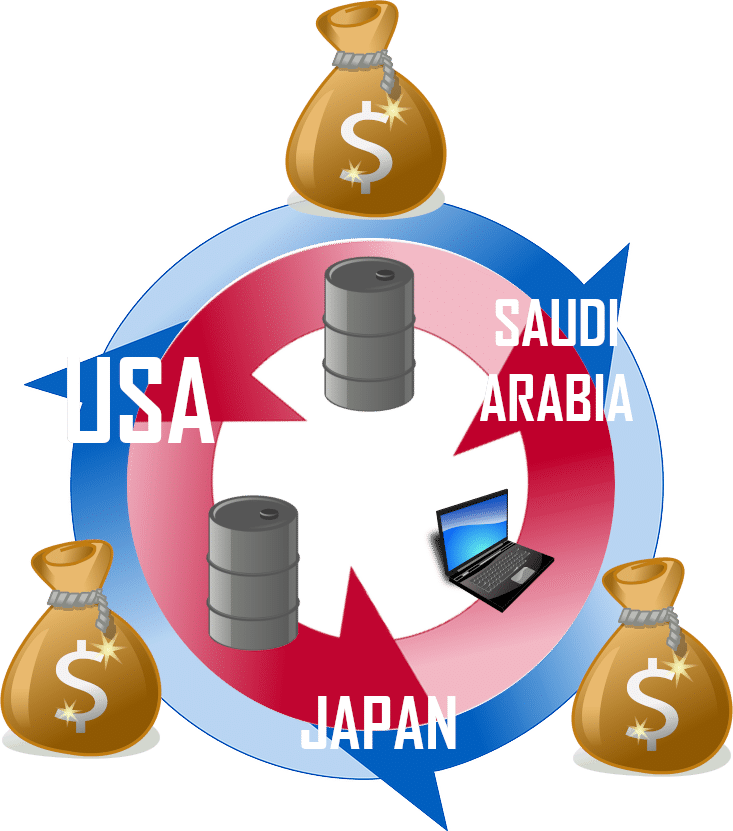

Distance: The United States imports oil from Saudi Arabia to the East Coast, but also exports oil to Japan from Alaska. This is because it is cheaper to bring oil from Saudi Arabia to the East Coast across the ocean than it would be to bring it by pipeline from Alaska. At the same time, the Alaskan oil fields are relatively close to Japan, making it cheap to export.

Quality: Japan has almost no oil in their own soil, so if they wanted to produce any themselves, they would need expensive offshore oil drilling platforms (and still would not have enough). They can instead buy oil from the United States far cheaper than they can produce it themselves, since the US can produce it relatively cheaply from Alaskan oil fields.

Aptitude: The United States has a much higher population than Japan, meaning we need to put a much smaller percentage of our workforce into oil production. This means it is fairly easy for the United States to have a large number of well-trained petroleum engineers, while Japan would need to take engineers away from other fields to work on oil research.

Skill: Japan tends to focus its research and development on technology and energy efficiency, and not on oil production. Saudi Arabia is rich in oil, so to best exploit this natural resource, they train many engineers and researchers to work with petroleum. This means Japan is more likely to produce computer chips and medical technologies that it trades for oil, while Saudi Arabia is more likely to produce oil that it trades for computer chips and medical technologies.

Capital: Japan has been investing heavily in its own infrastructure over the last 100 years in an effort to rapidly industrialize. This means that Japan has a lot of advanced technology in many fields, so it can compete on a global scale in a large number of industries. Saudi Arabia has been rapidly industrializing only over the last 40 years, continually re-investing its profits from oil into expanding their economy. This means that their economy is very dependent on the oil trade (and sensitive to the change in price of oil), while Japan does not rely on any one particular industry.

Specialization

Countries will choose what to produce themselves, and what to trade, based on their comparative advantages relative to the rest of the world’s economy. This means that by trading with other countries, both trading partners usually benefit. With our oil example:

Japan starts off by needing to import oil. It can import from Saudi Arabia or the United States. Both sellers are offering the same price, but the Saudi Arabian oil is farther away than the Alaskan oil, making it more expensive. This causes Japan to decide to import its oil from the United States.

The United States drills its oil in Alaska, but needs its oil in New York. It could send it to New York by pipeline, but the cost of building and maintaining that pipeline is more expensive than the transport cost of bringing in oil from Saudi Arabia. This causes the United States to import oil used on the East Cost from Saudi Arabia, while selling the oil it drilled in Alaska to Japan.

Saudi Arabia wants to buy computers from Japan, but Japan does not want anything from Saudi Arabia. So instead, Saudi Arabia sells its oil to the United States to get US dollars. Meanwhile, Japan wants to buy oil from the United States, so it is happy to trade its computers to Saudi Arabia to get their US dollars, completing the cycle. Everyone gets better off, thanks to the trade!

This lesson is part of the PersonalFinanceLab curriculum library. Schools with a PersonalFinanceLab.com site license can get this lesson, plus our full library of 300 others, along with our budgeting game, stock game, and automatically-graded assessments for their classroom - complete with LMS integration and rostering support!

Get PersonalFinanceLab

[qsm quiz=194]