A “Ticker Symbol” is a unique one to five letter code used by the stock exchanges to identify a company.

Time Decay is the inclination for options to decrease in worth as the expiration date draws near. The extent of the time decay is inversely connected to the changeability of that option.

Everywhere you turn there is another proprietary stock market timing system being sold. This is usually a computer program that tries to analyze real-time data for split-second trade decisions

A Trading Halt is the temporary suspension of trading of a security for a specific period of time. Trading Halts typically last for an hour, but can extend into days.

Trailing Orders are an order type that allows to set a moving stop or limit target price.

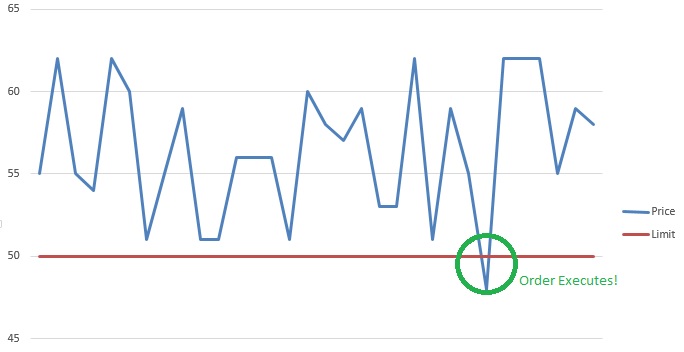

Trailing Stop is a Stop Loss order which is placed as a percentage value as opposed to an absolute dollar value. The order will only execute if the price of the security falls by a certain percentage.

A percentage Trailing Stop is a Stop Loss order which is placed as a percentage value as opposed to an absolute dollar value. The order will only execute if the price of the security falls by a certain percentage.

A dollar Trailing Stop is a Stop Loss order which is placed as a dollar value. The order will only execute if the price of the security falls by that dollar amount.

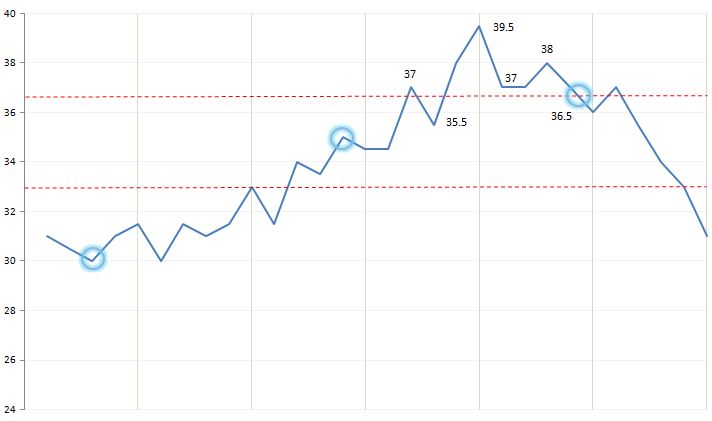

A Trailing Stop Loss is calculated in a manner like the way we calculated our initial stop loss, the difference being that while we calculated our stop loss from the entry price, we’re calculating our trailing stop loss from the highest price since entry.

Treasury bills, often referred to as T-bills, are short-term securities (maturities of less than one year) offered and guaranteed by the federal government. They are issued at a discount and pay their full face value at maturity.

A short call option position where the writer does not own the specified number of shares specified by the option nor has deposited cash equal to the exercise value of the call.

“Unemployment” is a major economic indicator measuring how much of the working population is currently looking for a job. Just because someone is jobless doesn’t mean they are unemployed – they need to be looking for work!

Unsystematic Risk is the risk that is unique to a company such as a strike, the outcome of unfavorable litigation, or a catastrophe that affects its production.

Variance is how far away from the average numbers are. The higher the variance, the farther away most numbers are from the group’s average.

Volume is the quantity of shares/contracts of a security that is traded within a specific time period.

In finance, Volume-Weighted Average Price (VWAP) is a ratio of the profit traded to complete volume traded over a distinct time horizon – normally one day. It’s a portion of the average price a stock traded at over the trading horizon.

“Wall Street” is a street in New York City, near the southern end of Manhattan Island. It is the home of the New York Stock Exchange, and the biggest center of stock trading and finance in the world.

“Wealth” means having an abundance of something desirable. This can be tangible, like money and property, or intangible.

Brokerages exist to allow individuals to make investments into the larger market. In other words, they connect individuals to the markets as a whole

In the world of trading, owing a long call means that you have a contract that gives you the right to buy the underlying asset at a specific price, before a maturity date.

A “Long Put” means buying the right to sell a stock at a certain price at a certain date in the future. You would buy a “Long Put” if you expected the stock’s price to go down.

A long stock is an expression used when you own shares of a company. It represents a claim on the company’s assets and earnings.

A short call means you sell someone the right to buy a specific stock from you in the future at a certain price. If the stock’s price goes down, they won’t exercise their option, so your profit is the price you sold the contract for.

A short put, the opposite of a short call, is the term used when you sell a put option for an underlying asset. You make a flat profit if the stock’s price goes up, but lose money if the price goes down

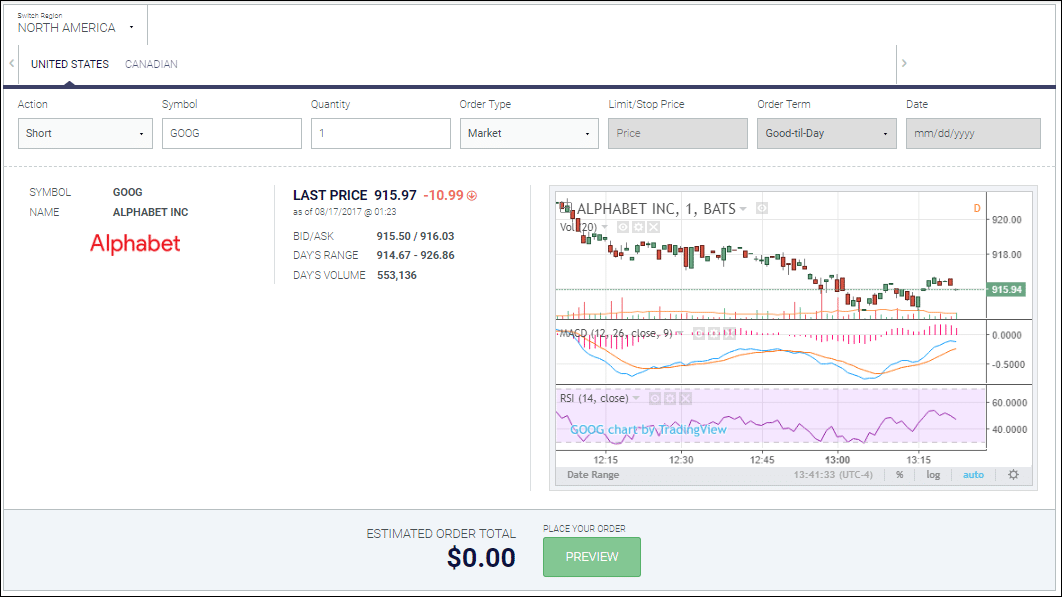

You “Short a stock” by borrowing a stock from your broker, then immediately selling it. Later, you buy the stock back on the market, and return it to your broker. You make a profit if the stock’s price dropped between when you sold it and when you bought it back.

A short stock is an expression used when you sold shares of a company that you did not own beforehand, and is described in more detail in this post!

Solvency is the possession of assets in excess of liabilities, or more simply put, the ability for one to pay their debts. People and organizations who are not “Solvent” face bankruptcy

The New York Stock Exchange (or NYSE) is the largest stock exchange in the world, where buyers and sellers come to trade U.S. stocks!

Yield is the return investors can expect on a security based on all the outflows and inflows they incur related to that security.

Yield To Maturity is the interest rate that will make the present value of a bond’s remaining cash flows (if held to maturity) equal to the price (plus accrued interest, if any).

A zero coupon bond is a bond sold without interest-paying coupons. Instead of paying periodic interest, the bond is sold at a discount and pays its entire face amount upon maturity, which is usually a one year period or longer.