A stock quote represents the last price at which a seller and a buyer of a stock agreed on a price to make the trade. Stock quotes also contain information about the volume, high and low prices of the day and year, and more.

Recession is generally described as a slowdown of economic growth over a sustained period of time.

An REITs or Real Estate Investment Trusts own, and often operate, real estate but are publicly traded like stock. Profit is paid as dividend to stock owners.

The Reserve Requirement is how much of all deposits that a bank is required to keep “on hand”, meaning in its vaults, or on deposit at the Federal Reserve Bank (in the United States).

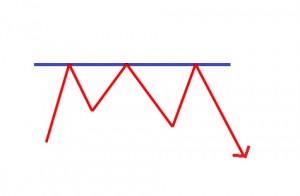

The Resistance Line is a point or range in a chart that caps an increase in the price of a stock or index over a period of time.

Retained Earnings is calculated by adding the net income to (or subtracting it from) the beginning retained earnings and then subtracting the dividends that were paid to shareholders.

This post describes, Return on Equity (ROE), which is used to measure how much profit a company is able to generate from the money invested by shareholders.

Your “Risk Level” is how much risk you are willing to accept to get a certain level of reward; riskier stocks are both the ones that can lose the most or gain the most over time.

Most traders do not learn about stock trading Risk Management until it is too late, and they experiences losses of varying degrees. Insurance, options, and other tools exist – learn to use them!

Return on Equity (ROE) is used to measure how much profit a company is able to generate from the money invested by shareholders. Click on this post to see how it is calculated, what kind of ROE you should look for, and more!

Scarcity refers to the fact that resources are finite – people and organizations need to allocate their finite resources between their infinite wants.

Screeners are a tool that investors and traders can use to filter ETFs based on user-defined metrics. ETF screeners are offered on many websites and trading platforms, and they allow users to select trading instruments that fit a certain profile set of criteria.

Many stock analysts have identified market trends related to specific times of the year. The success ratios of these trends are often far stronger than most other indicators.

Security is any financial instrument that represents a financial value.

Short selling is the act of borrowing a security from someone else, usually a broker, selling it and later repurchasing the stock in the hopes that it will be cheaper.

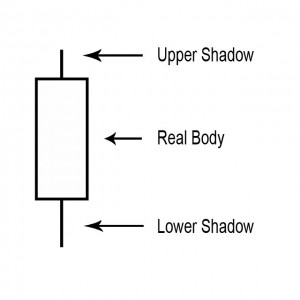

A shadow is the small line (like a candle wick) found at the top or bottom of an individual candle in a candlestick chart.

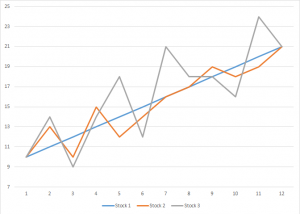

The Sharpe Ratio looks at a portfolio’s return over time, then gives it a rating based on how volatile the returns are. Portfolios with steady returns have a better Sharpe Ratio than portfolios with high returns but big swings

The Sharpe Ratio is an important tool for evaluating a stock, or a portfolio, based on how risky it is to get a higher return. You can use it to determine how consistent the returns of a stock or portfolio are, so you can determine if the returns are stemming more from wise investing, or “getting lucky”.

US federal legislation of 1890 that prohibited the creation of monopolies by outlawing direct or indirect attempts to interfere with the free and competitive nature of the production and distribution of goods. Amended by the Clayton Act of 1914. Also called Sherman Act.

A short call is a term used when you sell a call option for an underlying asset. If you use this type of option, you’re selling someone else the right to buy a stock from you at a certain price in the future. If the stock’s price goes down, you keep the money you made by selling the option. If the stock’s price goes up, you are required to sell the stock at the agreed upon price, taking a loss.

The cash received from the short sale of a security. The interest return from investment of the short proceeds is usually divided between the short seller, who gets partial “use of proceeds,” and the securities lender.

A Short Sale is a trade in which the investor borrows a security and sells it to another investor in the market.

Small cap stock investing is volatile. So, why risk your money by investing in what is typically considered risky business?

A Sole Proprietorship is the simplest, oldest, and most common form of business ownership in which only one individual acquires all the benefits and risks of running an enterprise.

“Specialization” is when a labor force begins to divide total production, leading to a rise of experts or specialists. This is called the Division of Labor, and it typically results in much higher productivity of labor.

A Spending Plan is a plan of what you will spend each month, and includes fixed and variable spending. They are used similarly to a budget, but many find them to be more flexible

Spot and Futures contracts are a standardized, transferable legal agreement to make or take delivery of a specified amount of a certain commodity, currency, or an asset at the current date. The price is determined when the agreement is made.

The difference between the ask price and the sell price is called the “spread” and it is kept by the broker.

Stagflation is high inflation and high unemployment are occurring simultaneously.

S&P 500 Index (Standard and Poor’s 500 Index) is a composite of the 500 most actively traded public companies in all ten economic sectors of the U.S. It is maintained by Standard and Poor’s, a division of the Parent company McGraw-Hill.

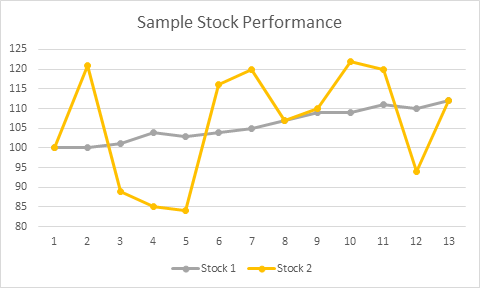

By measuring the compilation of similar stocks instead of just one or two stocks, a Stock Index provides information about that particular market or segment.

The stock market crash of 1929 was a massive crash in stock prices on the New York Stock Exchange, and marks the largest financial crash in the United States.

If you are brand new to investing then take time to understand what you are reading when viewing a Stock Exchange Symbol and learn Stock Market Investing Basics.

Stock volatility information can be used in many different ways but here is a quick and easy bit of stock volatility information that you can begin using today.

Stocks are a share of ownership of a company. If you own a stock, you are involved in some of its management decisions, and you are entitled to some of the company’s profits.

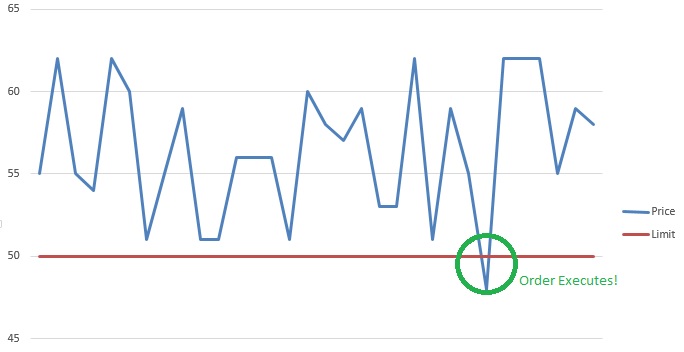

A Stop (or stop loss) order and Limit order are orders that try to execute when a certain price threshold is reached. These orders are mirrors of each other; they have the same mechanics, but have opposite triggers.

A Stop Limit is an order that combines the features of stop order with the features of a limit order. A stop limit order executes at a specified price (or better) after a specified stop price is reached.

A Stop Loss Order is placed with a broker to sell a security when it reaches a certain price. A stop-loss order is designed to limit an investor’s loss on a security position.

A Stop Order is an order to buy or sell a stock when the stock price reaches a specified price, which is known as a stop price. When the specified price is reached, the stop order becomes a market order.

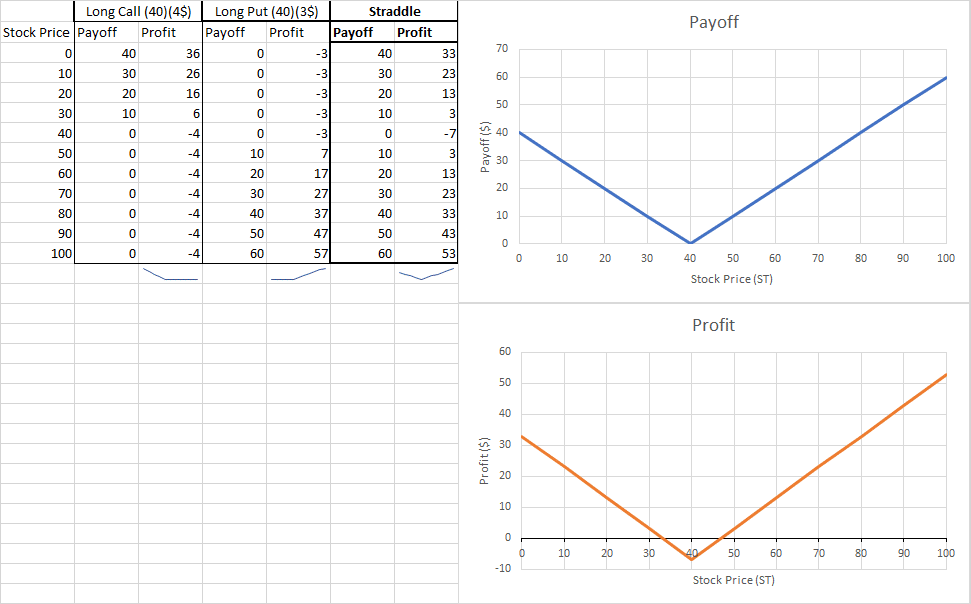

Straddles an option strategy that profits with volatility. You simultaneously buy long a call at Strike Price 1 and long a put at Strike Price 1. This creates a triangular shaped payoff and profit graph where the reward is based on the volatility of the stock – you’ll make a profit if the stock’s price makes a BIG move in either direction, but take a loss if it doesn’t move much.

A straddle is an investment strategy that involves the purchase or sale of an option allowing the investor to profit regardless of the direction of movement of the underlying asset, usually a stock. Read this article for details on the two straddle strategies: a long straddle and a short straddle.

Straight line depreciation is the most commonly used and simplest form of depreciation.

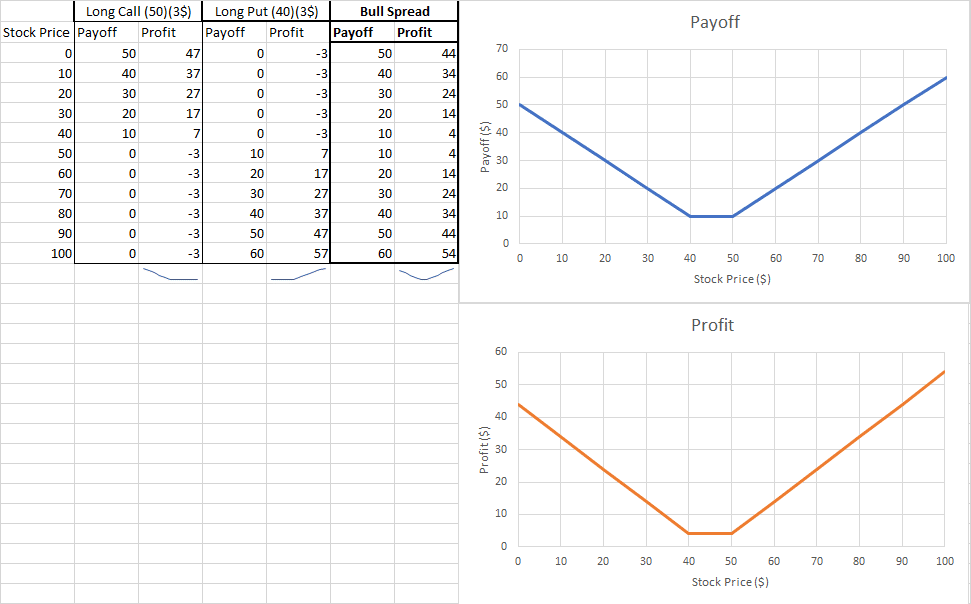

A Strangle is a volatility bet where you simultaneously long a put at Strike Price 2 and long a put at Strike Price 1, betting the stock price will make a big movement in either direction. This is similar to a Straddle, but the trader shorts the stocks instead of buying them (but the profit is basically the same)

Strike Price is the price at which an option can be exercised to buy or sell the underlying stock or futures contract.

In Economics, “Supply” means the relationship between prices and production. In general, the higher the market price of a good or service is, the more producers are willing to sell of it.

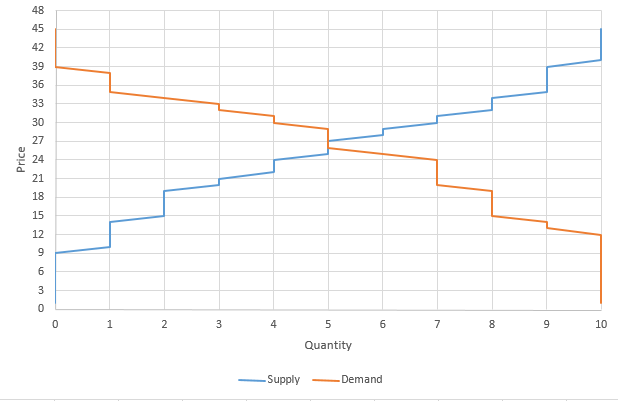

The stock market is the perfect place to see Supply and Demand in action! Many buyers and many sellers meet to trade – with the “market equilibrium” moving in real-time based on new information

In technical analysis, “Support” is a price trend line that a stock usually won’t fall below (at least in the short term), while “Resistance” is a price trend line that it has trouble rising above

Market Risk, aka Systemic Risk, which is a measure of how much of a loss an investor is facing while trading.

Technical Analysis is the use of technical indicators comprising of statistics using past market information to predict which direction the security price will move. Read this post to learn about the 6 principles that formed the foundation of technical analysis, and some of its purposes and uses.

Tick refers to a change in price, either up or down.