A long call is a term used when you own a call option for an underlying asset. A call option is a contract where the buyer has the right (not the obligation) to exercise a buy transaction at a specific strike price at or before an expiration date. In the world of trading, owing a long call means that you have a contract that gives you the right to buy the underlying asset at a specific price, before a maturity date.

A long put is a term used when you own a put option for an underlying asset. A put option is a contract where the buyer of the put has the right (not the obligation) to exercise a sell transaction at a specific strike price before an expiration date. In the world of trading, owning a long put means that you have a contract that gives you the right to sell the underlying asset at a specific price, before a maturity date.

A long stock is an expression used when you own shares of a company. It represents a claim on the company’s assets and earnings. As you increase your holdings of a stock, your ownership stake in the company increases. Read this post to learn about the components of a long stock, and what it looks like graphically.

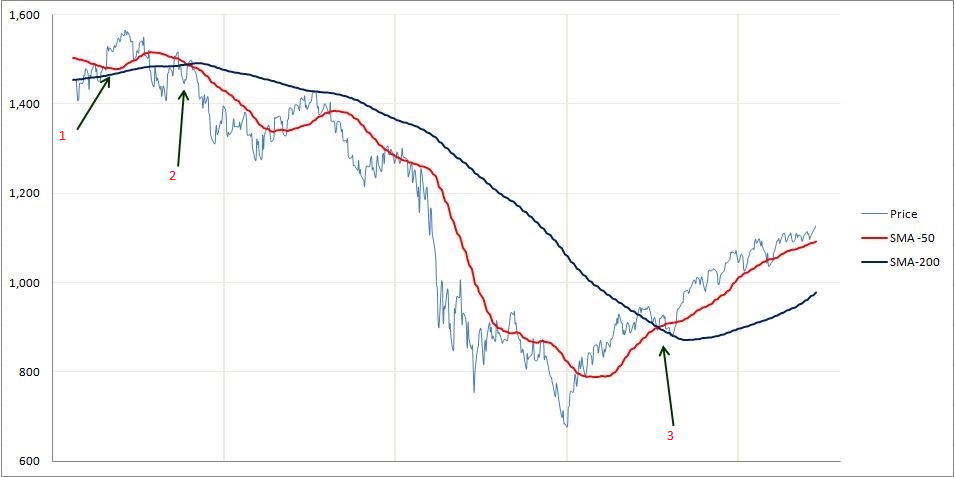

The Moving Average Convergence-Divergence (MACD) indicator is one of the easiest and most efficient momentum indicators you can get. The MACD moves two trend following indicators and moving averages into a momentum oscillator by subtracting the longer moving average from the shorter moving average. The result is that the MACD gives the best of both worlds: trend following and momentum.

The maintenance margin is the minimum amount of equity that must be maintained in a margin account.

“Major Economic Indicators” are numbers that you can look at to try to get a picture of how well the economy is doing. This includes GDP, Output, Inflation, Unemployment, and more!

Margin is the amount of money supplied by an investor as a portion of the total funds needed to buy or sell a security, with the balance of required funds loaned to the investor by a broker, dealer, or other lender.

Margin calls happen when you are trading “on margin” and your account value drops to a value below that allowed by a broker – and they force you to sell stocks or add more cash

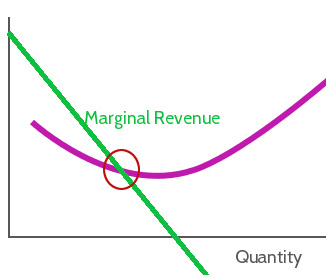

Everyone knows about costs and benefits of doing something – the pros and cons of making a choice. Marginal benefit and marginal cost are different – they look more closely at doing slightly more or less of different alternatives. Marginal costs and benefits are extremely important to producers when choosing their inputs and prices.

Market capitalization is calculated by multiplying the market price of stock by the number of issued shares of stock.

By aggregating the value of a related group of stocks or other investment vehicles together and expressing their total values against a base value from a specific date. Market indexes help to represent an entire stock market and thus give investors a way to monitor the market’s changes over time.

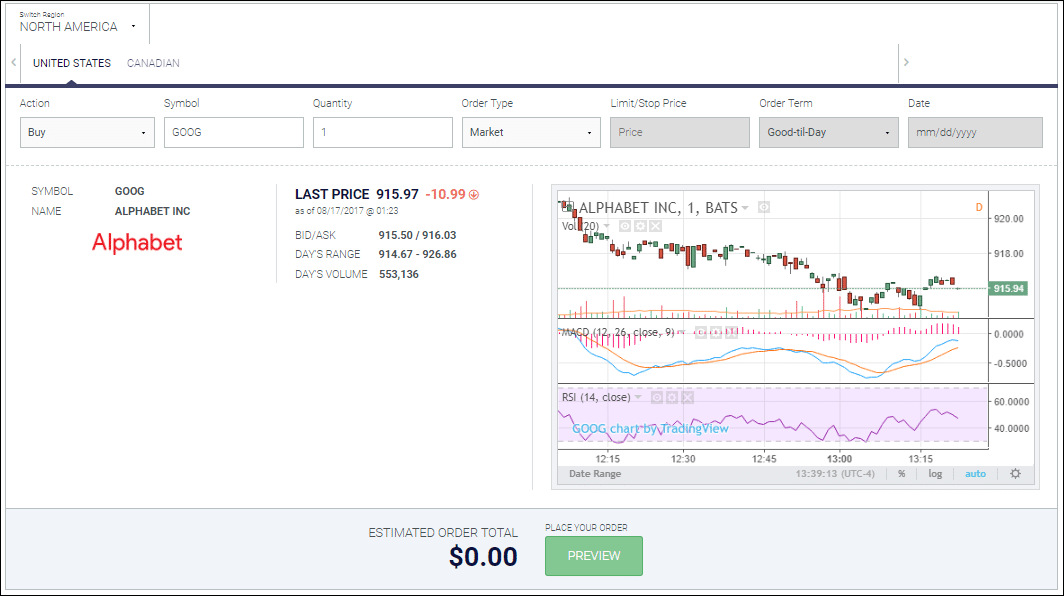

A market order is an order to buy or sell a stock at the best available price. Generally, this type of order will be executed immediately. However, the price at which a market order will be executed is not guaranteed. It is important for investors to remember that the last-traded price is not necessarily the price at which a market order will be executed. In fast-moving markets, the price at which a market order will execute often deviates from the last-traded price or “real time” quote.

Market Risk is the general risk for investing in the any security. Every industry in the market is affected by this risk. Examples of market risk: depression, war, inflation etc.

An investment strategy that aims to capitalize on the continuance of existing trends in the market. The momentum investor believes that large increases in the price of a security will be followed by additional gains and vice versa for declining values.

Money has value because we all agree it has value, and so we can use it as a medium of exchange. Forms of Stored Value simply are a storage system for money like checks and debt cards, meaning they do not have any value in and of themselves.

In the US, money is created as a form of debt. Banks create loans for people and businesses, which in turn deposit that money in their bank accounts. Banks can then use those deposits to loan money to other people – the total amount of money in circulation is one measure of the Money Supply.

Money supply is the total amount of money available in an economy at any particular point in time. Money is required for both consumers and businesses to make purchases. Money is defined as currency in circulation and demand deposits (funds held in bank accounts.)

Monopolistic Competition is characterized as a form of imperfect competition, which exist when there are many sellers of a good or service but the products do not contain noticeable differences. There are several forms of imperfect competition, of which Monopolistic Competition is one.

Monopoly, in economic terms, is used to refer to a specific company or individual has a large enough control of a particular product or service that allows them to influence it’s price or certain characteristics.

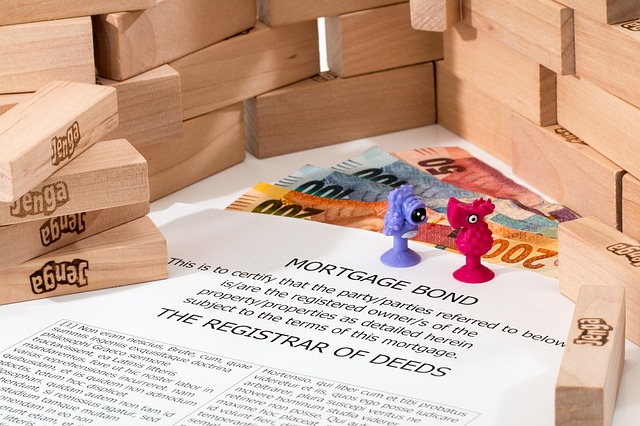

Your home will probably be the biggest purchase you make in your lifetime. Buying a home not only saves money on rent, but is a serious asset that can appreciate over time. Since homes are so expensive, (almost) no-one buys them in cash. Instead, homes are typically purchased with a special type of loan, called a “Mortgage”, that breaks the principle and interest into equal payments over the entire term of the loan.

In simple terms, the moving average is an average that compares the previous period over time. There are two types of moving averages: the Simple Moving Average (SMA) and the Exponential Moving Average (EMA) which puts more weight on the latest date.

Mutual Funds come in several different “flavors”, but the core concept is always the same: the fund is a pool of money contributed from many different investors that are used to purchase a bundle of securities. They are professionally managed, so you are basically buying a piece of a larger portfolio.

The basic form of short selling is selling stock that you borrow from an owner and do not own yourself. In essence, you deliver the borrowed shares. Another form is to sell stock that you do not own and are not borrowing from someone. Here you owe the shorted shares to the buyer but “fail to deliver.”

The total amount that the federal government has borrowed including internal debt (borrowed from national creditors) and external debt (borrowed from foreign creditors).

The offer price, or the Bid price is what an investor is willing to pay for an investment. It is only an offer and will not be accepted if the seller is not willing to let go at the offer price.

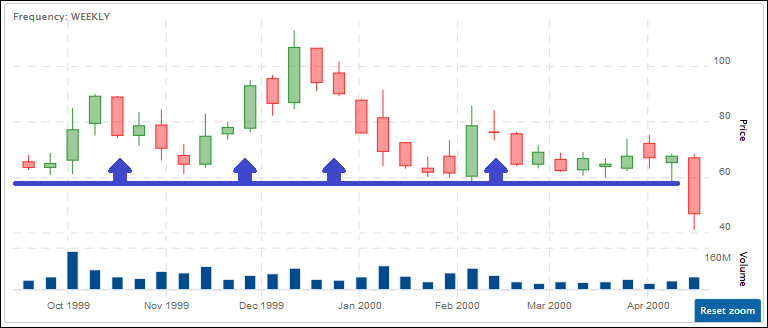

“OHLC” stands for “Open, High, Low, Close”, and this is a chart designed to help illustrate the movement of a stock’s price over time (typically a trading day, hour, or minute).

An oligopoly is characterized by a small number of sellers who dominate an entire market. All of the firms who partake in an oligopoly are considered to be very large in terms of profit, size and client base.

Open Interest is the total number of options or futures contracts that are “open”, meaning currently owned by an investor and not yet expired.

“Opportunity Cost” is what needs to be given up to get something. This is different from an item’s price – it refers to what you give up in order to get something. The opportunity cost for going to school is that you can’t stay home and nap. The opportunity cost of staying home to nap is not getting your diploma!

Options Spreads are option trading strategies which make use of combinations of buying and selling call and put options of the same or varying strike prices and expiration dates to achieve specific objectives (hedging, arbitrage, etc.).

An option allows you to pay a certain amount of money (the option price) to allow you to buy or sell a stock at the price (strike price) you decided on when buying the option.

An Options Contract is a contract which specifies how much of the underlying asset can be bought or sold at a specific price. An option contract to buy the underlying is a call option, and to sell the underlying is a put option. Most stock options contracts represent 100 underlying shares.

Market Orders, Limit Orders, Stop Market Orders, Stop Limit Orders and Trailing Stop Orders! Each one is used differently to balance a trading strategy – usually so you can place your orders and wait for prices to match your conditions

There are also thousands of companies that want to sell shares to the general public, but are not able to sell on exchanges like NASDAQ, or the NYSE. Therefore, other exchanges exist to allow these companies to sell public shares. Stock traded on these “Over The Counter” exchanges are known as OTC stocks.

Out-Of-The-Money refers to an option that is unfavourable to exercise.

Par Value is the amount that the issuer of a bond agrees to pay at the date of maturity.

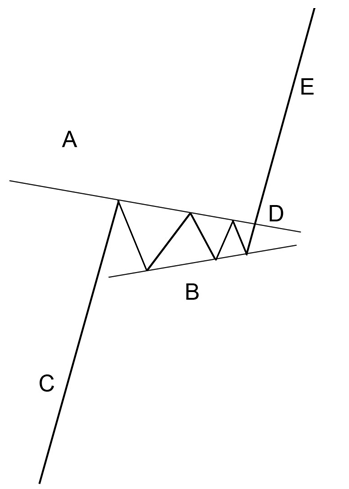

The pennant resembles the symmetrical triangle, but it’s characteristics are not the same. The pennants is shaped like a wedge of consolidation and normally appears after a sudden upward or downward movement.

This term is generally used to refer to stocks with a price below $5. The name also comes from the fact that most penny stocks have either started or will end at $0.01 (a penny).

Pink Sheets refer to the trading of stocks that are not listed on a major exchange or the OTCBB due to a lack of minimum listing requirements or filing financial statements with the SEC (Securities Exchange Commission)

A “Poison Pill” is a way to give shareholders more time to evaluate a hostile takeover bid and to give management the opportunity to make better informed business decisions. It was created in the 1980’s, a period rife with hostile takeovers and corporate raids.

Understanding what it means to build a diversified portfolio is one of the first concepts a new investor needs to understand. When talking about stocks, diversification means to make sure you don’t “put all of your eggs in one basket.”

Preferred stock is a special class of stock issued by a company that pays dividends. Preferred stock is more like a bond than true stock because the main appeal is dividend income. Most preferred stocks are limited in the total profit they can earn.

A price ceiling is a government-mandated limit on the price that can be charged for a given product, such as a utility or electricity. The intended purpose of a price ceiling is to protect the consumers from conditions that would make a vital product from being financially unattainable for consumers.

“Price Controls” are artificial limits that are put on prices. If the limit is put in place to prevent prices from getting too high, they are called Ceilings. If they are in place to prevent the price from getting too low, they are called “Floors”.

Price/Earnings To Growth, is a valuation metric for determining the relative trade-off between the price of a stock, the earnings generated per share (EPS), and the company’s expected future growth. It can be useful when looking at the future earning growth.

The price-to-sales ratios (Price/Sales or P/S) take the company’s market capitalization (the number of shares multiplied by the share price) and divide it by the company’s total sales over the past 12 months. The lower the ratio, the more attractive the investment.

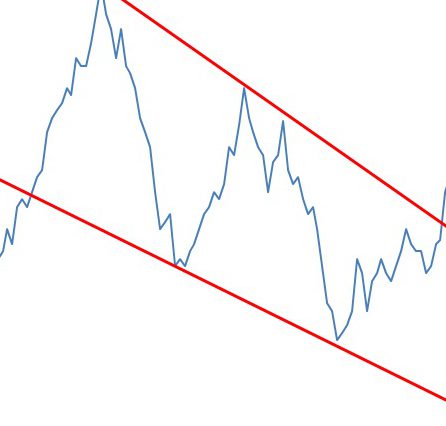

A pullback is a technical analysis term used frequently when a stock “pulls” back to a resistance and/or support line, usually after a breakout has occurred.

A Put Option gives the holder the right to sell the underlying stock or futures contract at a specified strike price.

Quick Ratio is the ratio that measures the ability of a firm to cover its current liabilities with their most liquid current assets. Quick Ratio = (Current Assets – Inventory) / Current Liabilities

A ratio strategy is an option strategy that is created by having X amount of call options at Strike Price 1 and shorting Y amount of call options at Strike Price 2. This strategy is used when the investor thinks the price won’t move much, but they want to get a bigger profit based on a slight movement up or down.