A long stock is an expression used when you own shares of a company. It represents a claim on the company’s assets and earnings. As you increase your holdings of a stock, your ownership stake in the company increases. Read this post to learn about the components of a long stock, and what it looks like graphically.

A short stock is an expression used when you sold shares of a company that you did not own beforehand, and is described in more detail in this post!

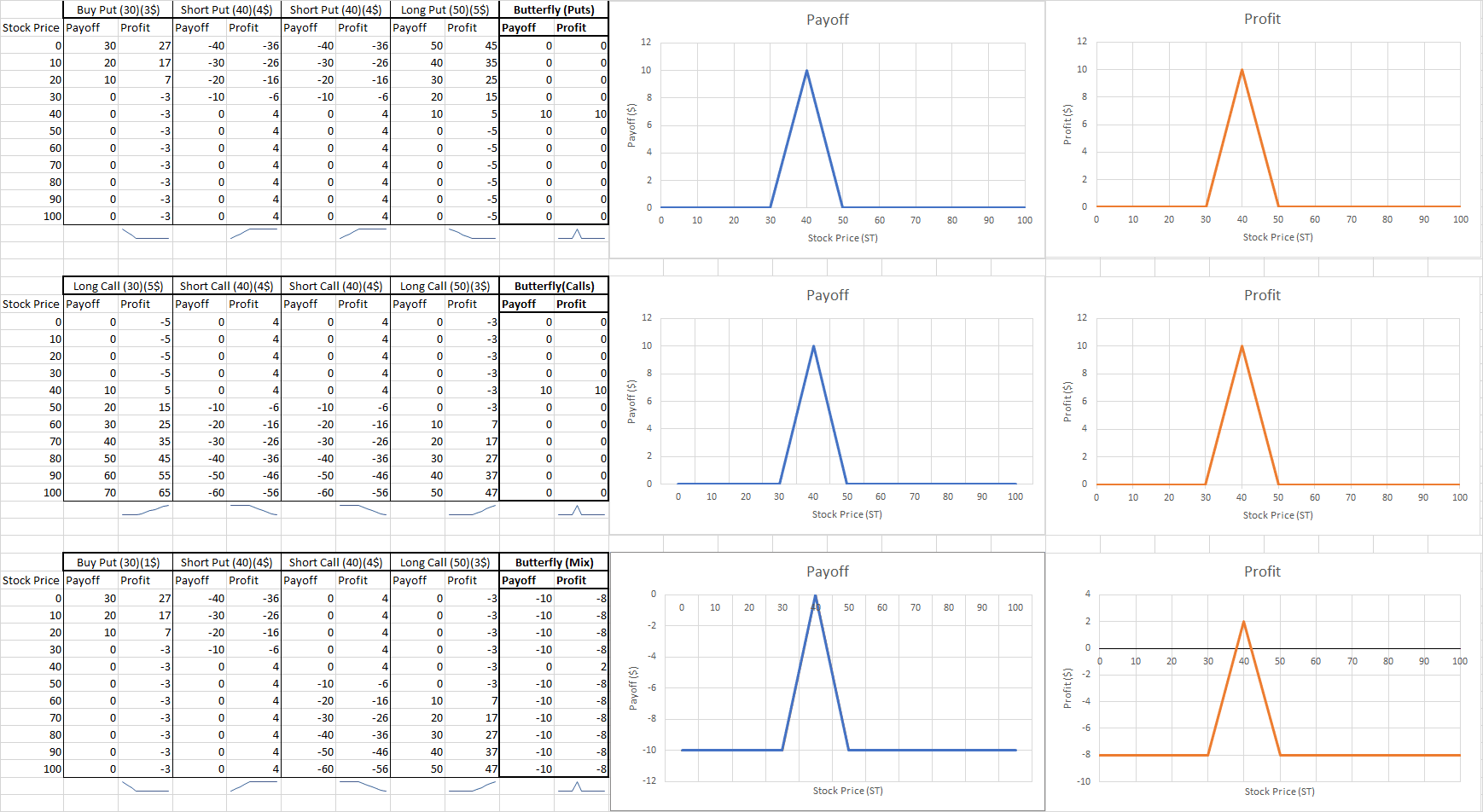

A butterfly is a volatility bet that the trader can implement to protect against large fluctuations, or to gain on volatility.

A Strangle is a volatility bet where you simultaneously long a put at Strike Price 2 and long a put at Strike Price 1, betting the stock price will make a big movement in either direction. This is similar to a Straddle, but the trader shorts the stocks instead of buying them (but the profit is basically the same)

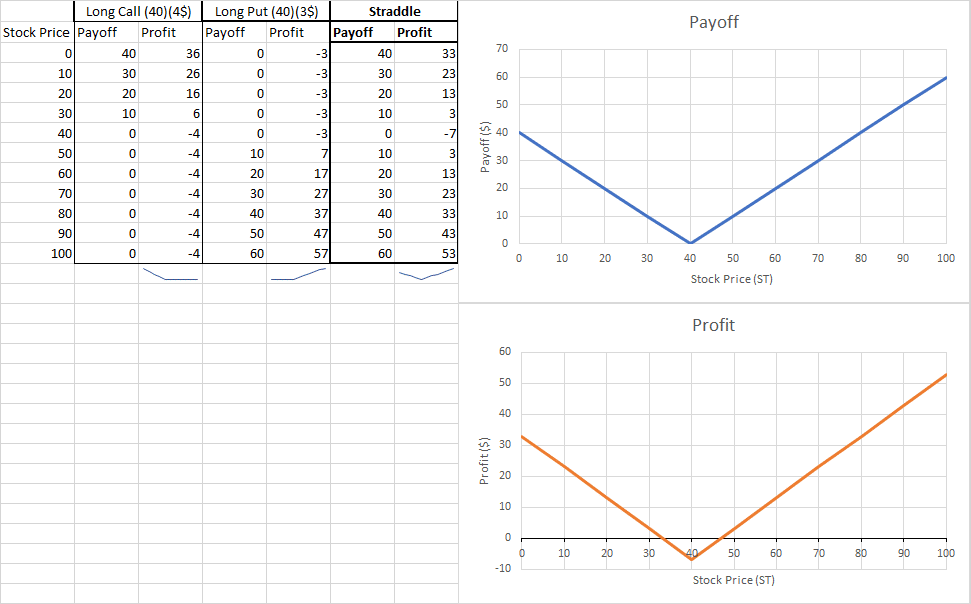

Straddles an option strategy that profits with volatility. You simultaneously buy long a call at Strike Price 1 and long a put at Strike Price 1. This creates a triangular shaped payoff and profit graph where the reward is based on the volatility of the stock – you’ll make a profit if the stock’s price makes a BIG move in either direction, but take a loss if it doesn’t move much.

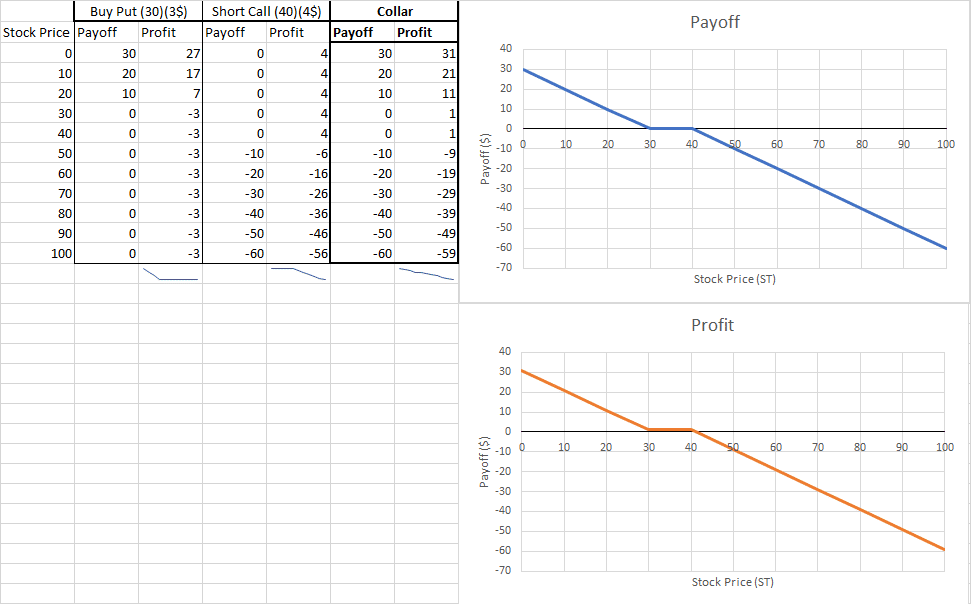

A bullish collar is a protection strategy where you simultaneously buy a call at strike price 1 and sell a put at strike price 2. This strategy is for investors who has a bullish perception on the underlying asset. We can also create a “bearish” collar by simultaneously buying a put at strike price 1 and selling a call at strike price 2.

A ratio strategy is an option strategy that is created by having X amount of call options at Strike Price 1 and shorting Y amount of call options at Strike Price 2. This strategy is used when the investor thinks the price won’t move much, but they want to get a bigger profit based on a slight movement up or down.

A box spread is an option strategy that is created by combining the components of the bull spread and the bear spread. In theory, a box spread should always have a zero profit and zero loss, but some investors use them if they see that current options prices aren’t fully “priced in”. In many cases, the commissions charged for the trades needed for this spread will be greater than the profit.

A bear spread is a strategy where you simultaneously buy a call option at Strike Price 1 (some amount higher than the current market rate), and sell a call option at Strike Price 2 (some amount lower than the current market right). This is used if the trader thinks the price of the stock will go down, but not by much. It limits both the risk and reward.

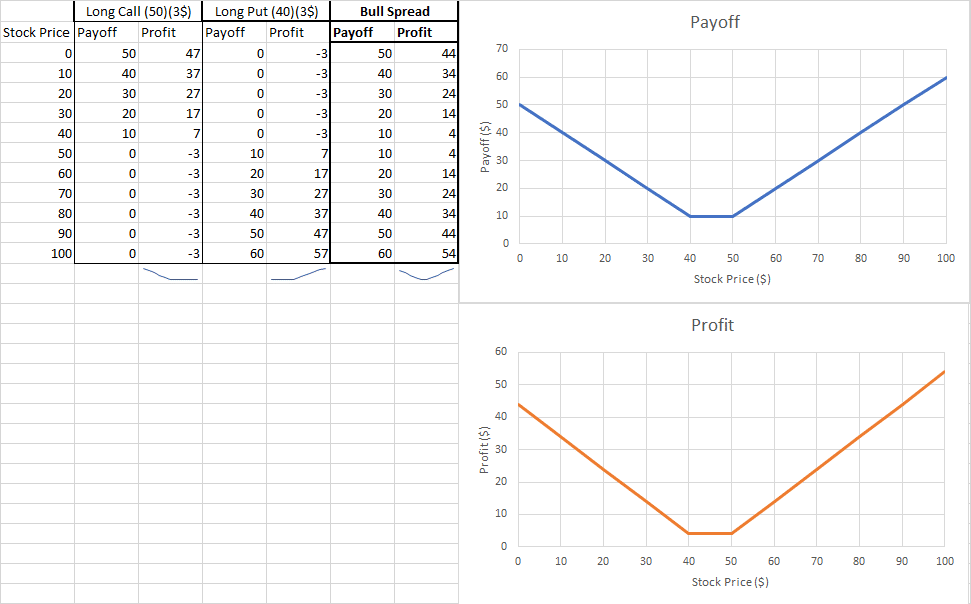

A bull spread is a strategy where you simultaneously buy a long call at Strike Price 1, and sell a call for Strike Price 2 (some higher amount). Use this strategy if you think that a stock’s price will go up above your Point 1, but not as high as your Point 2.

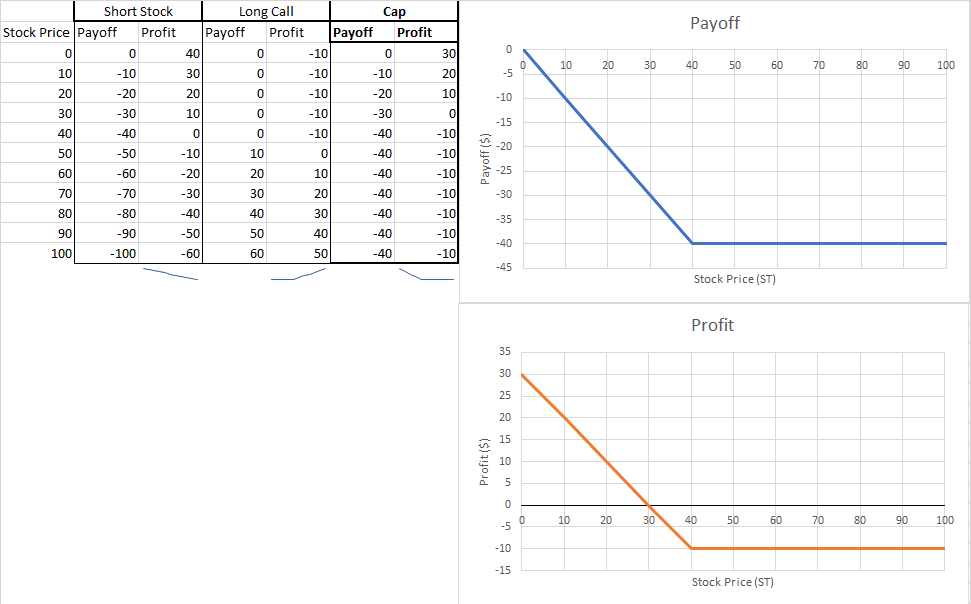

A cap is an options protection strategy where you simultaneously have a short position on a stock and a long call for the same underlying asset. Adding a long call to your open position means that you have the right to cover your short at the strike price.

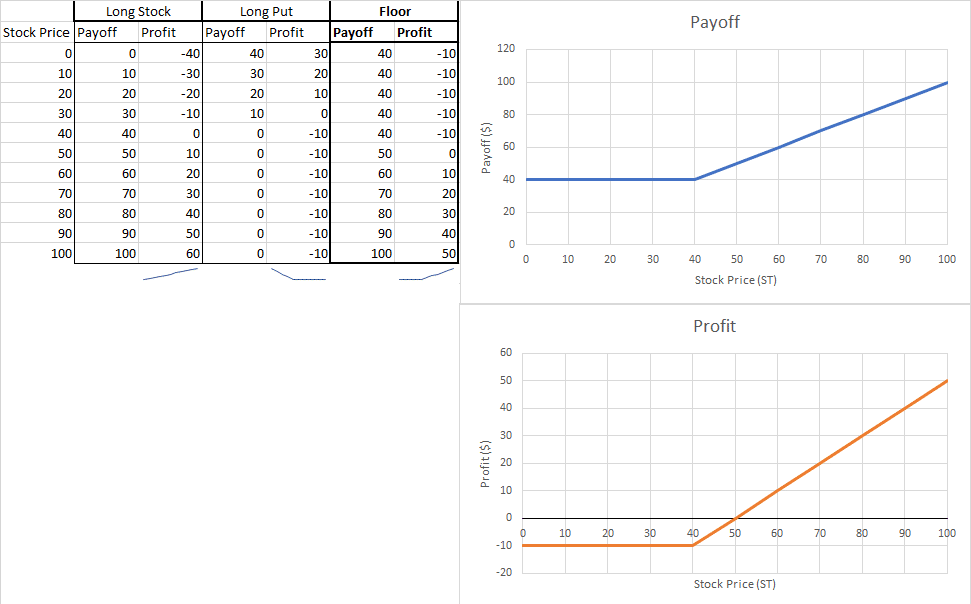

A floor is an options insurance strategy where you simultaneously have a long open position on a stock and a long put for the same underlying asset. Adding a long put to your open position means that if the stock’s price starts to fall, you still have the right to sell it off at the price specified by your option.

A covered put is an options insurance strategy where you simultaneously have a short open position on a stock and sell a put option for the same underlying option. This means you’re shorting a stock, but give someone else the right to sell you that stock at certain price in the future. You would use this if you were certain a stock’s price wasn’t going to go up, but you weren’t sure if would go down either – so you make a bit more money if the price doesn’t change.

A covered call is an options insurance strategy where you simultaneously own a stock and sell a call option for the same symbol (usually for a higher price than what you paid for it). This gives someone else the right (but not obligation) to buy your stock from you later at a specific price. If the underlying stock’s price goes up, the buyer will exercise the option and buy the shares. If the price goes down, the seller of the option keeps both the stocks and the price of the options.

A long call is a term used when you own a call option for an underlying asset. A call option is a contract where the buyer has the right (not the obligation) to exercise a buy transaction at a specific strike price at or before an expiration date. In the world of trading, owing a long call means that you have a contract that gives you the right to buy the underlying asset at a specific price, before a maturity date.

A short call is a term used when you sell a call option for an underlying asset. If you use this type of option, you’re selling someone else the right to buy a stock from you at a certain price in the future. If the stock’s price goes down, you keep the money you made by selling the option. If the stock’s price goes up, you are required to sell the stock at the agreed upon price, taking a loss.

A long put is a term used when you own a put option for an underlying asset. A put option is a contract where the buyer of the put has the right (not the obligation) to exercise a sell transaction at a specific strike price before an expiration date. In the world of trading, owning a long put means that you have a contract that gives you the right to sell the underlying asset at a specific price, before a maturity date.

A short put, the opposite of a short call, is the term used when you sell a put option for an underlying asset. You make a flat profit if the stock’s price goes up, but lose money if the price goes down

A “Long Put” means buying the right to sell a stock at a certain price at a certain date in the future. You would buy a “Long Put” if you expected the stock’s price to go down.

A short call means you sell someone the right to buy a specific stock from you in the future at a certain price. If the stock’s price goes down, they won’t exercise their option, so your profit is the price you sold the contract for.

In the world of trading, owing a long call means that you have a contract that gives you the right to buy the underlying asset at a specific price, before a maturity date.

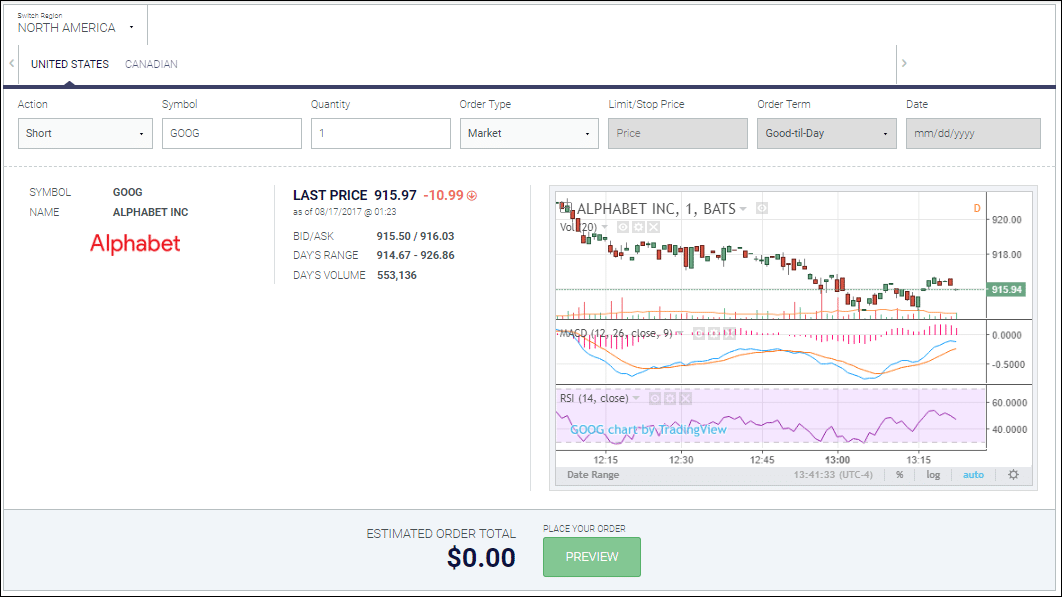

You “Short a stock” by borrowing a stock from your broker, then immediately selling it. Later, you buy the stock back on the market, and return it to your broker. You make a profit if the stock’s price dropped between when you sold it and when you bought it back.

A long stock is an expression used when you own shares of a company. It represents a claim on the company’s assets and earnings.

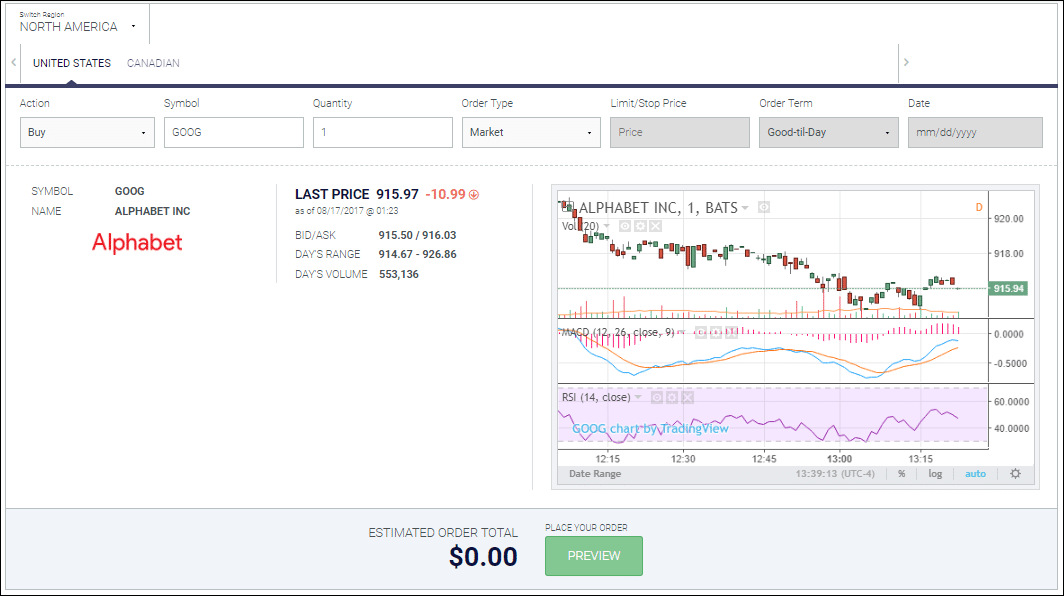

Brokerages exist to allow individuals to make investments into the larger market. In other words, they connect individuals to the markets as a whole

Your home will probably be the biggest purchase you make in your lifetime. Buying a home not only saves money on rent, but is a serious asset that can appreciate over time. Since homes are so expensive, (almost) no-one buys them in cash. Instead, homes are typically purchased with a special type of loan, called a “Mortgage”, that breaks the principle and interest into equal payments over the entire term of the loan.

Solvency is the possession of assets in excess of liabilities, or more simply put, the ability for one to pay their debts. People and organizations who are not “Solvent” face bankruptcy

Future Options are exactly what their name implies – an option on a futures contract.

Options Spreads are option trading strategies which make use of combinations of buying and selling call and put options of the same or varying strike prices and expiration dates to achieve specific objectives (hedging, arbitrage, etc.).

“Unemployment” is a major economic indicator measuring how much of the working population is currently looking for a job. Just because someone is jobless doesn’t mean they are unemployed – they need to be looking for work!

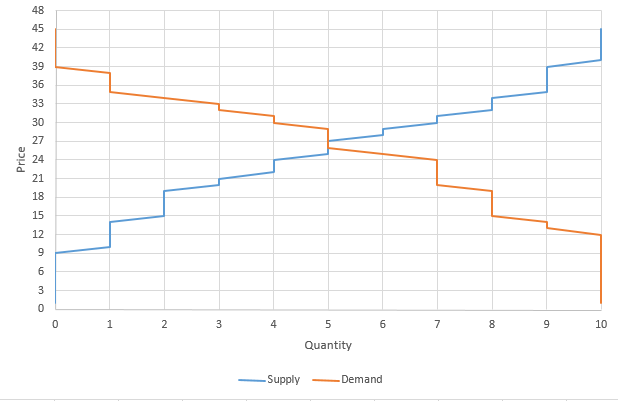

“Price Controls” are artificial limits that are put on prices. If the limit is put in place to prevent prices from getting too high, they are called Ceilings. If they are in place to prevent the price from getting too low, they are called “Floors”.

Interest rates are a percentage that is used to calculate how much a loan or investment grows over time. A “Nominal” interest rate is just the percentage on the loan – the “Real” rate subtracts expected inflation

Scarcity refers to the fact that resources are finite – people and organizations need to allocate their finite resources between their infinite wants.

“Specialization” is when a labor force begins to divide total production, leading to a rise of experts or specialists. This is called the Division of Labor, and it typically results in much higher productivity of labor.

“Opportunity Cost” is what needs to be given up to get something. This is different from an item’s price – it refers to what you give up in order to get something. The opportunity cost for going to school is that you can’t stay home and nap. The opportunity cost of staying home to nap is not getting your diploma!

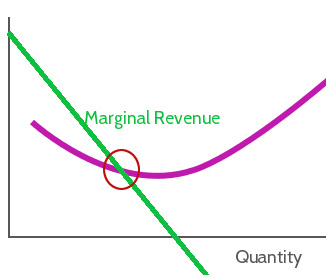

Everyone knows about costs and benefits of doing something – the pros and cons of making a choice. Marginal benefit and marginal cost are different – they look more closely at doing slightly more or less of different alternatives. Marginal costs and benefits are extremely important to producers when choosing their inputs and prices.

An Entrepreneur is someone who takes a risk to start a new business. Nearly every business that exists (apart those created as spin-offs of other businesses, or by government intervention) was started by one or several entrepreneurs, who took a risk to launch a new company.

Economic Incentives include anything that pushes people, businesses, and governments to do one thing or another. These include what products you buy, what career you choose, what products businesses produce, and what government programs are put in place

In Economics, an “Externality” is a benefit or cost that is not reflected in the price of a good or service. They can be positive or negative.

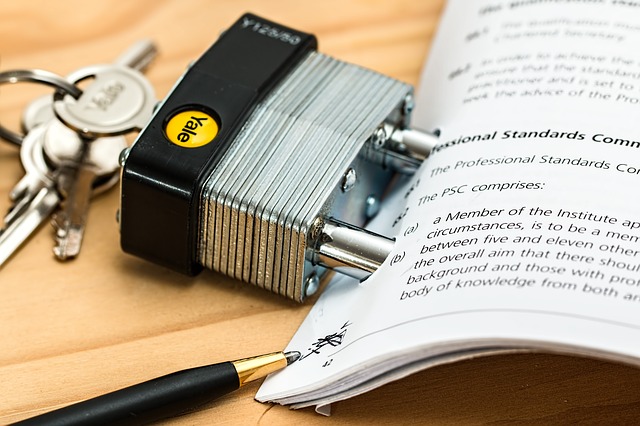

A “Contract” is a legally binding agreement between two parties (people, companies, or both). Having a contract means that if one party does not keep their word, the other can sue them in court to either force them to fulfill their side of the agreement, or pay back compensation.

When someone talks about banking, they generally group together Banks, Credit Unions, and Savings and Loans all in one – but their differences can have a big impact on the services you get!

A Spending Plan is a plan of what you will spend each month, and includes fixed and variable spending. They are used similarly to a budget, but many find them to be more flexible

Money has value because we all agree it has value, and so we can use it as a medium of exchange. Forms of Stored Value simply are a storage system for money like checks and debt cards, meaning they do not have any value in and of themselves.

“Wealth” means having an abundance of something desirable. This can be tangible, like money and property, or intangible.

Financial Records are what you use to have an easy way to tell where all your money and assets are, and exactly how much you have, at any given time. Most people’s financial records will not look the same as anyone else’s, because each person has unique ways of organizing their information to make it most accessible for him- or herself.

“Major Economic Indicators” are numbers that you can look at to try to get a picture of how well the economy is doing. This includes GDP, Output, Inflation, Unemployment, and more!

The stock market is the perfect place to see Supply and Demand in action! Many buyers and many sellers meet to trade – with the “market equilibrium” moving in real-time based on new information

In Economics, “Demand” is the relationship between prices and how much people want to buy a good or service.

In Economics, “Supply” means the relationship between prices and production. In general, the higher the market price of a good or service is, the more producers are willing to sell of it.

There are many different economic systems that try to result in more equality or faster growth. The structure of a country’s economy has a lot to do with the country’s politics and the values of its population. However, the economy of every country also changes over time, and how it falls between these broad categories will often change with it.

The Federal Reserve Bank, or the “Fed”, is the central banking system of the United States. It serves as the primary regulator of the US dollar, as well as the “lender of last resort” for other banks.