Owning a share in a company means that you are an integral part of the puzzle that helps the company tick. Typically, investors choose to own a stock for one of two profit driven reasons: the dividends they will receive from the company, or the hope that the stock price will increase and they will be able to sell it for a higher price than they purchased it at.

Big corporations are very powerful entities that can possess more capital than some countries in the world. However, every company begins as a small start-up business. Once a private company grows large enough, they can become public, meaning they sell stocks to the public to finance future endeavors. After selling stocks to the public, the company will have to pay dividends to those who have chosen to invest in them.

Asset Valuation is the process by which an individual can assess the changes in a companies asset overtime. This is done largely through comparing ratios from a company’s financial statement, but can also be a more complex affair (depending on what is being valued)

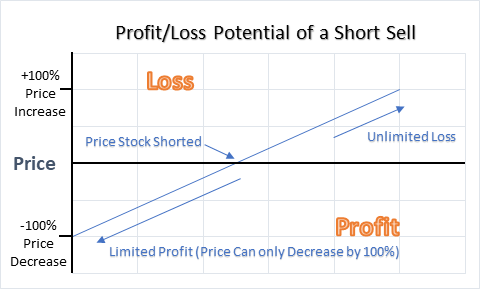

Margin trading is when you borrow money to invest. This increases the risk because now your returns need to not just make a profit, but more of a profit than you pay in interest. Market timing is also risky – instead of relying on fundamental business data, it means trying to pick the perfect hour, minute, or second to “beat” other traders who are trying to do the same thing.

Building the next “Big Thing”. Being your own boss. Getting the full rewards for your work. There are a lot of reasons to start a business (along with lots of risks), but taking the plunge is a step every entrepreneur has to face if they plan on striking out on their own.

Stocks are a share of ownership of a company. If you own a stock, you are involved in some of its management decisions, and you are entitled to some of the company’s profits.

The balance sheet is a financial snapshot of the firm on a specific date – specifically their assets, liabilities, and shareholder equity

The Income Statement is one of the financial statements that all publicly traded companies share with their investors, which shows the company’s sales, expenses, and net profit (or loss) over a period of time–usually 3 months, year-to-date, and twelve months.

The Cash Flow Statement is one of the four financial statements required by the SEC based on the U.S. GAAP (Generally Accepted Accounting Principles). This statement presents where the cash and its equivalents are coming from and where they are being allocated.