Gross Domestic Product (GDP) is a measure of the total economic output a country makes in a given year, and indicates the total size of the economy. Want to learn about how it is calculated? This article will answer that question, and more!

The government has two main ways it tries to influence the economy – through Fiscal Policy and Monetary Policy. Montetary policy involves the government directly injecting cash into the economy through government spending.

“Inflation” means that the general prices of goods and services goes up from one year to another. There are a few ways to calculate inflation – from a simple “basket of goods” compared over time, to complicated economic models looking across thousands of factors

In any society with a market-based economy, the government must: ensure the common defense, promote economic growth, and strive to maintain a just society. All three of these tasks are related to the economy in one way or another, meaning everything the government does will have an impact on the economy.

The Time Value of Money is a concept that a dollar in your pocket today is worth more than a dollar tomorrow – because you can use it right away. The time value of money is determined by interest rates and opportunity cost – what else could you be doing with that money?

Owning a share in a company means that you are an integral part of the puzzle that helps the company tick. Typically, investors choose to own a stock for one of two profit driven reasons: the dividends they will receive from the company, or the hope that the stock price will increase and they will be able to sell it for a higher price than they purchased it at.

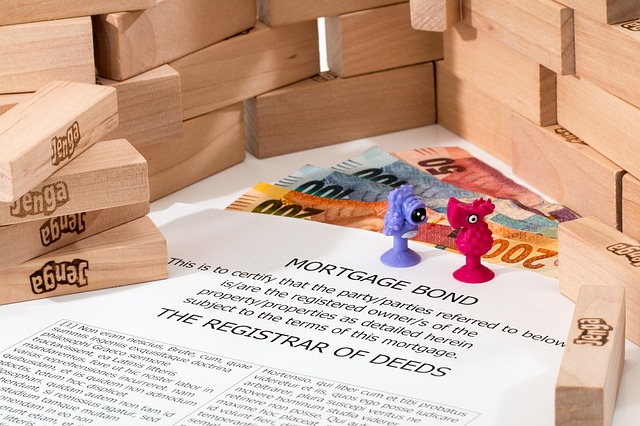

Your home will probably be the biggest purchase you make in your lifetime. Buying a home not only saves money on rent, but is a serious asset that can appreciate over time. Since homes are so expensive, (almost) no-one buys them in cash. Instead, homes are typically purchased with a special type of loan, called a “Mortgage”, that breaks the principle and interest into equal payments over the entire term of the loan.

Big corporations are very powerful entities that can possess more capital than some countries in the world. However, every company begins as a small start-up business. Once a private company grows large enough, they can become public, meaning they sell stocks to the public to finance future endeavors. After selling stocks to the public, the company will have to pay dividends to those who have chosen to invest in them.

Building a budget or spending plan is tough. Sticking to the plan is even tougher. Remember to “Pay Yourself First”, and don’t lose your head – stick to the plan!

Bankruptcy is a type of forced debt settlement, and is a legal procedure. When you declare bankruptcy, the courts will gather all your unsecured creditors together, and hear the debts you owe. They will then examine all your assets, and pay out as much as they can to settle as many debts as possible.

Everyone has had financial emergencies – when a huge spending shock breaks your budget or spending plan into pieces. If you have more than one emergency in a short time, such as if you lost your job, your outstanding debt balances might start to spiral out of control. But, you can try to ease these troubles by calling your creditor to discuss debt negotiation.

Asset Valuation is the process by which an individual can assess the changes in a companies asset overtime. This is done largely through comparing ratios from a company’s financial statement, but can also be a more complex affair (depending on what is being valued)

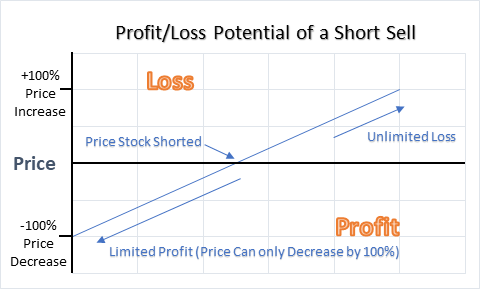

Margin trading is when you borrow money to invest. This increases the risk because now your returns need to not just make a profit, but more of a profit than you pay in interest. Market timing is also risky – instead of relying on fundamental business data, it means trying to pick the perfect hour, minute, or second to “beat” other traders who are trying to do the same thing.

Credit cards is a form of unsecured credit (meaning a loan without collateral) that you can use to make everyday purchases. All credit card purchases are made using a loan – you borrow money from your credit card issuer, and later pay it back with interest. Read this article for information about the differences between credit and debit cards, the types of credit balance, how finance charges and interest rates work with credit cards and gives details about the CARD Act of 2009.

An “Investing Strategy” is a plan for how to save money to help it grow. Sometimes an “investing strategy” can just mean “plan for trading stocks”, but it really means a lot more – what do you want your portfolio to DO?

Building the next “Big Thing”. Being your own boss. Getting the full rewards for your work. There are a lot of reasons to start a business (along with lots of risks), but taking the plunge is a step every entrepreneur has to face if they plan on striking out on their own.

“Credit” is when you have the ability to use borrowed money. This can come in many different forms, from credit cards to mortgages. There is a wide range of ways to use credit, which means that it is often a challenge for beginners to learn all the different ins and outs of using credit.

As a young person, thinking about saving for retirement seems like a world away. However, being able to save enough for retirement means people have to start much earlier than they think.

Interest rates are a percentage that is used to calculate how much a loan or investment grows over time. A “Nominal” interest rate is just the percentage on the loan – the “Real” rate subtracts expected inflation

The New York Stock Exchange (or NYSE) is the largest stock exchange in the world, where buyers and sellers come to trade U.S. stocks!

Stocks are a share of ownership of a company. If you own a stock, you are involved in some of its management decisions, and you are entitled to some of the company’s profits.

The balance sheet is a financial snapshot of the firm on a specific date – specifically their assets, liabilities, and shareholder equity

The Income Statement is one of the financial statements that all publicly traded companies share with their investors, which shows the company’s sales, expenses, and net profit (or loss) over a period of time–usually 3 months, year-to-date, and twelve months.

The Cash Flow Statement is one of the four financial statements required by the SEC based on the U.S. GAAP (Generally Accepted Accounting Principles). This statement presents where the cash and its equivalents are coming from and where they are being allocated.