PersonalFinanceLab is a gamified platform that focuses on engaging the student through interactive and experiential learning. The platform has a Budgeting game and a stock market platform, that allows the student to learn while doing, making mistakes and repeating the actions until they succeed, thereby learning and understanding the fundamentals of managing money and investing it.

In the last example, I had mentioned Opportunity Cost , which in itself is one of the fundamentals of money management. You have choices that are available to you, whether it be price versus quality or price versus functionality or price versus convenience.

In this edition, I want to discuss the value of money. By this I mean, before you spend your money, you have to recognize it’s worth. For every dollar that is spent, the student has to recognize the value of each dollar in terms of how long it took to earn it and whether the purchase made is the best “value” of your time.

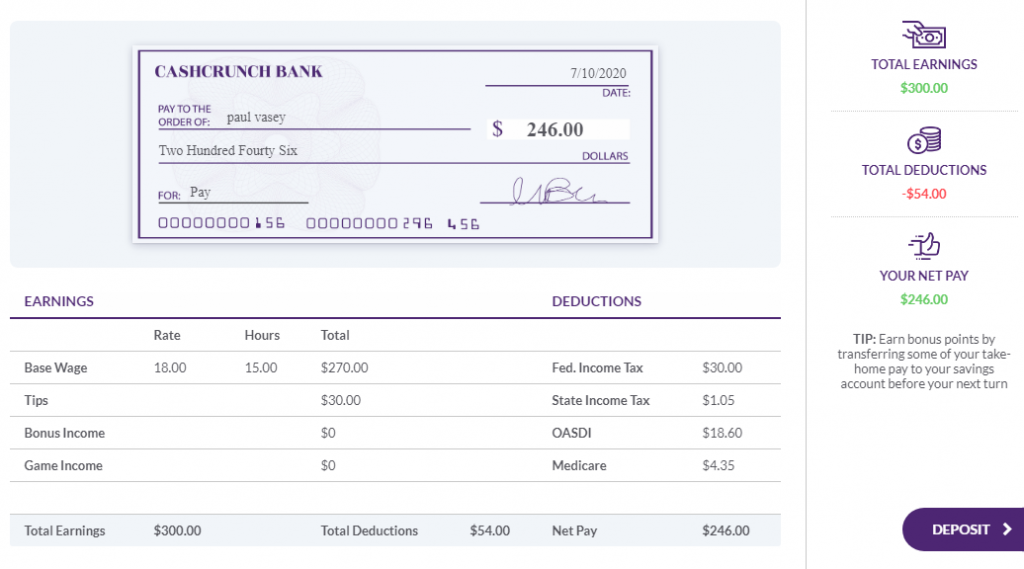

In the Budgeting game the student will receive a paycheck every Friday. In this example, the student is paid $15 an hour, but after taxes they receive $246, which equates to $13.67 an hour.

Now for every purchase, when a student buys a product, they need to be thinking that for every $13.67 spent on bills or random products, it will take 1 hour of their time to earn that money. So if a student wants to buy a pair of sunglasses for $50. It would take that student nearly 4 hours to earn enough money to buy those sunglasses. Firstly are they worth the time taken to earn that money? What else could they have bought with that money (opportunity cost) and did they get the best price and value for their money (comparison shopping)?

Building on from students receiving a paycheck in the game:

Simple activities:

Print out a US map.

- Research the minimum wage in 5 states plus their own and label them on the US map.

- Research the state income tax in 5 states plus their own including the highest and lowest levels and label them on the US map.

- Explain the difference between Total Earnings (sometimes called Gross Pay) and Net Pay.

- List 5 thing that you would like to buy or have bought. Using the minimum wage in your state, calculate how many hours it would take you to earn enough money to purchase those products.

In the next edition we will discuss unlimited wants, limited earnings and how we can manage expectations of earning and spending through a Budget.

Want more examples? Check out our lesson plan library, or book a demo with our team to discuss how PFinLab can be used in your class!

Request More Information

[contact-form-7 id=”17211″ title=”Pfinlab Contact Form”]