Building a budget or spending plan is tough. Sticking to the plan is even tougher. Remember to “Pay Yourself First”, and don’t lose your head – stick to the plan!

Budgeting, and trying to grow your savings, can be extremely challenging. However, there is one easy technique you can use to make sure your savings are always growing: Pay Yourself First. This is where you set aside your savings immediately after getting your paycheck – reducing your temptation to over-spend throughout the month.

Bankruptcy is a type of forced debt settlement, and is a legal procedure. When you declare bankruptcy, the courts will gather all your unsecured creditors together, and hear the debts you owe. They will then examine all your assets, and pay out as much as they can to settle as many debts as possible.

There are a variety of Debt Management Services that are available via credit counselling such as debt management plans and debt settlement. Different services have different impacts on your credit score, but they can help avoid bankruptcy and get your life back on track.

Consolidating your debt means taking out one big loan, and using that to pay off all outstanding balances from all your previous loans. This can make the debt easier to manage, and stop late fees and interest payments from building up.

Everyone has had financial emergencies – when a huge spending shock breaks your budget or spending plan into pieces. If you have more than one emergency in a short time, such as if you lost your job, your outstanding debt balances might start to spiral out of control. But, you can try to ease these troubles by calling your creditor to discuss debt negotiation.

It happens to everyone: a monetary emergency happens, such as a car breakdown, draining your bank account. Bills are still coming in, and you already know that you will not even be close to paying off everything this month. How can you get out of this situation with the least pain?

One of the cornerstones of strong personal finances is knowing why you buy what you do, and knowing how to research your purchases in advance. What are some of the ways that you would research a purchase? What types of purchases demand the most research effort?

Every high school student makes a choice when they are about to graduate – enter the job market right away, enter a trade school, or enroll in a university? While you can always switch paths later in life, the year immediately after graduation will have a ripple effect that can last a lifetime!

When deciding whether a product is worth it or not people typically think that if the benefit of the item is greater than the cost, they should go ahead with the purchase. However, there are more factors at play here that should play a role in buying decisions, tread carefully!

Health Insurance is usually the most complicated and expensive insurance you need. Unfortunately, it is also usually the most important, making it very difficult to avoid the cost. With very few exceptions, health insurance is mandatory for all citizens in the United States.

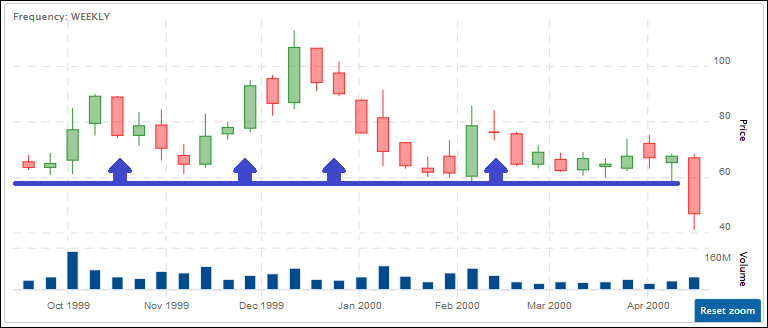

The most challenging aspect of starting to invest is picking the first few stocks to add to a portfolio. Every investor has their own techniques and strategies, but some fundamentals remain – buy what you know, do your homework, and don’t overthink your first steps!

Use this tool to search for jobs and internships, either near you or around the world. A great way to get introduced to the job market, and identify what qualifications you need to build to land your dream job!

Experienced workers have a job search lasting about 43 days, and fresh graduates can expect a longer wait. Your search will be much harder if you make one of the following very common mistakes. Avoiding all 5 of the mistakes described in this article will not promise an interview, but hitting any might mean you are missing out.

Internships are an increasingly popular phenomenon, with a little over 1.5 million positions per year in the United States. But not all internships are created equally – students with paid internships typically get a lot better experience and better job prospects than those with unpaid positions!

Have an interview coming up? Looking to improve your interview skills? Show up on time. Be neat and clean. Know exactly what you’re there for, take notes, and ask questions!

How can you get your resume read, let alone rise to the top of the pile? Enter keywords – your new job search best friend. In big companies, your resume will have to get past a robot filter before human eyes ever see it, so pay attention to key words to get past the gatekeeper!

Life Insurance is an insurance policy designed to pay out if the insured person dies. They were created to make sure that if the main income holder of a household dies, the payout from the policy can be used to help continue to support his or her family.

Homeowner’s Insurance is a broad type of insurance coverage designed to cover a home and the property it sits on. This insurance is very broad, wrapping many different types of coverage into one package.

“Rental Insurance” is taken out on property you rent to insure against damage. Rental insurance works like a lighter version of Homeowner’s Insurance. This is usually much cheaper, just covering your “stuff” in case of break-ins, water damage, or other mishaps.

Car insurance is very important, but it can be hard to know which one to pick! Liability coverage is required everywhere, which just covers the cost if you do damage to someone else’s property or person. Collision covers your stuff too, but can have a big impact on cost!

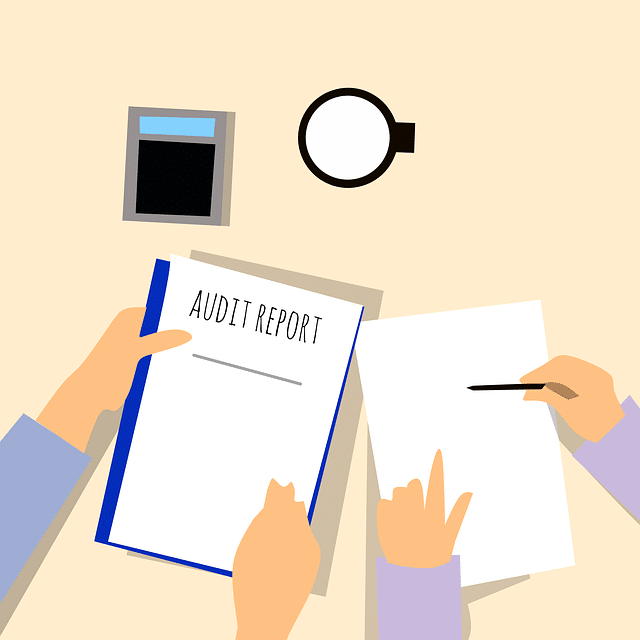

An “Audit” is what happens when the IRS picks your return out from the pile for extra scrutiny. The auditing process is designed to catch errors in the tax returns, verify the correct amount of tax or return is being paid, and preventing fraudulent tax claims.

Most young people are perfectly capable filing their own taxes, such as filing the Form 1040. As personal finances grow and become more complex, knowing when to ask for help can get tricky.

Everyone loves getting tax breaks, but what can really ruin your finances in the long-run is forgetting about tax additions – extra taxes and fees that you need to add on to your tax bill. In the Gig Economy, these can add up fast, so make sure to include taxes in your budget!

When you file your income taxes, you can “write off” certain expenses, and get extra tax credits based on your living situation. This can make a big impact on your bottom line, but only if you have proper documentation to back up your claims!

Income tax is the tax you pay on your income, usually directly taken out of your paycheck. Additionally, if you earn rents from rental properties, investment income, interest on your savings account or bonds, or any other revenue stream, you will probably owe some income tax on it.

“Sales Tax” is a tax that is charged on goods sold to end customers, and is a set percentage of the price of the good. Different states and countries have different sales taxes – some have none at all!

“Short Term” financing means taking out a loan to make a purchase, usually with the loan term at less than a year. Short-term financing usually has a higher interest rate than long-term loans – and can even include credit card debt.

Credit cards is a form of unsecured credit (meaning a loan without collateral) that you can use to make everyday purchases. All credit card purchases are made using a loan – you borrow money from your credit card issuer, and later pay it back with interest. Read this article for information about the differences between credit and debit cards, the types of credit balance, how finance charges and interest rates work with credit cards and gives details about the CARD Act of 2009.

Before debit cards became popularized, people had to carry cash and cheques or use credit cards or short-term financing for everyday payments. Debit cards became the most popular method since they are easier and are associated with less fees that credit cards!

Not all debt it bad debt: in fact, having a healthy amount of debt is almost an essential part of growth, but taking on lots of small debts frequently can also be very dangerous to your bottom line.

Automatic Payments can be a huge time saver, but can also be problematic for your planning processes and account reconciliations. What cases are they appropriate? Can you think of a case where automatic payments would be a bad idea?

There’s a difference between a “Project Budget” and a “Living Budget”! You’ll need a different attitude when you’re thinking about how to plan your monthly income, expenses, and savings goals compared to just how to accomplish something specific over a short time.

Reconciliation is the process of reconciling your checkbook by comparing your own written records with your bank statements. Although this process has changed drastically in the 21st century, it is still an important for your personal finances.

If you save receipts for every purchase you make the paper will pile up quickly. Think about what types of receipts you DEFINITELY need to save, and which ones you can throw out!

There are over 600 articles, videos, and calculators in the Personal Finance Lab Learn Center. However, we have selected the best 100 for use in personal finance classes, with integration with the Pfinlab Assignments feature.

This article can help you decipher options symbols into meaningful information to help you understand the option at hand!

Companies issue stock to raise money to finance business operations. Stock represents ownership in a company. Thus, if you are a stockholder, you own part of a company. A stock certificate shows how many shares you own.

Click here to read about the importance of savings!

Investing in capital goods occurs when businesses purchase capital goods in order to increase the productivity of workers. This investment always involves some risk.

Financial institutions encourage people to save by offering interest on savings. They loan these savings to businesses and consumers. Banks compete with one another to attract savers and borrowers. The goal of the bank, like any business, is to make a profit.

People often put their savings into financial investments like stocks, bonds, or certificates of deposit. Some of these are more risky — but have the potential of a much better rate of return — than less risky investments.

Teaching a personal finance class? We have some great class ideas on how to integrate the portfolio simulation and educational content with your classes!

To be “In Debt” means to owe money to someone else, usually making fixed payments to pay back the amount over time, plus interest. Properly managing debt helps minimize how much total interest you pay, and has a solid strategy on how to become debt-free

It is pretty obvious that you will be compensated by your employer when you have a job, in some way or another. However, the form that the compensation comes in can be drastically different across companies and employers. This article contains the basics on the different kinds of compensation you can get!

Today, all of our financial lives are online. This creates a problem when making sure that you are the only one who has access to it. Fraud and Identity Theft are growing problems, impacting just about everyone, but there are some steps you can take to avoid this.

An “Investing Strategy” is a plan for how to save money to help it grow. Sometimes an “investing strategy” can just mean “plan for trading stocks”, but it really means a lot more – what do you want your portfolio to DO?

Building the next “Big Thing”. Being your own boss. Getting the full rewards for your work. There are a lot of reasons to start a business (along with lots of risks), but taking the plunge is a step every entrepreneur has to face if they plan on striking out on their own.

“Credit” is when you have the ability to use borrowed money. This can come in many different forms, from credit cards to mortgages. There is a wide range of ways to use credit, which means that it is often a challenge for beginners to learn all the different ins and outs of using credit.

Credit reports are documents that keeps a record of (most) of your regular bill payments. They are not to be confused with credit scores, which is are single number. Having good credit reports are vital to demonstrating your financial stability, which is important for activities like applying for a mortgage.