Hey teachers! Our feature update list for the Spring semester is shorter than some of our previous releases, but that’s because they are some big ones! Get excited for the biggest update to our Assignments engine we’ve ever seen, and a new AI assistant to help students understand their portfolios in our Stock Game! Assignments Read More…

Hey teachers! Our stock game is getting a big upgrade for students looking for help building their portfolio with our new AI companion – the Wealth Wizard! Not a fan of AI in the classroom? The Wealth Wizard can be toggled on or off in your class settings! What is the Wealth Wizard? The Wealth Read More…

Hey teachers! We are excited to announce the biggest overhaul we’ve ever made to our Assignments engine – just in time for your Spring classes! What are Assignments? “Assignments” refers to the built-in tracking system featured on PersonalFinanceLab. This system allows teachers to assign work for their students to do on the platform – from Read More…

The Fall semester is already here, and we’re excited to announce our newest slate of updates! Fall 2025 Updates Webinar Recording Want a full walkthrough of these updates in action? Watch our recorded webinar where we demonstrate the new features, answers questions, and shares best practices for using them in class. Budget Game Public Transit Read More…

We are excited the newest addition to our Budgeting Game – Public Transit Mode! One of the major expenses in the game is owning a car. Car ownership comes with several bills players need to pay (including a Car Insurance and Gasoline bill), plus various events throughout the game itself relating to other expenses involved Read More…

PersonalFinanceLab is excited to announce the addition of International Bonds to our bonds trading simulation! Until now, PersonalFinanceLab has allowed students to trade a wide range of US corporate and treasury bonds – based on the settings chosen by their instructor when setting up their class stock game. Our new addition adds an additional selection Read More…

PersonalFinanceLab’s stock game has been available in a variety of languages since inception, but until now our Budget Game and Curriculum Library have been supported exclusively in English. As one of our biggest enhancements for Fall 2025, we are excited to announce full translation across our entire platform* – including the entirety of or Budgeting Read More…

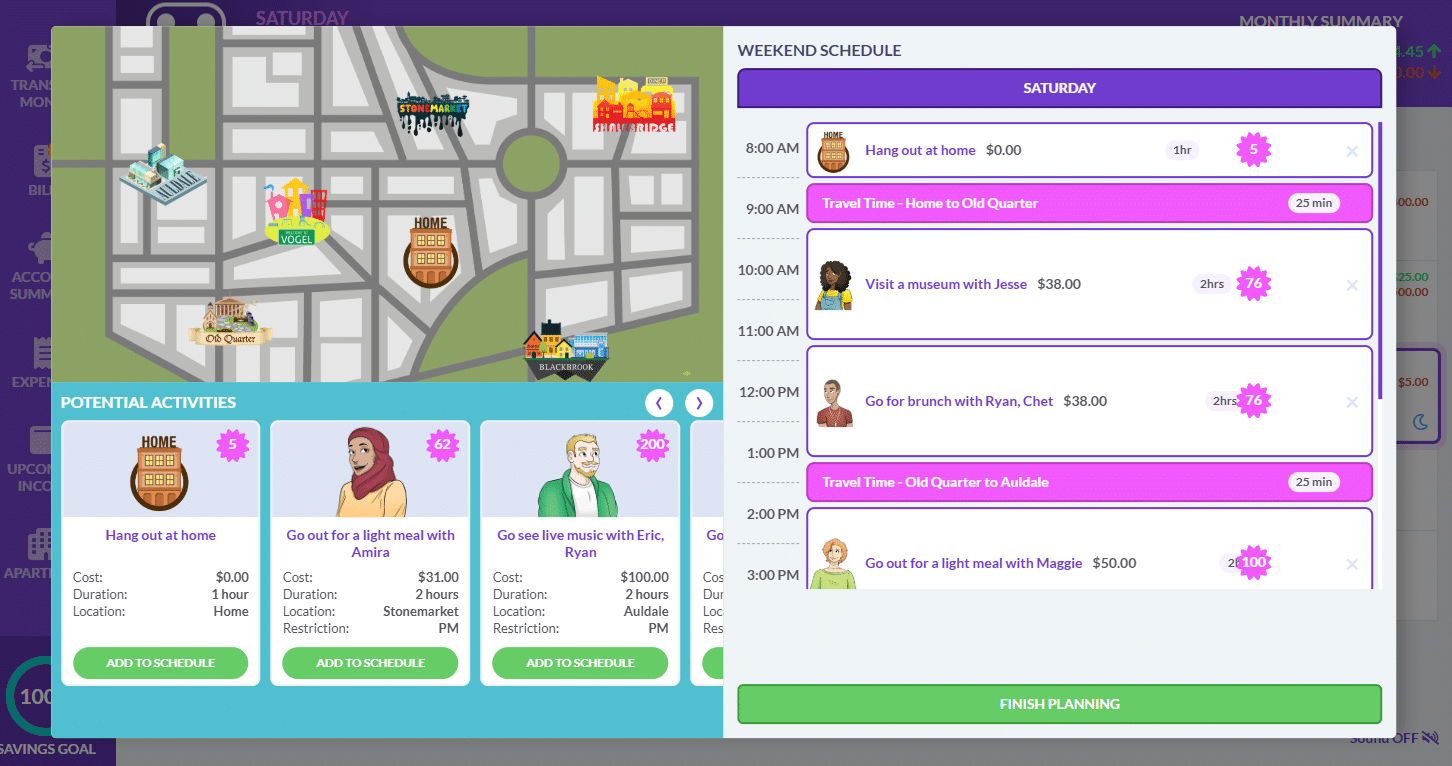

The PersonalFinanceLab Budget Game is a unique resource for schools to teach students about money management in the real world. As one of the cornerstone decisions students make each “week” of the simulation is how they are going to spend their weekend, through our student-driven “Weekend Choice” mechanic. Besides simply choosing what area students want Read More…

This project comes recommended from Leesa Hudak from Bow High School in New Hampshire. Learn more about Leesa’s classes in our case study! Objective: Students will build and manage a stock portfolio over the course of a semester, making investment decisions based on research, market trends, and risk assessment. Project Guidelines: Evaluation Criteria: 20 points: 1. Read More…

Picking up some extra cash in today’s gig economy is a financial reality that most young adults at least consider at one point or another – and having the option to pick up some extra cash can be a life-saver (and budget savior). Our budgeting game captures this in our Weekend Choice – players have Read More…

Knowing how to manage one’s time is as important as managing money – which is the cornerstone of our new “Socializing” mini-game in our personal budgeting game! How The Time Management Game Works The Time Management game launches as part of our Weekend Events, triggering when a user chooses to Socialize with their friends on Read More…

PersonalFinanceLab is all about helping young people learn more about financial literacy, with our animated videos, budgeting game, and stock game working with our lesson library to bring learning to life. To bring these concepts to life, our cast of characters has been showing up across our games, videos, and lessons for the last year. Read More…

Ryan is a charismatic and confident entrepreneur who effortlessly navigates the cutthroat world of high-stakes business deals with his quick wit, sharp instincts, and infectious charm. About Ryan He can be described as: His money habits are: His goals and motivations are: Ryan’s Investing Portfolio Ryan’s investing portfolio is a mix of ETFs and stocks. Read More…

Tia is a meticulous and analytical individual who thrives in the world of numbers and technology, always seeking to optimize her life. She could spend hours doing puzzles or complex math-based games. About Tia She can be described as: Her money habits are: Her goals and motivations are: Tia’s Investing Portfolio Tia’s investing portfolio is Read More…

Maggie is a sentimental and practical individual who values stability and security, often prioritizing comfort and familiarity over adventure and risk. About Maggie She can be described as: Her money habits are: Her goals and motivations are: Maggie’s Investing Portfolio Maggie’s investing portfolio is a mix of ETFs and stocks. Maggie’s ETFs and Mutual Funds Read More…

Jesse is a driven and resourceful individual who embodies the spirit of a true go-getter, always striving to achieve her goals and live life on her own terms. She is athletic and plays competitive volleyball. About Jesse She can be described as: Her money habits are: Her goals and motivations are: Jesse’s Investing Portfolio Jesse’s Read More…

Esteban is fascinated by space since he was a kid. He loves reading and writing science fiction, and his dry sense of humor is loved by his friends and classmates (and tolerated by his teachers). He effortlessly gets good grades. About Esteban He can be described as: His money habits are: His goals and motivations Read More…

Eric is a rugged and energetic handyman who thrives on action and competition, always looking for the next challenge or project to tackle with his hands-on skills and booming personality. He used to play football in school, and now plays recreational softball on weekends. About Eric He can be described as: His money habits are: Read More…

Amira is a creative and empathetic individual who thrives in the world of art and self-expression, always seeking to inspire and uplift those around her. About Amira She can be described as: Her money habits are: Her goals and motivations are: Amira’s Investing Portfolio Amira’s investing portfolio is a mix of ETFs and stocks. Amira’s Read More…

Chet is a laid-back and carefree individual who lives in the moment, often prioritizing short-term pleasures over long-term consequences. About Chet He can be described as: His money habits are: His goals and motivations are: Chet’s Investing Portfolio Chet’s investing portfolio is a mix of ETFs and stocks. Chet’s ETFs and Mutual Funds Invesco QQQ Read More…

April is Financial Literacy Month, and we are celebrating with our 6th annual Spring Financial Literacy Challenge! It ran for the month of April, 2025 About The Challenge The April Financial Literacy Challenge is our annual free world-wide budgeting and investing competition open to all K-12 schools. Students will be challenged to build and maintain Read More…

We hope you are as excited as we are, because we have some major updates for your classes this Spring! From financial math and calculators, to comparison shopping games, to bug fixes and improvements, stay tuned to see what we have in store for your spring classes! If you want to learn more about these Read More…

To celebrate the New Year, everyone here at PersonalFinanceLab is excited to announce our brand-new calculators, available now for all Personal Finance classes as part of our Financial Literacy Curriculum! About The Calculators Each calculator was developed and released to be part of a lesson on financial literacy – this semester we focused mainly on Read More…

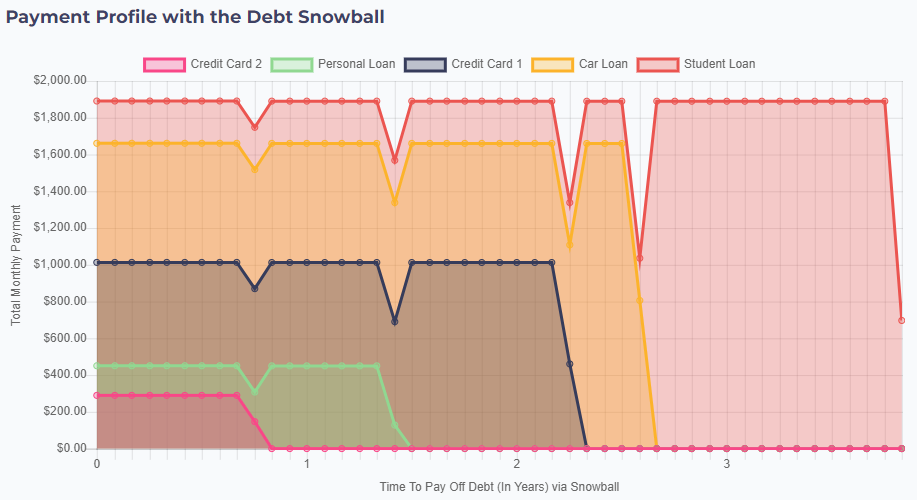

We are excited as ever to announce the latest addition to our Personal Finance Curriculum Library – our interactive lesson on Debt Snowball and Debt Avalanche! What is a Debt Snowball and Avalanche? Debt Snowball and Debt Avalanche refers to two accelerated debt repayment techniques, which can save a person trying to get out of Read More…

Financial math is more important than ever – and we are here to support teachers along the way! These new topics generally build on the more basic lessons in our personal finance curriculum library, with additional complexity and examples to make them at home in a class focusing on financial algebra. About Each Lesson This Read More…

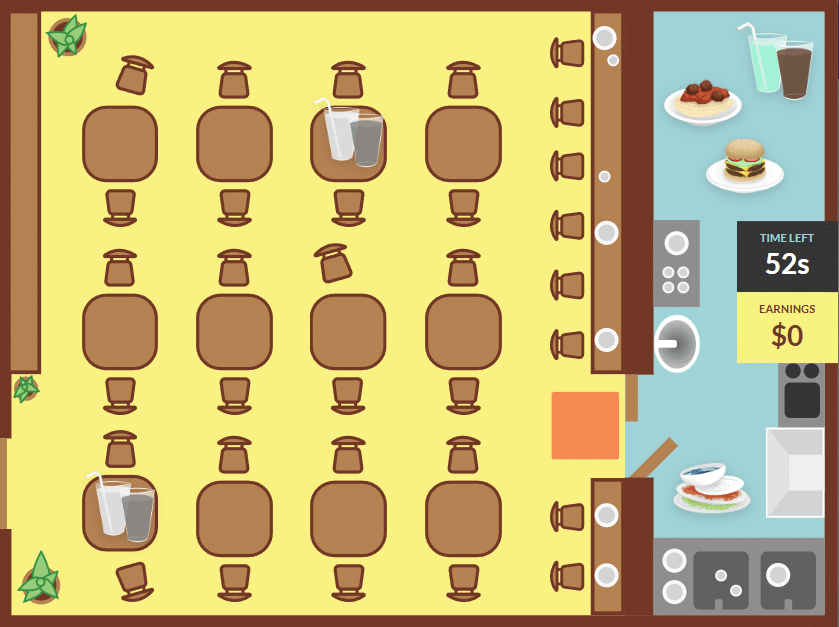

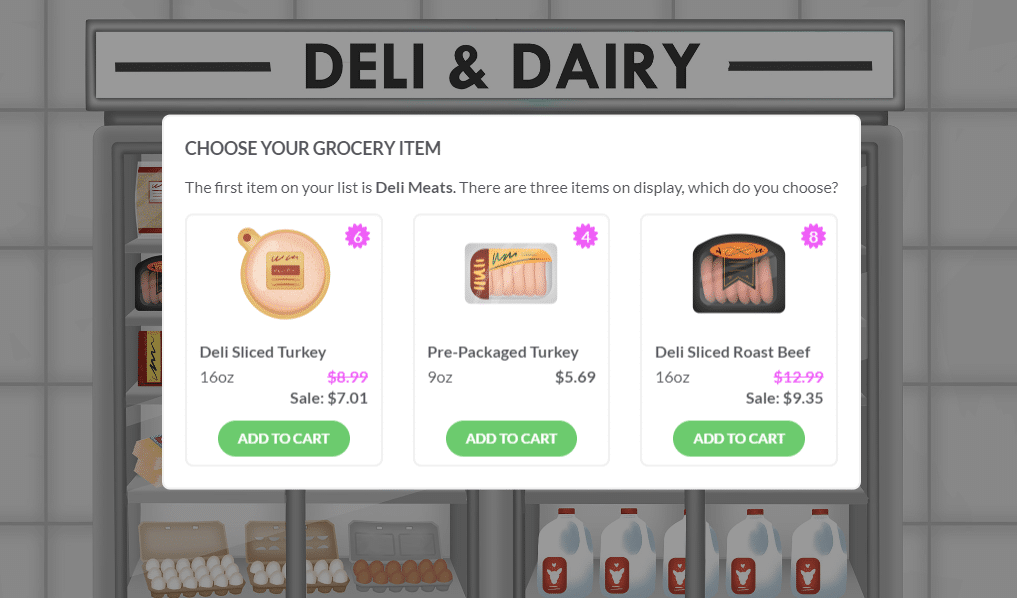

Knowing how to comparison shop for the best deal is a a fundamental skill for every consumer. Different package sizes, different perceived quality, and different prices can be confusing to navigate, especially for young people. This is why we are so excited to add our “Comparison Shopping” mini-game to our personal budgeting game! How The Read More…

The Fall semester is here, and boy do we have a huge set of updates for you! New This Fall Combined Budget + Stock Game! This is a big one – teachers can now directly connect the Budgeting Game and Stock Games for their class with direct money transfers! This update means that instead of Read More…

Celebrating Success: Winners of the April Financial Literacy Challenge! Congratulations to the following students who emerged as winners in the Budget Game. Your dedication to financial literacy has truly paid off. Budget Game Winners Students were invited to participate in our Budgeting Game, competing with tens of thousands of other students from around the United States Read More…

When you have students participating in our stock game, it can be a struggle to get students to understand the basics of conducting research and comparing stocks. After all, between stock prices, the news, financial statements, stock charts, and what they hear from their friends, there is a lot of noise out there – and Read More…

Personal Finance is all about choices – like economics, it is a “dismal science” of choosing between trade-offs. In our budgeting game, we make a point to highlight these tradeoffs in how students choose to spend their free time each weekend – the Weekend Choice. The Weekend Choice is a decision students need to make Read More…

Investing is all about trying to maximize gains and minimizing losses. But we aren’t trying to teach students to be constantly watching every investment in their retirement account – what can the average investor use to protect their nest-egg without limiting their investment growth? Introducing Trailing Stops There are more options when investing than just Read More…

Hey Teachers – we’ve got an exciting update for our learning library for January 2024! New Video First up, we have a new video about how to manage receipts! This video is included in our lesson on “Managing Receipts” in our Personal Finance Learning Library for classes too. This joins our other video lessons covering Read More…

As students work through the PersonalFinanceLab Budgeting Game, they can see their class rankings, and might have some sense of how their game score or net worth has grown over time. But to really get a clear picture of how their financial future is shaping up, wouldn’t it be nice if there was a single Read More…

Learning how to file a federal income tax return is a cornerstone of every Personal Finance class. At PersonalFinanceLab, we’re excited to share our two activities specifically designed to help students learn how to file their own taxes once they start work. Filing Taxes Mini-Lesson As part of the Budget Game, we have a built-in Read More…

PersonalFinanceLab is packed to the brim with Financial Literacy Resources for schools, with the cornerstone being our library of 300+ standards-aligned, customizable lessons built into our Assignments engine that teachers can leverage for their class. Most of our lessons take students less than 15 minutes to complete, with a 3-5 question, automatically-graded quiz at the Read More…

PersonalFinanceLab’s Budget Game is an awesome tool to help teach students how to manage their money, pay bills on time, build up their credit, and get experience managing personal finances in a safe enviornment. But one of the cornerstones of true financial literacy is being able to look over financial records, like bank statements, and Read More…

One of our recently featured highlights was Assignment Rewards – a great way to incentivize students to complete their lessons on time. But as the teacher, how can you find which of your students earned their bonuses? Introducing Rewards Reporting When you set up your Assignment Rewards, you have the option to credit it to Read More…

At PersonalFinanceLab, we’re all about making Personal Finance easier to teach – and that means making sure teachers have the resources they need, right where they need them. With this in mind, we’re excited to announce a complete revamp of our Admin Dashboard! Meet Your New Dashboard The new Admin Dashboard was designed with ease-of-use Read More…

PersonalFinanceLab has over a dozen different reports – showing class registration information, budget game progress, stock game trades, and more. But you’re a busy teacher – you want one page that has exactly the information that is most relevant to your class. Don’t worry – our Custom Reporting tools are here to help! Custom Reports Read More…

PersonalFinanceLab’s lesson library and assignments is an awesome way to add extra supplements to your class – you can even give students rewards in their stock portfolio or budget game checking account when they complete their lessons on time! But an article with a quiz at the end is not the best way to keep Read More…

PersonalFinanceLab’s Budget Game is an awesome tool to help students master the core skills needed to build a healthy financial future. But while students are progressing from month to month, it can be hard to tell how well they are doing – apart from their Class Ranking. With this in mind, we’re excited to announce Read More…

Using a stock game in class to teach about investing has been a staple of classrooms for decades. And for the whole time, building a portfolio has been a great group activity to help students work and learn together. But there is always one nagging problem with every group project – how can teachers measure Read More…

Picture this – you set up your class stock and budget games, along with assignments with tutorials and other info you want students to work through before finishing the games. But students always seem to want to play first, learn later. How can you incentivize them to get through their lessons and quizzes first? Introducing Read More…

The PersonalFinanceLab Budgeting Game is an excellent way to get students thinking about money over time – sometimes even TOO engaging. Teachers may set up a game lasting 18 virtual months with the intention for the class to progress through it over the course of 10 weeks, only to find some students moved too far Read More…

Every teacher has been there – you’ve had your students complete a formative quiz, and you want to review their answers to see where the class is struggling. All the quizzes are graded, but going through every student one-at-a-time to find patterns can be frustrating and time consuming. This is where our Class Quiz Summaries Read More…

Picture this – you are a student playing through the PersonalFinanceLab budgeting game, and you get a prompt – do you want to buy an aquarium? The cost is $100. In the real world, tons of people buy aquariums – it is a personal preference, but maybe you really like looking at fish. This is Read More…

You’ve got an important announcement for your students. Maybe you already posted it to your classroom page, and sent out an email. Even wrote it on the board in class. But if you want to be extra sure they see it, you also want to pop it in front of them while they’re working through Read More…

You’re planning to use the PersonalFinanceLab stock game in your class. You’ve used stock games before, and have seen some students buy something in the first week, then forget about it until the end of the semester. You want to encourage students to keep an eye on their portfolio, and re-balance it over time, just Read More…

Did It Work? That is the biggest question teachers need to know after using any resource in the classroom – did it actually improve outcomes? And we at PersonalFinanceLab could not agree more. That is why a year ago we implemented our Pre- and Post- tests as part of our Assignments engine, allowing teachers to Read More…

Stash101 shuts down as a money management and investment simulation for schools, with all existing accounts disabled on January 31, 2023. What happened to Stash101? Stash is primarily a banking app, which also can include a personal checking account. Stash101 was a free “practice” version with other educational resources built in, designed for schools and Read More…