Definition:

Fundamental analysis is the process of looking at the basic or fundamental financial level of a business, especially sales, earnings, growth potential, assets, debt, management, products, and competition. This type of analysis examines key ratios of a business to determine its financial health and gives you an idea of the value its stock.

Many investors use fundamental analysis alone or in combination with other tools to evaluate stocks for investment purposes. The goal is to determine the current worth and, more importantly, how the market values the stock. Usually fundamental analysis takes into consideration only those variables that are directly related to the company itself, rather than the overall state of the market or technical analysis data but here I’m going to describe a top down approach to the typical fundamental evaluation.

It starts with the overall economy and then works down from industry groups to specific companies. As part of the analysis process, it is important to remember that all information is relative. Industry groups are compared against other industry groups and companies against other companies. It is important that companies are compared with others in the same group. First and foremost in a top-down approach would be an overall evaluation of the general economy. When the economy expands, most industry groups and companies benefit and grow. When the economy declines, most sectors and companies usually suffer. Once a scenario for the overall economy has been developed, an investor can break down the economy into its various industry groups. If the prognosis is for an expanding economy, then certain groups are likely to benefit more than others. An investor can narrow the field to those groups that are best suited to benefit from the current or future economic environment. If most companies are expected to benefit from an expansion, then risk in equities would be relatively low and an aggressive growth-oriented strategy might be advisable. A growth strategy might involve the purchase of technology, biotech, semiconductor and cyclical stocks.

If the economy is forecast to contract, an investor may opt for a more conservative strategy and seek out stable income-oriented companies. A defensive strategy might involve the purchase of consumer staples, utilities and energy-related stocks. To assess a industry group’s potential, an investor would want to consider the overall growth rate, market size, and importance to the economy. While the individual company is still important, its industry group is likely to exert just as much, or more, influence on the stock price. When stocks move, they usually move as groups. Once the industry group is chosen, an investor would need to narrow the list of companies before proceeding to a more detailed analysis. Investors are usually interested in finding the leaders and the innovators within a group.

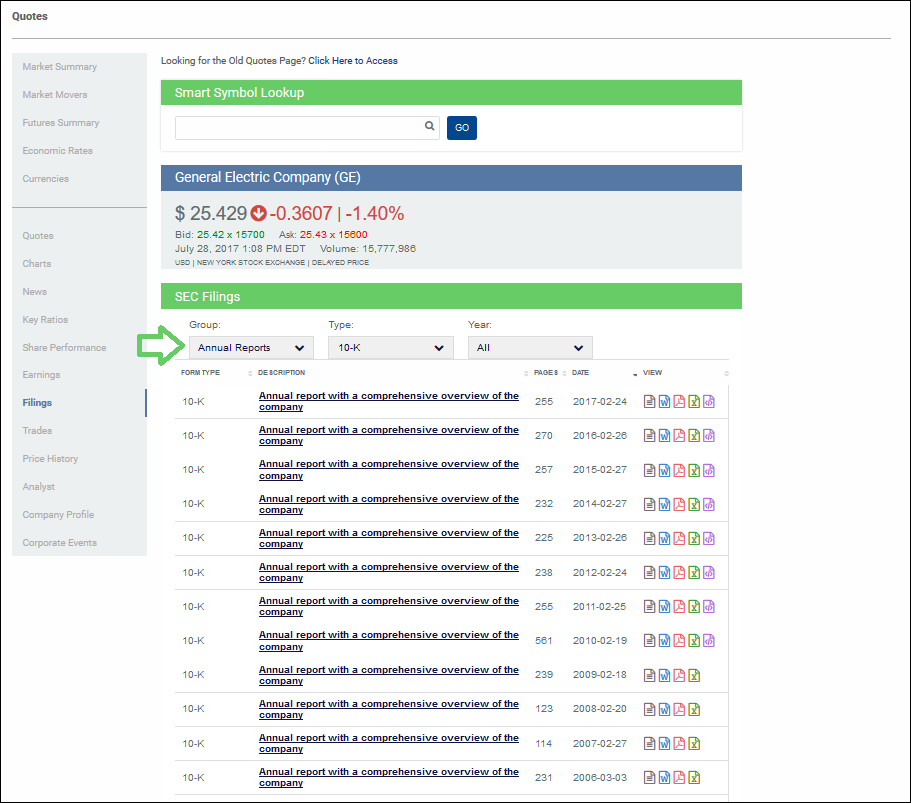

The first task is to identify the current business and competitive environment within a group as well as the future trends. How do the companies rank according to market share, product position and competitive advantage? Who is the current leader and how will changes within the sector affect the current balance of power? What are the barriers to entry? Success depends on an edge, be it marketing, technology, market share or innovation. A comparative analysis of the competition within a sector will help identify those companies with an edge, and those most likely to keep it. At point you will have a shortlist of companies and the final step to this analysis process would be to take apart the financial statements and come up with a means of valuation. Some of the more popular ratios are found by dividing the stock price by a key value driver.

Fundamental Analysis Tools

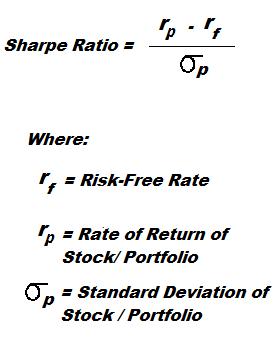

These are the most popular tools of fundamental analysis. They focus on earnings, growth, and value in the market. For convenience, I have broken them into separate articles. Each article discusses related ratios.

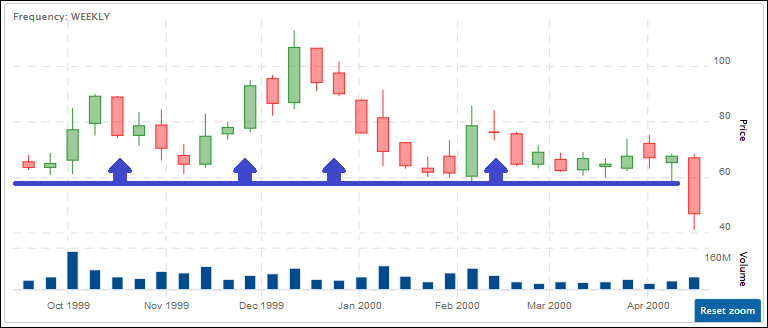

None of these mean much on their own but when you combine some of them together and adapt your combinations based on the sector the company you’re analyzing is in you will find that they are very good identifying the true value of a stock, thus find you identify the “ticket price” of your potential investment and to determine if your current investments are at or near their full potential. This methodology assumes that a company will sell at a specific multiple of its earnings, revenues or growth. An investor may rank companies based on these valuation ratios. Those at the high end may be considered overvalued, while those at the low end may constitute relatively good value. But it could also mean that the ones on the low end are “bad companies” and are not worth investing in while the ones on the high end could be very good companies which still have room to grow. Remember that the market is usually right in the long run. After all this work you will be left with a handful of candidates and this is where I recommend using technical analysis to develop a trading plan for each one of them.

I know investors tend to shy away from technical analysis but this a grave mistake, in my opinion. Knowing how to read charts and understanding that technical analysis is in fact understanding basic human psychology will help you maximize your gains and minimize your losses; how does that sound to you? So here, in a nutshell, are the advantages and disadvantages of fundamental analysis:

Advantages:

Fundamental analysis is good for long-term investments based on long-term trends, very long-term. The ability to identify and predict long-term economic, demographic, technological or consumer trends can benefit patient investors who pick the right industry groups or companies.

Sound fundamental analysis will help identify companies that represent a good value. Some of the most legendary investors think long-term and value. Graham and Dodd, Warren Buffett and John Neff are seen as the champions of value investing. Fundamental analysis can help uncover companies with valuable assets, a strong balance sheet, stable earnings, and staying power.

One of the most obvious, but less tangible, rewards of fundamental analysis is the development of a thorough understanding of the business. After such painstaking research and analysis, an investor will be familiar with the key revenue and profit drivers behind a company. Earnings and earnings expectations can be potent drivers of equity prices. Even some technicians will agree to that. A good understanding can help investors avoid companies that are prone to shortfalls and identify those that continue to deliver. In addition to understanding the business, fundamental analysis allows investors to develop an understanding of the key value drivers and companies within an industry. A stock’s price is heavily influenced by its industry group. By studying these groups, investors can better position themselves to identify opportunities that are high-risk (tech), low- risk (utilities), growth oriented (computer), value driven (oil), non-cyclical (consumer staples), cyclical (transportation) or income-oriented (high yield).

Stocks move as a group. By understanding a company’s business, investors can better position themselves to categorize stocks within their relevant industry group. Business can change rapidly and with it the revenue mix of a company. This happened to many of the pure Internet retailers, which were not really Internet companies, but plain retailers. Knowing a company’s business and being able to place it in a group can make a huge difference in relative valuations.

Disadvantages:

The main disadvantage for me is that if used on its own, fundamental analysis (FA) doesn’t take into consideration the “herd mentality” phenomenon. In the long run, the price per share (PPS) of companies is driven by their earnings, i.e., the profit they’re yielding. In the short term, the momentum can be quite influential on the PPS; I’m sure you’ve noticed that some stock are considered market darlings and, to a certain degree, it doesn’t matter what their quarterly results are; people keep on buying. The same applies for companies that, all of a sudden, fall out of favor for whatever reason, genuine or not. They keep getting hammered regardless of the results the company pumps out, until one day it reverses. FA doesn’t consider this irrational behavior.

Fundamental analysis may offer excellent insights, but it can be extraordinarily time-consuming. Time-consuming models often produce valuations that are contradictory to the current price prevailing on Wall Street. When this happens, the analyst basically claims that the whole street has got it wrong. This is not to say that there are not misunderstood companies out there, but it is quite brash to imply that the market price, and hence Wall Street, is wrong.

Valuation techniques vary depending on the industry group and specifics of each company. For this reason, a different technique and model is required for different industries and different companies. This can get quite time-consuming, which can limit the amount of research that can be performed.

Fair value is based on assumptions. Any changes to growth or multiplier assumptions can greatly alter the ultimate valuation. Fundamental analysts are generally aware of this and use sensitivity analysis to present a base-case valuation, a best-case valuation and a worst-case valuation. However, even on a worst-case valuation, most models are almost always bullish, the only question is how much so.

The majority of the information that goes into the analysis comes from the company itself. Companies employ investor relations managers specifically to handle the analyst community and release information. As Mark Twain said, “there are lies, damn lies, and statistics.” When it comes to massaging the data or spinning the announcement, CFOs and investor relations managers are professionals. Only buy-side analysts tend to venture past the company statistics. Buy-side analysts work for mutual funds and money managers. They read the reports written by the sell-side analysts who work for the big brokers (CIBC, Merrill Lynch, Robertson Stephens, CS First Boston, Paine Weber, DLJ to name a few). These brokers are also involved in underwriting and investment banking for the companies. Even though there are restrictions in place to prevent a conflict of interest, brokers have an ongoing relationship with the company under analysis. When reading these reports, it is important to take into consideration any biases a sell-side analyst may have. The buy-side analyst, on the other hand, is analyzing the company purely from an investment standpoint for a portfolio manager. If there is a relationship with the company, it is usually on different terms. In some cases this may be as a large shareholder.

When market valuations extend beyond historical norms, there is pressure to adjust growth and multiplier assumptions to compensate. If Wall Street values a stock at 50 times earnings and the current assumption is 30 times, the analyst would be pressured to revise this assumption higher. There is an old Wall Street adage: the value of any asset (stock) is only what someone is willing to pay for it (current price). Just as stock prices fluctuate, so too do growth and multiplier assumptions. Are we to believe Wall Street and the stock price or the analyst and market assumptions? It used to be that free cash flow or earnings were used with a multiplier to arrive at a fair value. In 1999, the S&P 500 typically sold for 28 times free cash flow. However, because so many companies were and are losing money, it has become popular to value a business as a multiple of its revenues. This would seem to be OK, except that the multiple was higher than the PE of many stocks! Some companies were considered bargains at 30 times revenues.

To conclude, fundamental analysis can be valuable, but it should be approached with caution. If you are reading research written by a sell-side analyst, it is important to be familiar with the analyst behind the report. We all have personal biases, and every analyst has some sort of bias. There is nothing wrong with this, and the research can still be of great value. Learn what the ratings mean and the track record of an analyst before jumping off the deep end. Corporate statements and press releases offer good information, but they should be read with a healthy degree of skepticism to separate the facts from the spin. Press releases don’t happen by accident; they are an important PR tool for companies. Investors should become skilled readers to weed out the important information and ignore the hype.

More Detail:

Quantitative and Qualitative

You can define fundamental analysis as “researching fundamentals.” This is not much help to an investor who does not know what “fundamentals” are and how to use them. Basically, fundamentals include things like revenue and profit. Fundamentals also include everything from the company’s market share to the quality of its management.

Fundamental factors are grouped into two categories: quantitative and qualitative. Quantitative factors are capable of being measured in numerical terms. Qualitative factors relate to the quality or character of something, as opposed to size or quantity.

Quantitative fundamentals are numeric characteristics about a business. The easiest way to identify quantitative data is the financial statements. Revenue, profit and assets can be measured with great precision.

Qualitative fundamentals are less tangible factors – things like quality of a company’s board members and key executives, its brand-name recognition, patents or proprietary technology.