The diligent investor knows that he or she needs relevant, timely, and high-quality information in order to make sound investment decisions.

The earnings reports released by companies can be invaluable in providing such information. Released by public companies on a quarterly and annual basis, they can be used to assess and gauge a company’s:

o financial condition

o strategic plans

o industry and competitive position,

o Key performance drivers and risk factors

o Future performance

SEC REGULATIONS

Publicly-traded companies are required to file earnings reports with the Securities and Exchange Commission on a quarterly (10-Q) and annual basis (10-K). Such reports have to be furnished within a specified timeline after the ending of the company’s accounting cycle.

ELEMENTS OF EARNINGS REPORTS

HIGHLIGHTS

The first section of these reports typically provides an overall summary of the company’s financial performance and key developments. A comparison between current results and prior years’ or quarters’ numbers are used to indicate how the company fared during the period. Brief highlights include:

o Financial results such as sales, expenses, net income, EPS (along with growth percentages from prior periods)

o Performance of key business segments or product lines

o Important industry developments

STRATEGIC AND INDUSTRY ANALYSIS

Within earnings reports, companies will usually provide detailed information regarding the strategic plans of executive management.

Investments in new markets, business segments, or products can indicate the strategic direction the company is heading towards.

Key drivers affecting the execution and performance of such strategies are usually elaborated on.

An analysis of important industry and market developments and their impacts is also commonly presented.

KEY RISK FACTORS

Since the future performance of the company is uncertain, and is dependent on a multitude of unpredictable forces, management usually pinpoints important factors that might have negative impacts to the business.

Such factors can be country, industry, or company-specific or a combination.

Examples include:

- Political events

- Technological developments

- Demographic trends

- Inflation

- Interest rates

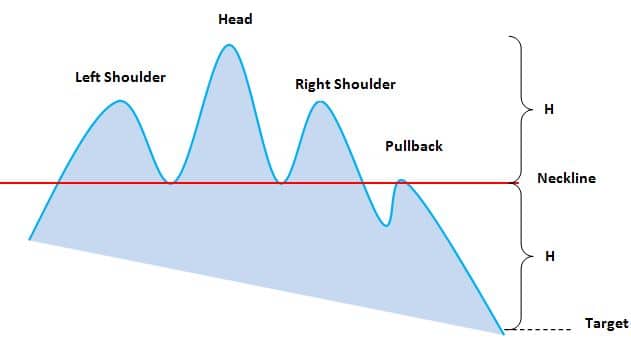

- Business cycles and stock market fluctuations

- Volatility of prices

MANAGEMENT AND DISCUSSION ANALYSIS (MD&A)

In the MD&A section, executive management (commonly the CEO or CFO) present an in-depth analysis of the financial, operational, and business performance of the company.

An examination of trends and comparison with prior-period results is discussed, with the aim of explaining such fluctuations.

Detailed analysis is provided regarding items such as business segments & product lines, capital investments, production & operations, industry and market developments, mergers/acquisitions, and many other company specific items of interest.

FINANCIAL STATEMENTS AND SUPPLEMENTAL SCHEDULES

Prepared in accordance with accounting principles (e.g. US/Canadian GAAP, International GAAP), the company’s financial statements are presented. Additionally, the historical statements are shown alongside current-period numbers for comparison purposes.

Main Financial Statements:

o Income Statement

o Balance Sheet

o Statement of Cash Flows

o Statement of Comprehensive Income

o Statement of Retained Earnings

Supplemental Schedules can include information regarding:

o Operations and production

o Capital expenditure

o Business-segment specific data

o Debt or Long-term liabilities schedules

o Employee stock options

o Other company-specific info

ACCOUNTING PRINCIPLES & RULES

Companies can use a multitude of accounting principles and rules to recognize, present, and report financial results to investors.

Within earnings reports, investors will typically find a section detailing the assumed accounting principles used by the company regarding such items as:

o Revenue recognition

o Expense recognition (the capitalization of expenditures versus expensing them)

o Inventory valuation rules (e.g. FIFO, LIFO)

o Depreciation (e.g. straight-line, declining-balance, etc)

o Investments in other companies and accounting for mergers and acquisitions

o Foreign exchange translations

o Pension accounting

o Off-Balance Sheet items (e.g. leases, SPV)

USING EARNINGS REPORTS TO ASSESS EARNINGS QUALITY

Company management has, at their disposal, numerous accounting principles and rules that they can be used to recognize financial information and report their results to the public, and this presents investors with several challenges.

Recognizing that financial information has a significant impact on the company’s stock price performance (and thus executive compensation) management has strong incentives to choose accounting principles that will allow them to portray the company’s financial position in the best light possible.

A well-informed and diligent investor will scrutinize the company’s assumed accounting principles to assess the impact of the choice of such rules on the reported results. This in turn, will allow the investor to gauge the quality of the earnings (i.e. how reflective they really are of actual performance and financial condition), and adjust their analysis accordingly.

Some accounting principles can be used to:

o Recognize revenue too early

o Excessively capitalize expenses (which defers their negative impact on earnings)

o Report certain gains and losses in comprehensive income, thus bypassing the income statement

o Mask liabilities by overly using off-balance-sheet accounting

o using investment accounting principles to reduce volatility of reported investment results

CONCLUSION

The financial and non-financial information within earnings reports can be used to make sound investment decisions.

They can be an excellent tool in evaluating and valuing the financial health, strategic and industry position, and the future performance of the company.

As such, the well-informed investor will scrutinize all information, including the impact of accounting principles on reported results – which can affect the quality of reported earnings.

Hungary is an EU member country with a medium-sized, liberal economy that is rapidly developing. It has the 5th largest economy in Central and Eastern Europe, with major exports in machinery, chemicals, textiles, and agricultural products.

Hungary is an EU member country with a medium-sized, liberal economy that is rapidly developing. It has the 5th largest economy in Central and Eastern Europe, with major exports in machinery, chemicals, textiles, and agricultural products.