| Old Title | New Title |

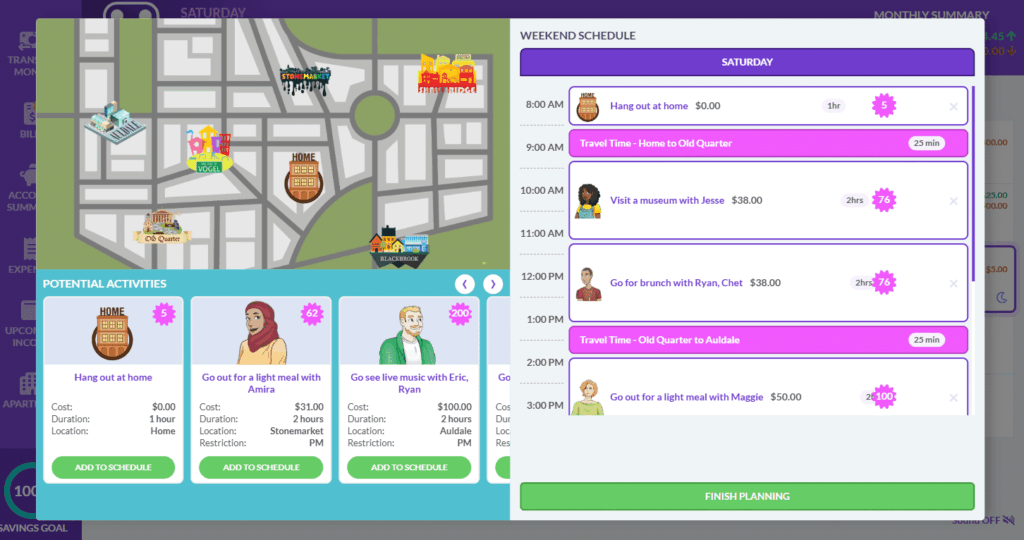

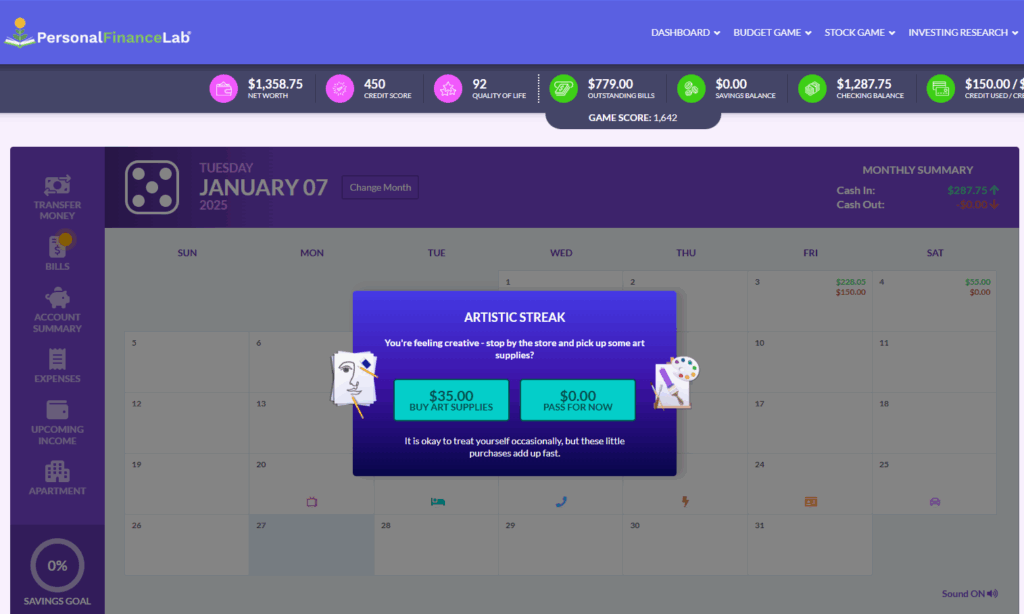

| Budgeting | Break Free From Money Stress with a Budget |

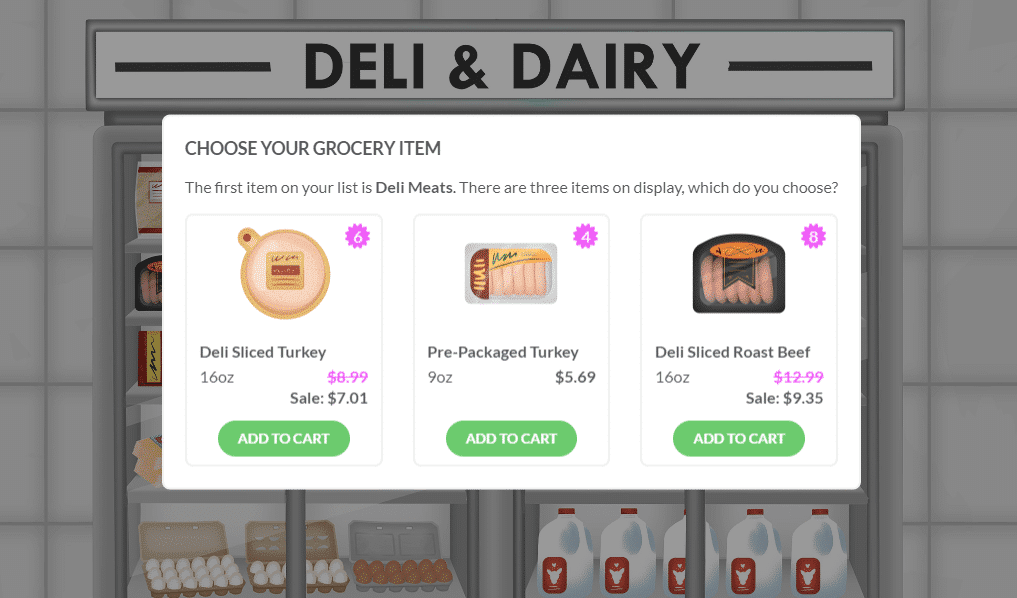

| Budgeting and Spending Strategies | Proven Techniques to Stop Overspending |

| What is Money? | What is Money? |

| Building Wealth | A Strategy to Build Wealth, Not Debt |

| Use the Compound Interest Calculator | Watch How Your Savings Could Grow (A lesson on compound interest) |

| Spending and Savings Plans | Achieve Financial Goals with a Spending Plan |

| Pay Yourself First | A Simple yet Powerful Way to Build Wealth |

| Preparing for Spending Shocks | How to Prepare for Unexpected Expenses |

| Financial Records and Receipts | Receipts: What to Keep and Why |

| Researching Spending | How Do You Stop Impulse Purchases? |

| Managing Bills | The Art of Juggling Many Bills in a Pinch |

| Planning Long Term Purchases | Evaluating Big-Ticket Purchases |

| Family Planning | The Cost of Raising a Family |

| Use the Net Worth Calculator | Get a Snapshot of Your Financial Health (A lesson on Net Worth) |

| Use the Buy vs Lease Calculator | Rent or Buy: Which is Right for You? |

| Use the Home Budgeting Calculator | Find Out Your Monthly Home Budget |

| Using Credit | A Beginner’s Guide to Borrowing Wisely |

| Credit Cards | Credit Cards: Terms, Fees, and More |

| Buying a Car | The Car Buying Checklist |

| Good Debt, Bad Debt | How to Use Debt to Your Advantage |

| Use the Car Loans Calculator | Calculate Your Car Loan Payments |

| Short-Term Financing | What to Do When You Need Money Fast |

| Student Loans | Financing Your Education |

| Mortgages | Mortgage Options for First-Time Homebuyers |

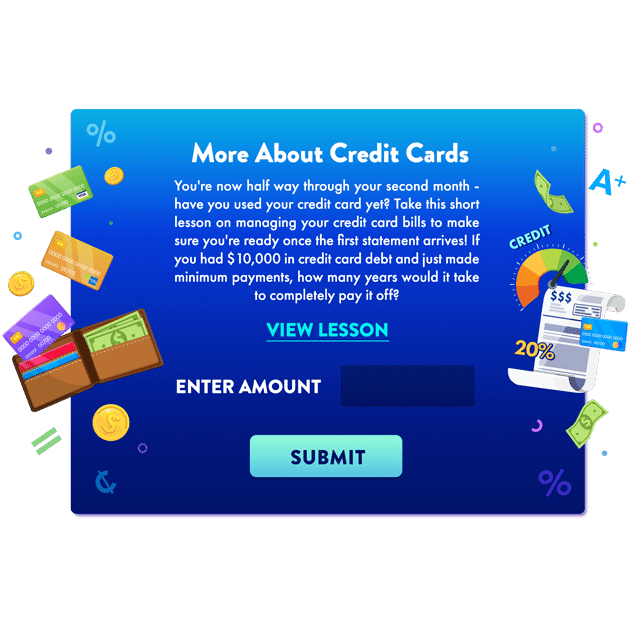

| Use the Credit Card Payments Calculator | Calculate the True Cost of Credit Card Debt |

| Credit Reports | What Your Credit Report Says About You |

| Managing Debt | How Borrowers Manage Personal Debt |

| Debt Management Services | Getting Help With Debt Repayment |

| Consolidating Debt | Debt Relief: Is Consolidation the Answer? |

| Debt Negotiation | How to Negotiate With Creditors |

| Debt Snowball and Avalanche | Debt Snowball and Avalanche |

| Bankruptcy | What Is Bankruptcy? |

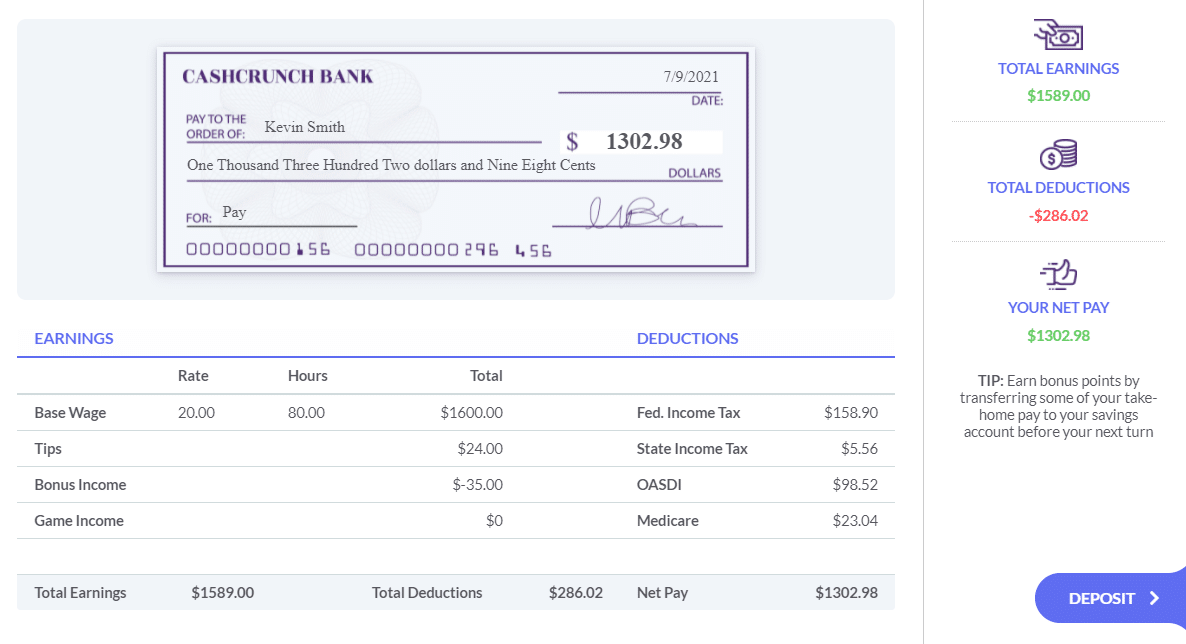

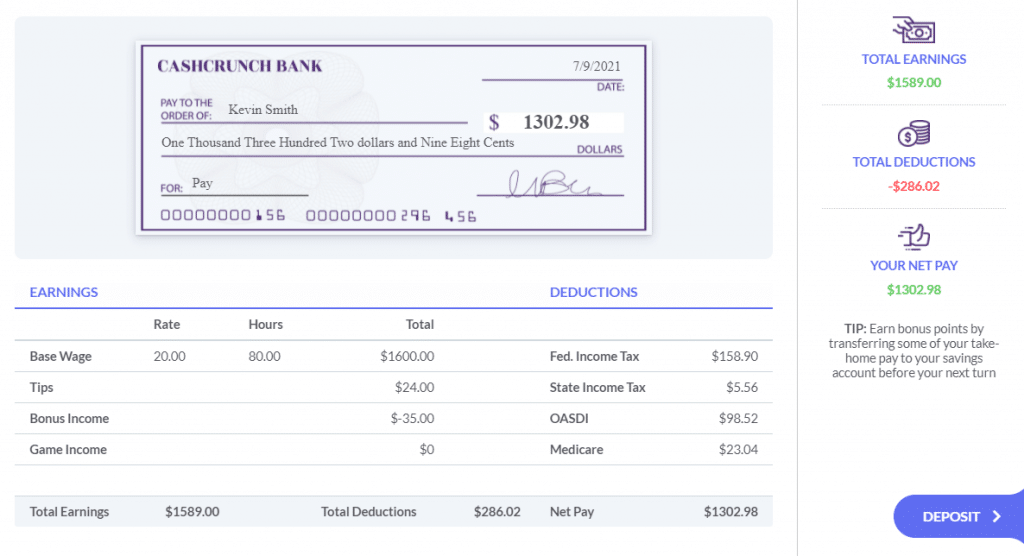

| Income and Compensation | What’s in Your Compensation Package? |

| Workplace Benefits | What Benefits to Look for in a Job Offer |

| Career Development | Planning Your Career Path |

| Employer and Employee Rights and Responsibilities | The Ultimate Employee Guide |

| Unemployment and Other Programs | Public Financial Assistance Programs |

| Banks, Credit Unions, and Savings and Loans | Choosing the Best Banking Option for You |

| Debit Cards | How Debit Cards Work |

| Automatic Payments | Automatic Payments: Convenience vs. Risk |

| Taxation Overview | Tax Basics You Need to Know |

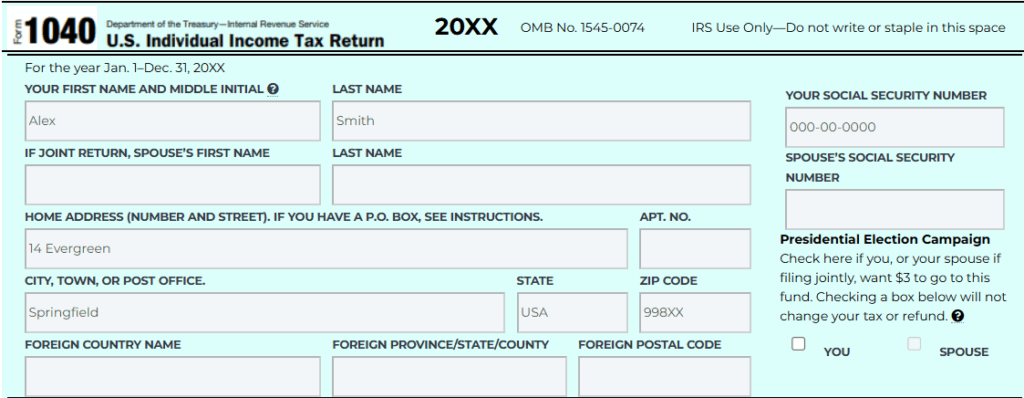

| Tax Filing and the Form 1040 | Income Tax Filing Tips & Tricks |

| Practice Filing The Form 1040 | Get Practice Filing a Sample Tax Return |

| Sales Tax | Sales Tax: Who Pays, Collects, and Why? |

| Biggest Mistakes of Job Seekers | Biggest Mistakes of Job Seekers |

| Acing Job Interviews | Acing Job Interviews |

| How To Choose an Internship | Are Internships Worth It? |

| Using Keywords In Your Resume | How to Get Past Resume Software |

| What is Wealth? | What is Wealth? |

| Charitable Giving | A Guide to Effective Charitable Donations |

| Preparing for Retirement | The Secret to a Comfortable Retirement |

| Use the Saving to be a Millionaire Calculator | Crack the Code to Becoming a Millionaire |

| Consumer Rights and Responsibilities | Protect Yourself as a Consumer |

| Classifying Products and Services | Why You Buy What You Buy |

| Common Tax Deductions | Tax Credits & Deductions You Need to Know |

| Common Tax Additions | Uncovering Hidden Income Taxes You Owe |

| When to Hire a Tax Professional | Do You Need a Tax Professional? |

| What Makes a Contract Valid? | The 6 Elements of a Binding Contract |

| Renter’s Insurance | What’s Not Covered in Renter’s Insurance? |

| Home Owner’s Insurance | What Damage Does Home Insurance Cover? |

| Rental Agreements and Homeowner’s Associations | Rules for Renters & Homeowners |

| Car Insurance | Car Insurance: How to Lower Your Rates |

| Life Insurance | Life Insurance: The Ultimate Safety Net |

| What Are Annuities | Is an Annuity Right for You? |

| Disability Insurance | Don’t Let Disability Derail Your Finances |

| Health Insurance | Why Health Insurance is So Expensive |

| Protecting Yourself Against Fraud | How to Avoid Identity Theft, Scams & Fraud |

| Using Spreadsheets – Comparing Car Financing Options | Find Your Best Car Loan Deal |

| What are Financial Records? | Tame Your Financial Paperwork |

| Reconciling Accounts | Balance Your Books in 10-Minutes |

| Tax Audits | What Is a Tax Audit? |

| Work VS Study | Go to College or Start Working? |

| Simple and Living Wills | Who Gets Your Stuff When You’re Gone? |

| Starting a Business | Starting a Business 101 |

| Income Taxes in Canada | The Basics of Filing Taxes in Canada |

| Pay Yourself First in Canada | #1 Rule for Building Wealth in Canada |

| Canadian Credit Reports | Your Canadian Credit Report |

| Planning for Retirement in Canada | A Guide to Retiring in Canada |

| Types of Canadian Insurance | Insurance Basics Everyone Should Know |

| Protecting Against Fraud in Canada | How to Spot a Scam in Canada |

| Bankruptcy in Canada | How Bankruptcy Ruins Your Credit |

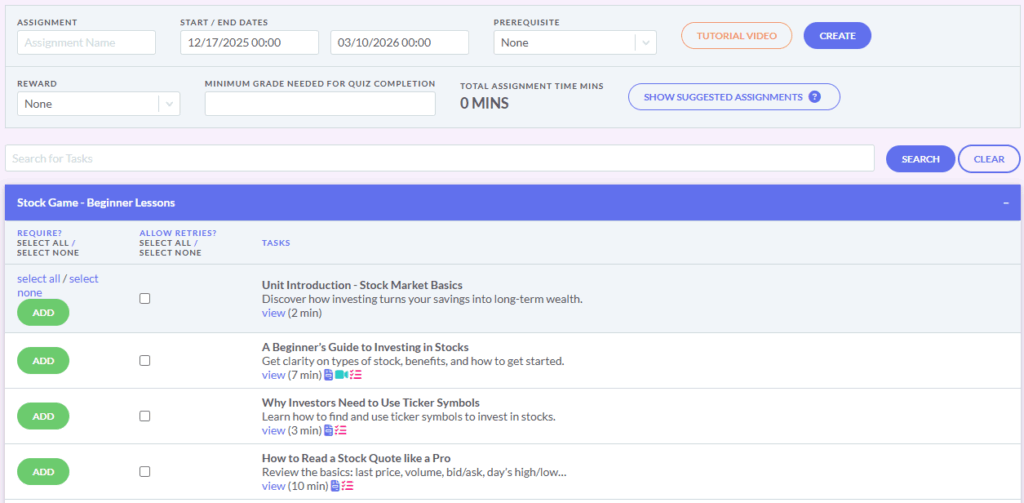

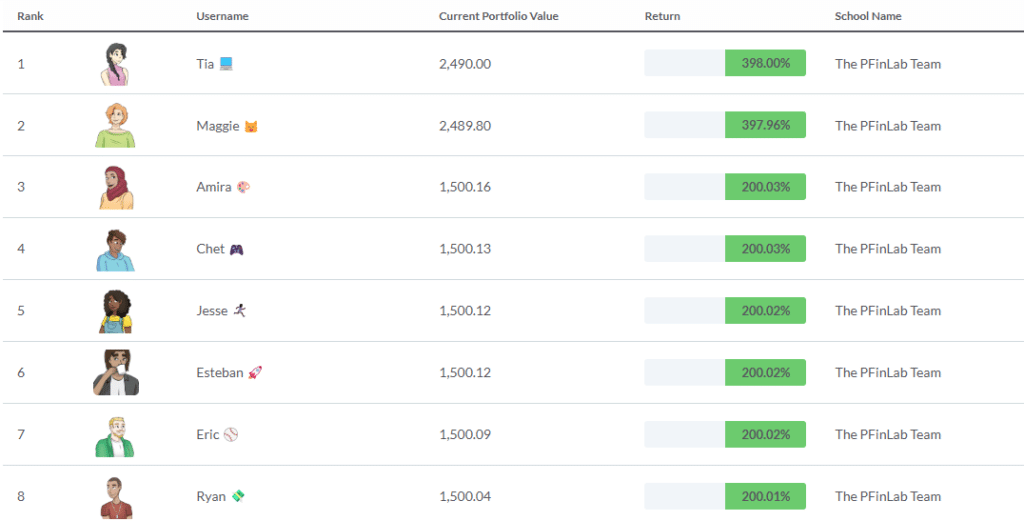

| What is a Stock? | A Beginner’s Guide to Investing in Stocks |

| What is a Ticker Symbol? | Why Investors Need to Use Ticker Symbols |

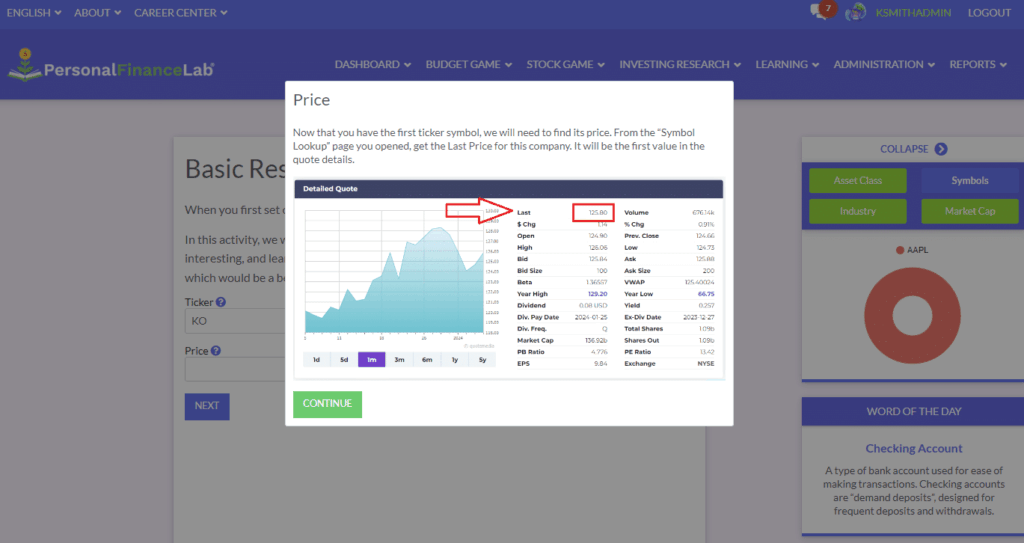

| Getting (and Understanding) Stock Quotes | How to Read a Stock Quote like a Pro |

| Why Invest in Stocks? | Why Invest in Stocks vs. Just Saving? |

| Building a Diversified Portfolio | Why You Should Diversify Your Portfolio |

| Getting Trading Ideas | 5 Ways to Get Trading Ideas |

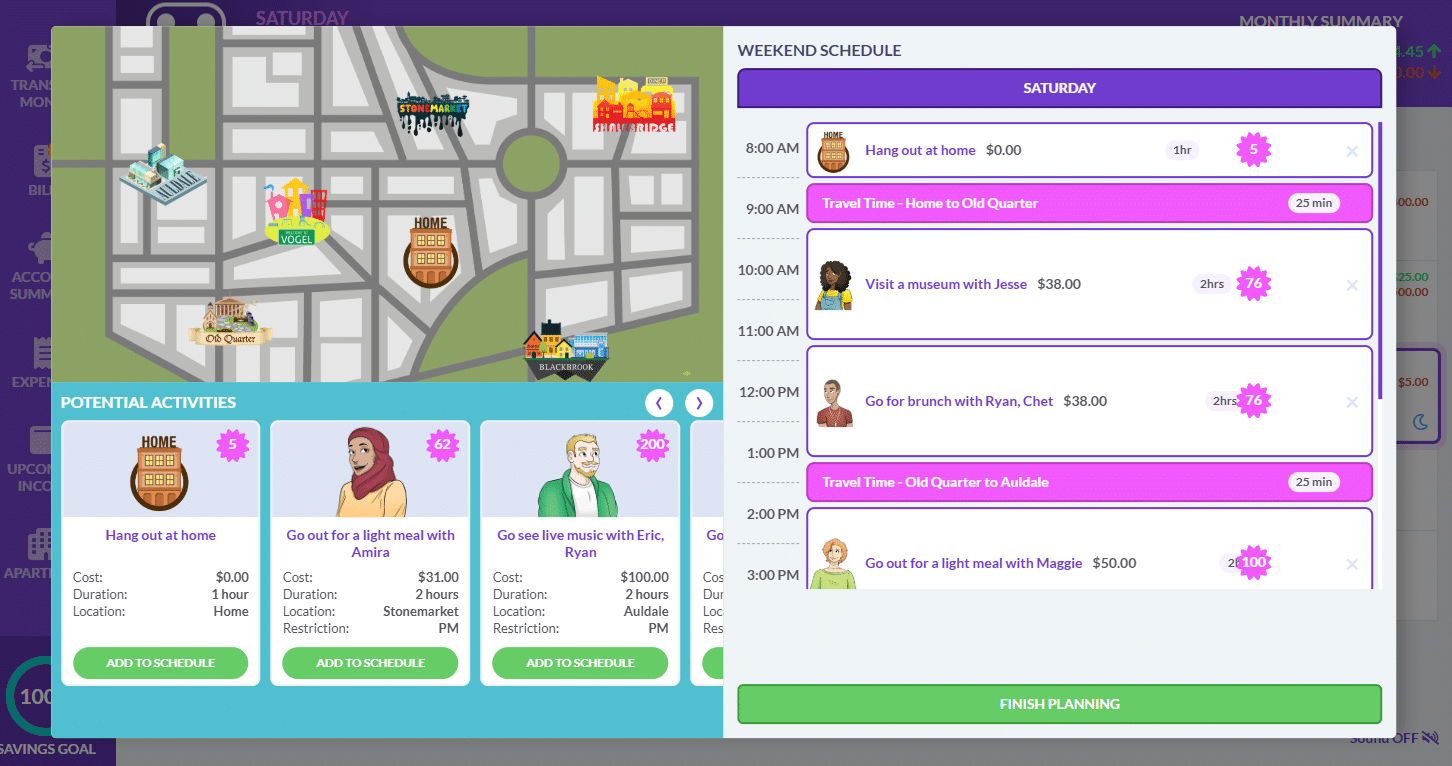

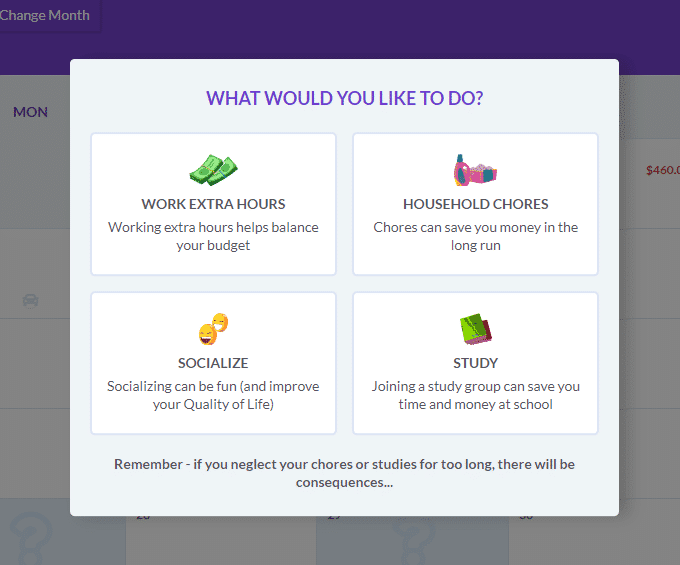

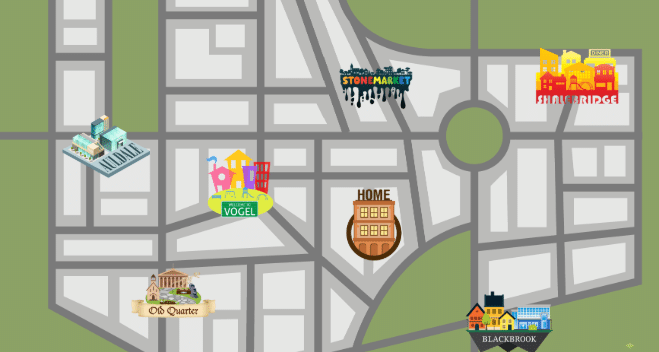

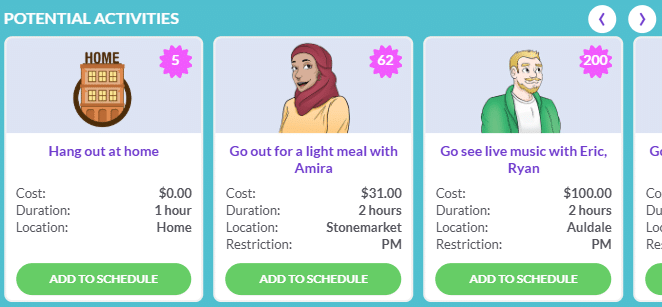

| Navigating The Site | How to Navigate The Platform? |

| Order Types | How to Use Order Types? |

| Trading Stocks Tutorial | How to Trade Stocks? |

| What is an ETF? | A Simple Explanation of ETFs |

| What is a Mutual Fund? | The Pros and Cons of Mutual Funds |

| Trading Mutual Funds Tutorial | How to Trade Mutual Funds? |

| What are Bonds? | Getting Started with Bond Investing |

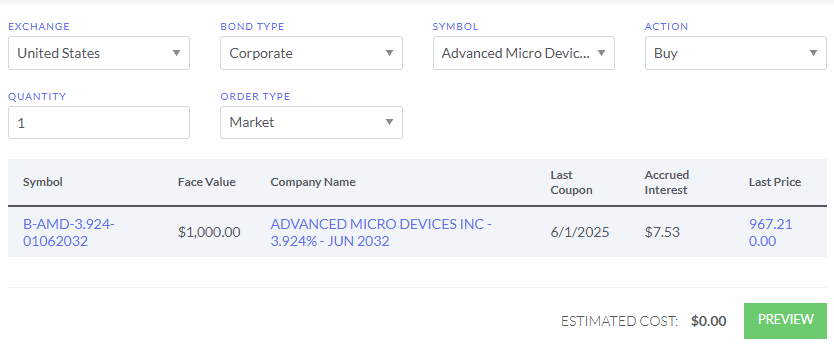

| Trading Bonds Tutorial | How to Trade Bonds? |

| Understanding Margin Trading | Margin & Short Selling Explained |

| What is a Brokerage? | How to Choose a Brokerage Account? |

| Investment Research | How to do Investing Research? |

| How to Choose and Compare Stocks | How to Choose Stocks Strategically |

| Understanding Price Movements | Decoding What Moves The Market |

| What is an Income Statement? | What is an Income Statement? |

| What is a Balance Sheet? | What a Company Owns vs. Owes (A lesson on Balance Sheets) |

| What Is A Cash Flow Statement | The Cash Flow Statement Explained |

| Investing Strategies | How to Develop an Investing Strategy |

| Certifications in the Finance Industry | Want to Work in Finance? |

| What are Cryptocurrencies? | What are Cryptocurrencies? |

| Use the Investment Return Calculator | Model Your Financial Future (A Lesson on Investment Growth) |

| Use the Net Present Value Calculator | Net Present Value (NPV) Calculator |

| Basic Research and Comparing Stocks | How to Research & Compare Stocks |