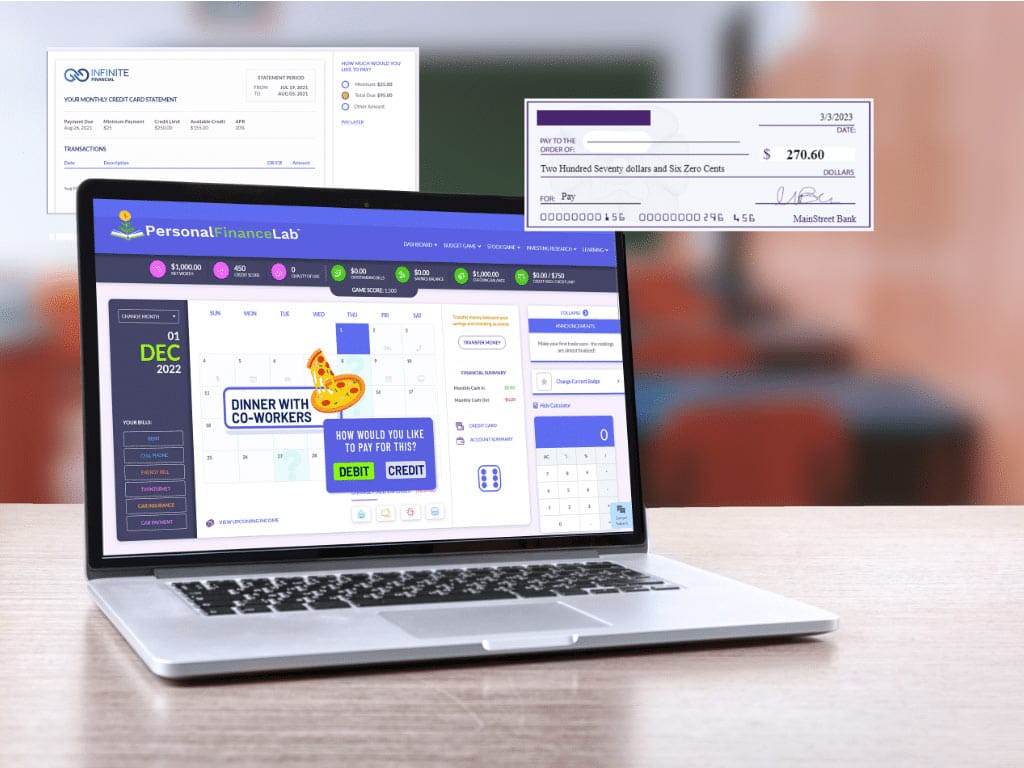

Students can transfer money back and forth from their Investing Account and Budget Game account. We rank students in the Stock Game by portfolio % return (not raw $ value) so students who are less successful at the Budgeting Game are not at a disadvantage in the stock game. However, this could allow students to inflate their % return in the stock game by selling all of their assets and transferring their cash back to the budgeting game.

For example, a student may invest $100 in a stock that increases in price by 10% (a $10 return), while the rest of their original cash is uninvested. This would make their portfolio value $510, or a 2.5% total return for the rankings. This student may then choose to sell their stock, and transfer $490 from the Stock Game to the Budget game. Now their portfolio value is $20, on an initial investment of $10 – showing a 100% return.

The rule requiring students to maintain a minimum balance in the stock game is in place to prevent students from using a similar technique to artificially increase their total portfolio return and gain an unfair advantage in the overall rankings.